Political Risk

Political risk, a favourite word for global market participants, is taking on a higher level as a calming outcome for markets is hard to imagine, whoever wins this politically divisive race for the White House.

Most of the early market focus has been on FBI Director Comey’s comments earlier today, when he stated the FBI had found no criminal element in the latest batch of Clinton emails under investigation. We had seen a rush for USD top side cover in the higher election beta currencies, reversing much of the sell-off from last week when the FBI initiated the e-mail probe. The implication is that this could again shift the undecided and independent vote to the Clinton Camp.

Outside of this morning’s blip in price action, trading volumes are falling as the market is reducing outright USD risk and trading smaller clips on headline driven events. This notion was evident this morning when during low-level liquidity, the market was knocked aggressively around in small volumes. I would expect this type of headline-driven chop fest to continue as we near election day.

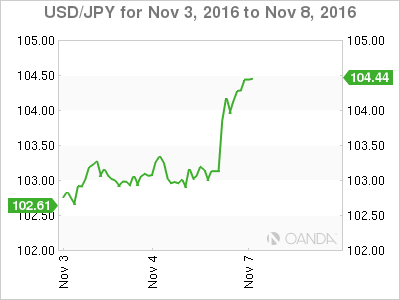

I expect a binary play on the election night, with a move to 106 on a Clinton victory. However, it is debatable if USD/JPY will gain traction above 106.00 as December rate hike expectations are all but priced in and unlikely to provide new tail winds.

On the flip side, in the event of a Trump victory, I anticipate high volume safe haven flows into the yen amid a Global equity market frenzy that could see us test the key 101.50 level.

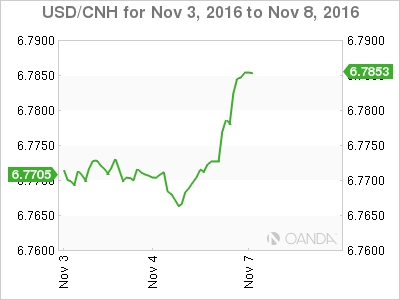

Much of this morning’s price action is due to the broader based US dollar move on the back for the FBI headlines. In general, the USDCNH continues to remain well supported on dips and should remain so as year-end seasonality factors add another layer of demand.

These are certainly unusual times, and while we should expect to see some dramatic swings on election day, it is assumed that despite whoever gets into the White House, China relations would be the top priority and it is not anticipated that any severe repercussions from a potential threat of US protectionism will take hold.

EM Asia

The election night tail risk may be in store for export-driven countries like KRW, USD/TWD and CNY.

- KRW is a favourite short due to political upheaval, and that may take a back seat to TWD and CNY

- PHP relations with the US are tarnished

- IDR and INR, the high yielders, should be less sensitive to election night jitters

- At this stage, MYR appears to be more of an energy play

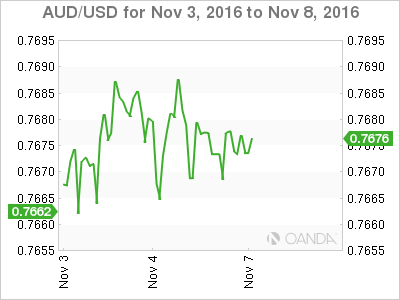

Most of Friday’s actions came in the wake of both domestic Retail Sales, which insignificantly beat markets expectations, and the Statement of Monetary Policy, which offered up little in the way of a surprise for currency watchers.

My view that Friday’s NFP would have little impact on the USD was correct, with a print of 161K, which came in well above the danger zone to have any immediate influence on Fed hike expectations.

The US presidential election is sure to mandate the most this week, with US election headlines likely to drive price action leading up election day.

AUD price action has been very constructive, but 7725/50 remains a formidable resistance level pre-US election, so it is more likely that the AUD will continue to be relatively contained, but susceptible to any pre-election jitters.

I am maintaining my base view for a Clinton victory and that the Republicans will continue in the House of Representatives. If you add in a Federal Reserve Board that will keep looking for excuses not to hike, and an RBA that feels little need to cut interest rates, the stage is set for a significant push higher in the Aussie dollar. However, when you also consider that dealers have been hesitant to add risk as the US polls have gradually narrowed, it is possible the markets are well under-priced for this outcome is equally significant.

If Trump surprisingly wins, given the apparent divergence of Central Bank Policy, the Federal Reserve Board will be sure to remain on hold in December. In this scenario, I expect the AUD will provide excellent opportunities on a post-election knee jerk lower.

While the AUD may look vulnerable to a noticeable drop in global risk appetite, there may be some yield appeal and safe haven in flow that might surprise the bears.