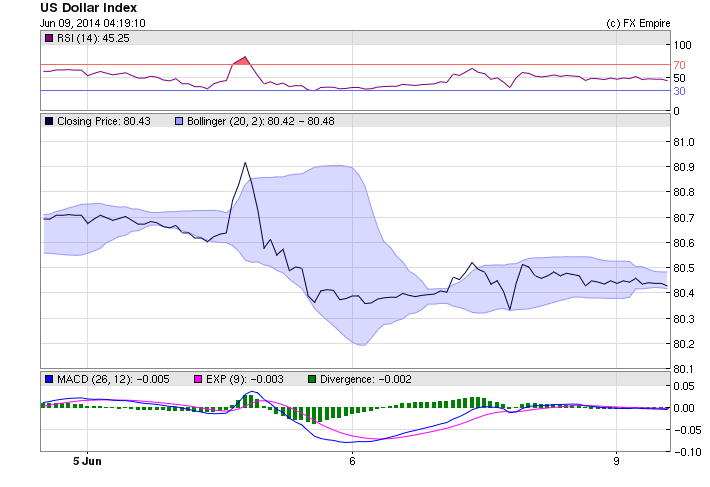

At the end of the week, traders were pleasantly surprised after the release of the nonfarm payroll (NFP) report. U.S. payrolls expanded by 217,000 in May, extending a 282,000 rise in April, the Labor Department said on June 6. That marked the fourth monthly increase in employment of more than 200,000, the first time since early 2000. The jobless rate remained at 6.3 percent, the lowest in almost six years. The US dollar closed the week on a strong note and is trading this morning at 80.44 as the new week begins. The US Dollar Index traded on a flat note last week on the back of a rise in risk appetite in market sentiments in the latter part of the week, which led to a decline in demand for the low yielding currency. However, losses were wiped off owing to favorable economic data from the country. The currency touched a weekly high of 81.07 and closed at 80.43 on Friday.

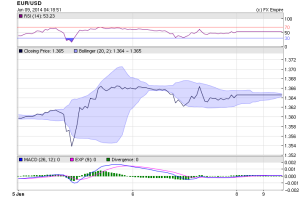

Last week, traders saw two major events. Before the NFP release, investors witnessed Mario Draghi unleash the big bazooka as the European Central Bank mounted its offensive against falling inflation and diminishing growth in the eurozone. The ECB cut lending rates and deposit rates, pushing banks to see negative deposit rates as well as introducing several programs to provide stimulus for the eurozone countries. The euro took the news as a positive move and is trading at 1.3645. The euro traded on a positive note, up around 0.1 percent last week on the back of favorable trade data from the region. Also, upbeat market sentiments supported an upside in the currency.

However, sharp upside in the currency was capped due to the European Central Bank (ECB) cutting the deposit rate to minus 0.1 percent and a reduction in the benchmark refinancing rate by 10 basis points to 0.15 percent. The euro touched a weekly high of 1.3677 and closed at 1.3641 in the last trading session.

The German Trade Balance was at a surplus of 17.7 billion euros in April as against a previous surplus of 15 billion euros a month ago. German Industrial Production grew by 0.2 percent in April from a decline of 0.6 percent in March. The French budget balance was at a deficit of 64.2 billion euros in April as againsta deficit of 28 billion euros the prior month. The French trade balance was at a deficit of 3.9 billion euros in April as compared to deficit of 4.9 billion the previous month.

The meeting of the Bank of England was ignored by traders as the bank held rates and did not make a public statement. The pound was trading at 1.6808 this morning. Sterling traded higher by around 0.3 percent last week on the back of a rise in risk appetite in the market as sentiments supported gains. However, mixed economic data from the country capped sharp gains. The UK’s Consumer Inflation Expectations was at 2.6 percent in May from 2.8 percent in April. The trade balance was at a deficit of 9.6 billion pounds in April as against a deficit of 8.3 billion pounds a month earlier.

This morning, the Japanese government increased its economic GDP for the first quarter, saying that capital spending was sharply higher than initially thought. GDP increased at an annualized rate of 6.7% in the January to March period from the previous quarter, the Cabinet Office said, revising its initial estimate of a 5.9% expansion. The result, adjusted for price changes, marked the sixth straight quarterly expansion. The surprise upward revision showed that a consumption splurge ahead of a tax increase in April was not the only factor fueling growth in the quarter, as Japan’s economy continued to expand under Prime Minister Shinzo Abe’s pro-growth policies known as Abenomics. The JPY remained near its 2014 trading range at 102.53. Australian markets are closed for the Queen’s holiday with the Aussie trading at 0.9352 after strong Chinese export data hit the markets.