Bond yields continue to surge higher

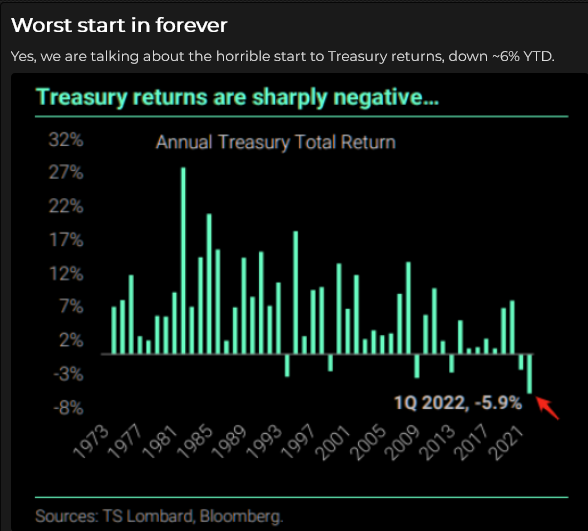

The announcement on Tuesday by Fed Governor Lael Brainard, a former dove (and Biden’s nominee for Fed Vice-Chair), that the Fed will launch an aggressive program of Quantitative Tightening (QT) (monthly sales of $60B of Treasuries and $35B of mortgages after a three-month phase-in period) beginning with the May 3-4 FOMC meeting super-charged the recent rise in bond yields.

(And why not? The Fed will switch from being a massive buyer of bonds and mortgages to a massive seller.) Brainard’s comments were sustained by the March Fed meeting minutes released on Wednesday.

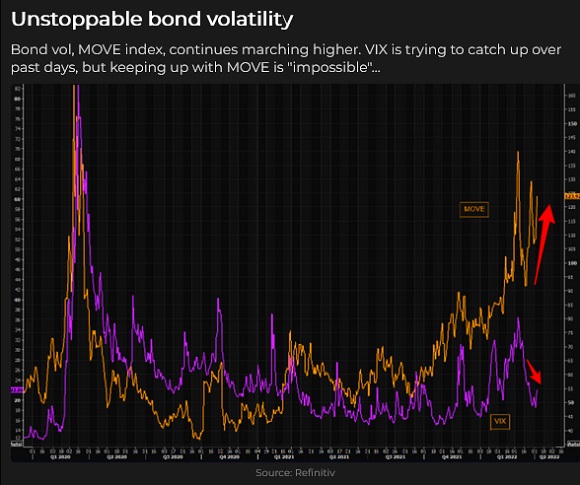

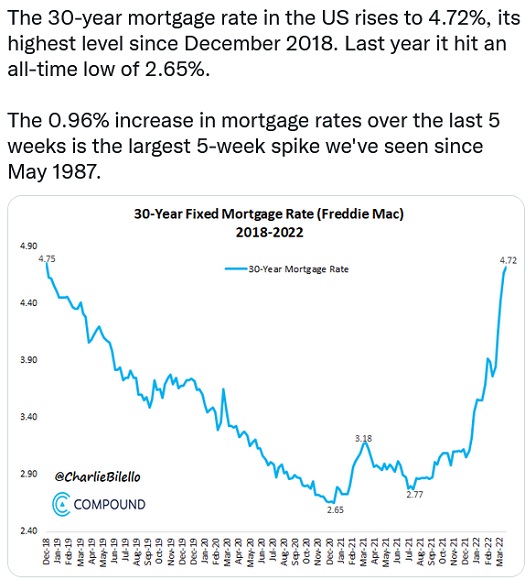

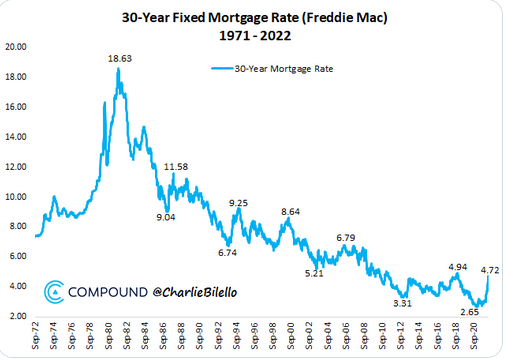

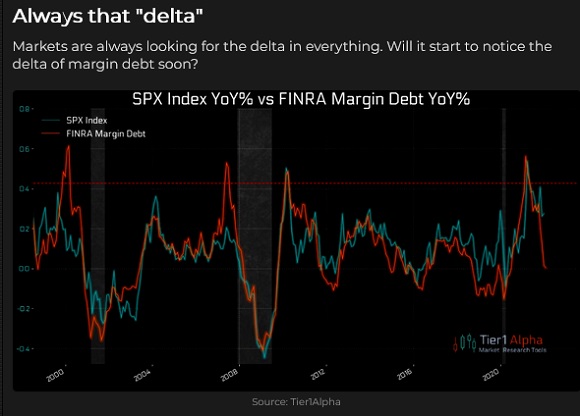

The rate of change in bond prices (the delta) has spiked over the last five weeks, with bond option volatility soaring to the highest levels since the COVID panic of March 2020.

Comments from former New York Fed President Bill Dudley to the effect that the Fed needs to “crash” the market to slow inflation (or risk losing the public’s confidence in their “resolve” to fight inflation) added to the pressure on bond prices. The ten-year Treasury yield has jumped from ~1.7% a month ago to ~2.7% on Friday, a three-year high.

Short rates are also at a three-year high (the two-year Treasury is ~2.52%), but the rate of change slowed this week after a sizzling rise throughout March briefly inverted the 2/10 Treasury yield curve.

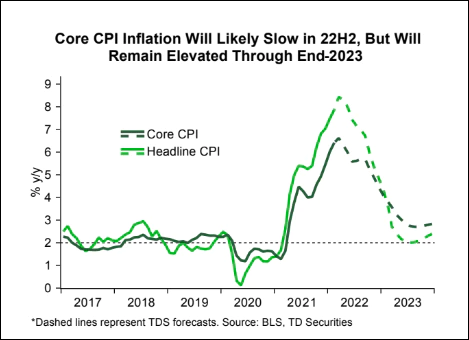

Perhaps the prospect of aggressive QT will cause markets to “dial back” future expectations of sharp increases in Fed Funds. (Aggressive QT and raising interest rates are both forms of tightening. If year-over-year inflation is peaking the Fed may be wary of “overkill.”)

The bond market had its worst quarterly performance in >40 years in Q1/2022, with many analysts writing that bonds have become an anchor rather than ballast for the classic 60/40 portfolio.

The rationale for the Fed’s tightening policies is that inflation is running far hotter than they thought it would. But will tighter monetary policies dampen supply shortage inflation, especially when the Federal government is busy “fighting” inflation with inflationary fiscal policy?

It may well be that “demand destruction” due to higher prices is (as I’ve previously written) “politically unviable,” especially in the run-up to the mid-term elections when consumers tell pollsters that their biggest worry is inflation! (h/t to the Heisenberg Report.)

The Fed could impact real estate inflation

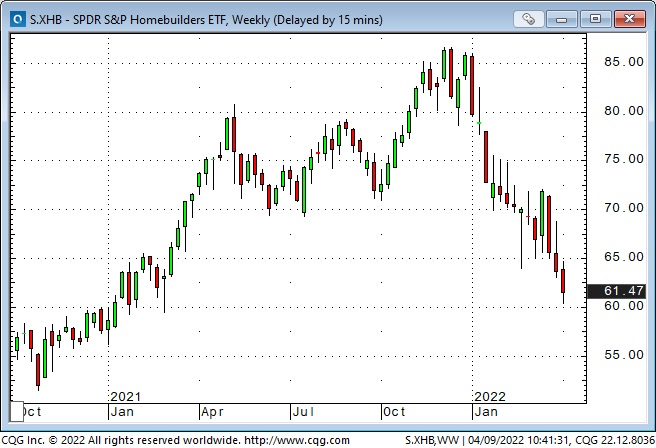

The real estate market may be vulnerable (may experience “demand destruction”) if mortgage rates continue their steep rise due to MBS sales by the Fed. A “levelling off” or a “dip” in real estate prices ahead of the mid-terms might be politically expedient. Homebuilder shares have already suffered “demand destruction.”

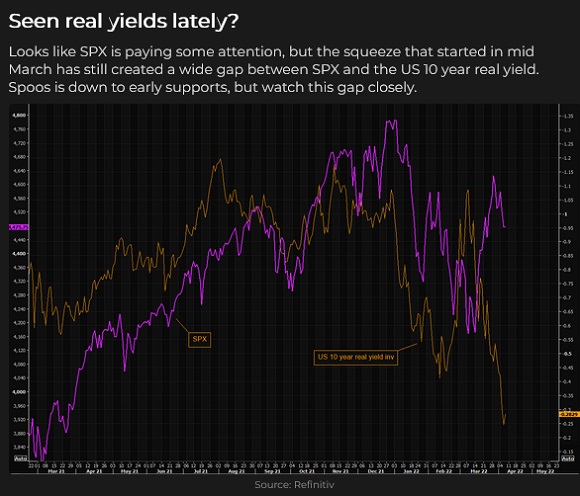

Surging interest rates may be dampening equity markets

The major stock indices had a strong rally in the 2nd half of March (I’ve thought of it as a bear market rally) with the S+P up >10%, but the indices weakened a bit (rotated to defensives) the past two weeks as bond yields spiked. (Don’t underestimate how much the Masters, especially with Tiger back in the game, draws attention away from the markets!)

The prospect that inflation and higher interest rates may lead to an economic slowdown (stagflation) may have tipped the scales in favor of the bears. As I noted last week, the DJ Transportation Index may be flashing a warning.

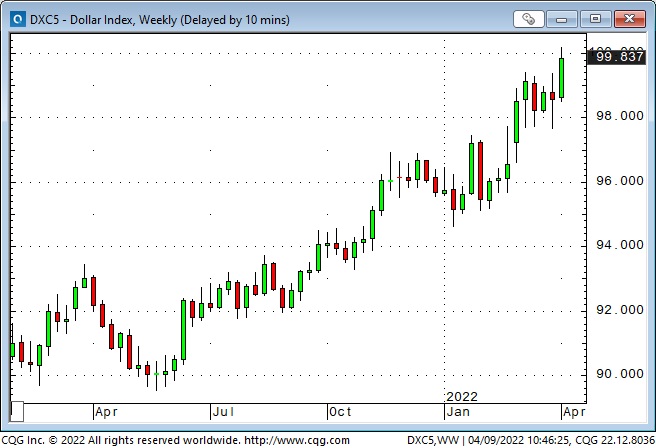

Surging US interest rates boost the US dollar

The USDX traded above 100 this week for the first time in nearly two years. I have long maintained that capital flows to America for safety and opportunity. These days money also flows to the US as the market sees American interest rates rising while rates in Europe, Japan and China are flat or falling.

The Japanese yen has fallen to a seven-year low as the BOJ is determined to keep government bond yields from rising.

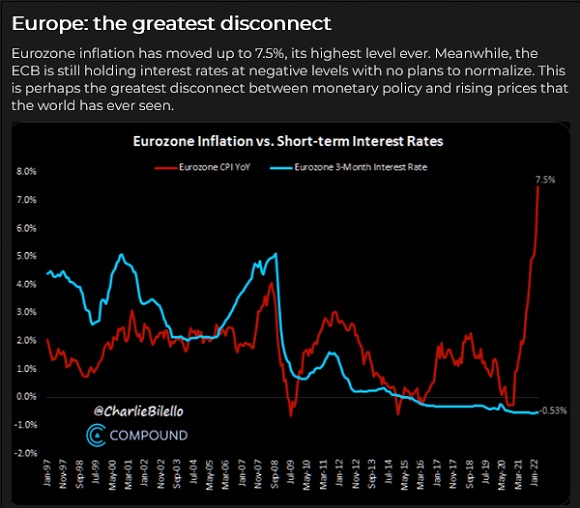

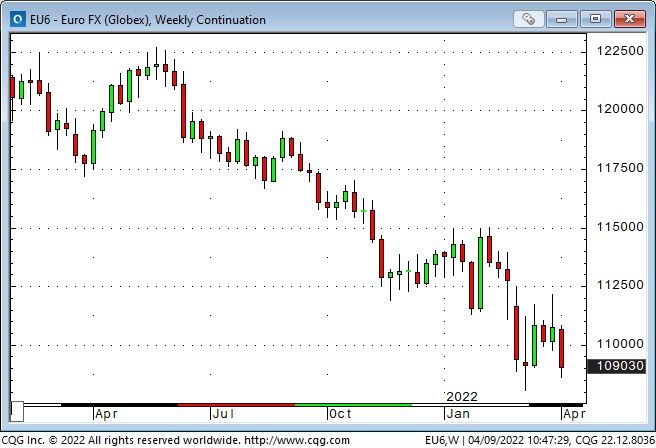

Knock-on effects from the continuing war in Ukraine weigh on the euro, as does the sustained easy monetary policy of the ECB vis à vis the Fed. The first round of French presidential elections starts on Apr. 10—a strong showing by Le Pen could pressure the euro.

Surging interest rates and a rising US dollar help weaken commodity indices

Commodity prices have fallen back from the “Invasion” spike and may have made a critical high on the back of rampant Malthusian warnings of mass starvation and energy shortages.

Were WTI crude oil prices “too cheap” for a few years?

My short term trading

I got short S+P futures above 4600 Wednesday of last week. I stayed with the trade over the weekend and was stopped for a 60 point gain when the market rallied Monday. I sold S+P futures again on Tuesday and covered the trade on Wednesday for a 70 point gain.

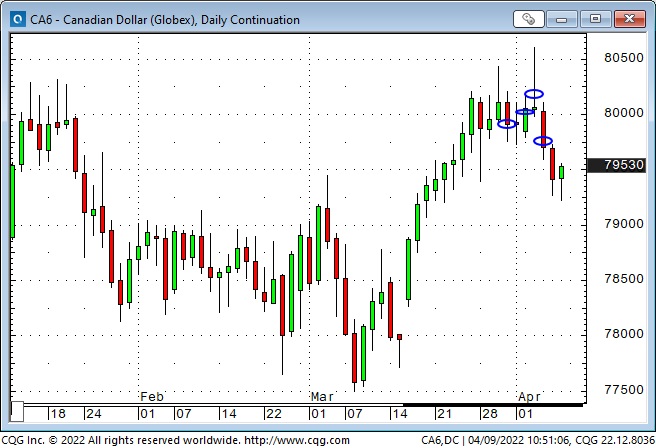

I sold CAD Thursday of last week (not a good entry point) and was stopped for a 25 tick loss on Monday. I resold CAD on Tuesday when it fell back from a spike high and covered it the following day for a 53 point gain.

This week, I made two other trades that resulted in slight losses, and I did not trade Thursday or Friday. I was flat going into the weekend. My P+L on the week was up >1.0%.

Thoughts on trading – the trades I didn’t make

Usually, when I think about trades I didn’t make, I’m thinking about the “big one that got away.” For instance, I turned bullish on the US dollar on Jan. 6, 2021, and the USD has had a great run since then, primarily without me. The commodity markets have had a scorching rally over the past two years, and I’ve missed most of it.

In my defense, I’ll say that it’s easy to look at charts of past market action and wonder how I missed so many trades. The truth is that you never know what is going to happen. If you’re convinced that you know what will happen, you’ll probably lose too much money when you’re wrong.

Two other points in my defense: 1) I’m honest with myself about missing trades that would have been big winners, and 2) I also missed making some trades (like writing puts on bonds the past two weeks) because I decided they were not good trades and I saved myself from what could have been severe losses.

Being honest about missing great trades leaves me “open” to considering how I could do things differently. For example, I’ve been good about taking losses quickly throughout my trading career, but I’ve also been guilty of (far too often) taking profits too quickly.

When I reflect on “why I take profits too early” I believe it is a fear of seeing unrealized profits disappear. I know that most of the trades I make in a year will offset one another and I also know that, in order to make great returns, I must have a few outsized winners—but “how” do I develop the discipline and the patience to achieve that? (Or does “staying with a winning trade” not fit my personality?)

I recently listened to an excellent podcast hosted by Kevin Muir (The Market Huddle series) with Jerry Parker of Chesapeake Capital. Jerry is one of the original Richard Dennis Turtles, and he has had tremendous success over the past few decades using a long-term trend following method. He is refreshingly candid about his trading experiences and credits Richard Dennis with being a terrific mentor who taught him 1) don’t worry about losing money, 2) do the right thing, 3) follow the rules and 4) you will get rewarded.

I highly recommend the podcast—even if you are a short-term trader with no interest in long-term trend following systems. Jerry is a successful veteran trader, and you will learn something from his insights that will benefit your trading.

For instance, I’ve often said that I make money from managing risk, not from having a great crystal ball. Jerry agrees with that 100%, but he defines risk as a permanent loss of capital— so he keeps relatively tight stops on initial positions. But, when the market has moved in his favor, and he has moved his stops to breakeven or better, he can be very patient with the trade because he believes that a drawdown in Open Trade Equity (unrealized gains) is NOT a loss of capital.

Another successful veteran trader, Peter Brandt has a similar view of unrealized gains; he does not view OTE as “his money” until he closes out the trade. I believe this is a “principle” of his trading methodology that allows him to stay with winning trades.

Quotes from the notebook

“Nobody knows nothing. If you think you know how something will turn out, you probably have a presupposition that is clouding your thinking.”

“How did I not see that coming?”

Greg Noble, a friend who is also a very accomplished golfer

My comment: We can acknowledge that it is impossible to know the future, yet we are surrounded by people who make predictions. Some “marketing guys” make a lot of money by pretending they know what will happen.