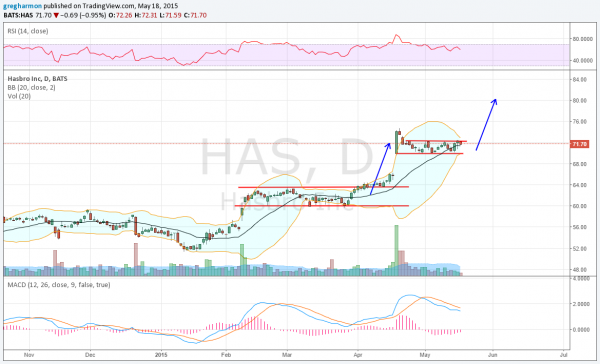

Hasbro (NASDAQ:HAS) stock ($HAS) had been moving in a channel into their last earnings report April 20th. A few days ahead of time it teased traders with a break out to the upside. But stalled there for a week. Finally, when no one was looking, it reported on a Monday morning, and the stock gapped higher. Since then it has done nothing. Back in consolidation mode. That means it is time to prepare for a trade again! Wait a minute, what?

Yes that is right, with the stock moving sideways and no clear catalyst for a couple of months it is time to get ready for a trade. The chart above gives the clues as to why. The Bollinger Bands® have gone from being over $15 wide to only $3 wide. This type of Bollinger Band squeeze is often a precursor to a move in the stock. In fact you can see this happened in March before the last move higher.

Now the question becomes, which way will it move? The momentum indicators put in a vote to the upside. The RSI is in the bullish zone and the MACD has stopped falling and is level, heading towards a cross. The volume pattern looks that way too. A high volume move up followed by declining volume, looking like a bull flag. This would suggest a target to 80 on a break to the upside.

Clearly the price can go either way. And by buying a June 70/72.5 Strangle for $2.20 can cover both ways. But if you can get an edge on direction then the cost can often drop by nearly half. And buying the June 72.50 Calls for $1.30 can get you there.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.