Top event risk is the European Central Bank meeting and ECB President Draghi's comments on tapering. While recent ECB meetings have rendered little market reaction, there has been speculation recently that the central bank will begin tapering its bond purchase program at one of its next meetings.

While Draghi was optimistic about the outlook for the Eurozone economy, most economists predict the ECB won't start tapering before the second half of 2017. Quantitative easing is currently scheduled to end in March and with consumer prices still hovering close to zero, policymakers should at least be comfortable with the current level of stimulus or even extend the program before gradually phasing it out once inflation approaches the ECB's goal of 2 percent.

The ECB will announce its policy decision at 11:45 UTC, but no changes are expected. The main focus will be on the press conference 45 minutes later and Draghi's comments. If he pushes back aggressively against recent talk of tapering, the euro could be vulnerable to further losses.

Any signal that the ECB plans to reduce bond purchases will provide a strong boost to the euro. If the central bank however refrains from providing any signals and defers any changes until December, today's announcement could turn out to be a non-event for euro traders.

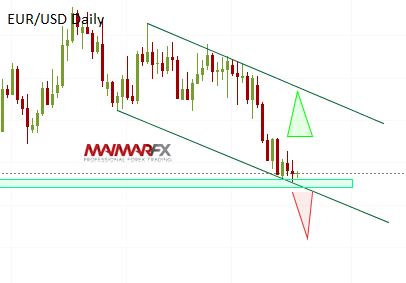

To cut it short, let us have a look at the technical chart and prepare for both possible scenarios.

EUR/USD

The euro recently weakened against the U.S. dollar but found some halt around the 1.0950-level, the descending trend line of the euro's recent downward channel. If the pair breaks below 1.0940, we see a higher likelihood of further losses towards 1.09 and 1.0830. On the upside, the euro would need to break above 1.1060 in order to spark some bullish momentum towards 1.1170.

Apart from the ECB meeting we have U.K. Retail Sales at 8:30 UTC, the Philly Fed index at 12:30 UTC as well as U.S. Existing Home Sales at 14:00 UTC scheduled for release, but all these reports could take a backseat to the ECB.

Here are our daily signal alerts:

EUR/USD

Long at 1.1015 SL 25 TP 40, 80

Short at 1.0940 SL 25 TP 30, 70

GBP/USD

Long at 1.2332 SL 25 TP 20, 40

Short at 1.2230 SL 25 TP 30-40

Daily Signal performance in pips:

October 2016:

EUR/USD: +166 pips

GBP/USD: +195 pips

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI