Many of you may know the old saying, "what goes up must come down." Well, the Nikkei 225 Index (Japanese stock index) has been soaring higher as of late. The catalyst for the recent rally in the Nikkei 225 Index has once again been caused by money printing and the promise of more of it by the Japanese government.

The Japanese yen (Japan's currency) has been plummeting against most other major currencies including the U.S. dollar, and the euro. A falling yen will usually help to increase exports. At this time, it seems that most central banks around the world are taking a page out the Federal Reserve's (U.S. central bank) book. They are all trying to inflate there way out of the deflationary pressures that have been plaguing most major economies in 2008.

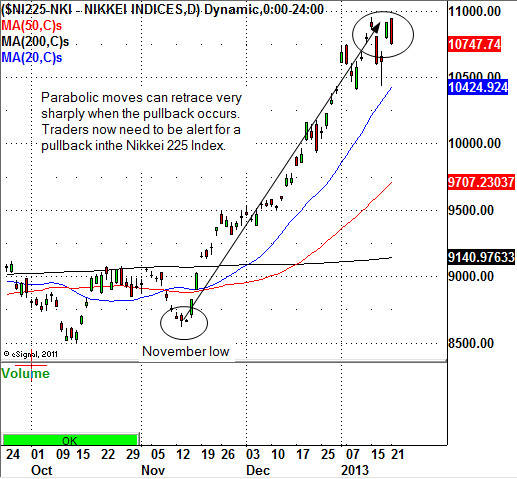

This time around, the Japanese government is printing money like never before, inflating the Nikkei 225 Index from a low 8619.45 made on November 13, 2012 to a high of 10,952.31 made on January 15, 2012. Please understand, the Nikkei 225 Index has gained more than 2300.0 points in roughly two months.

This type of stock market move is unsustainable for any stock or index. A good rule of thumb is to simply look at a stock chart from the last pivot low to the high. If the the move on the chart is steeper than 60.0 degrees from low to high than it is usually unsustainable and will will pullback sharply. Monday night, the Nikkei 225 Index sold off by more than 1.50 percent. While this is a large one day decline, the market can certainly decline much further. A pullback in the Nikkei 225 Index down to toward the 9600.00 level would be a natural correction from its recent surge.

Many of the leading Japanese ADR's such as Toyota Motor Corporation (ADR) (TM), Canon Inc. (ADR) (CAJ), Honda Motor Co Ltd (ADR) (HMC), and Sony Corporation (ADR) (SNE) have recently soared higher along Nikkei 225 Index. This tells us that if the Japan stock market pulls back, the Japanese ADR's could pullback as well. So traders should now prepare for a pullback in many of the Japanese stocks that are traded here in the United States. Traders can also follow and trade the Nikkei 225 Index by using the iShares MSCI Japan Index (ETF) (EWJ).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trading Asia: Beware Of Parabolic Moves

Published 01/23/2013, 12:40 AM

Updated 07/09/2023, 06:31 AM

Trading Asia: Beware Of Parabolic Moves

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.