As of Tuesday 25th June:

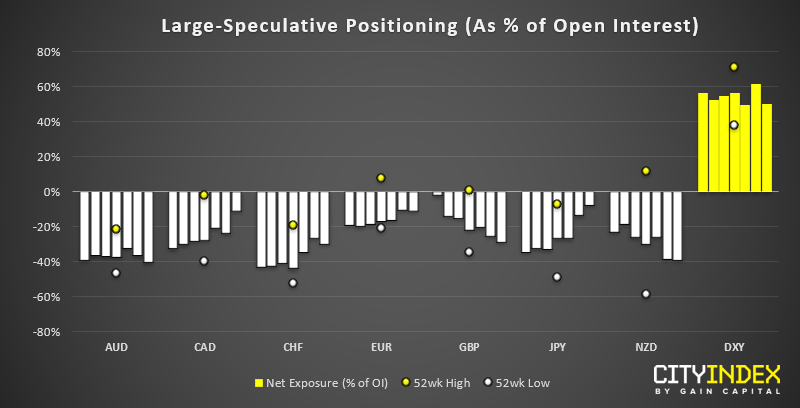

- Traders reduced net-long exposure to USD for a 4th consecutive week, shedding -$1.1 billion of long positions to $19.6k billion (23.3k billion against G10 currencies).

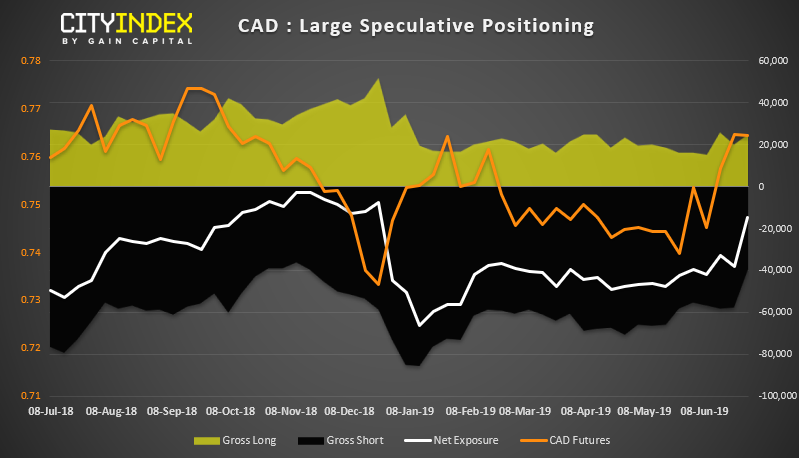

- The Canadian dollar saw the largest weekly change, where net-short exposure was reduced by -23.3k contracts.

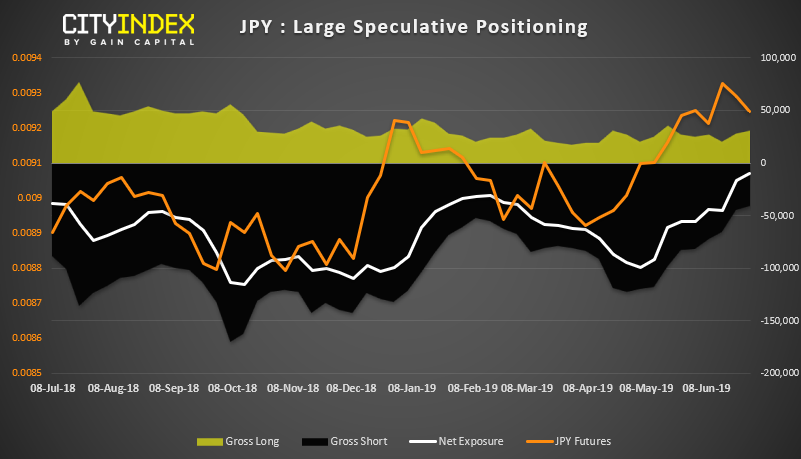

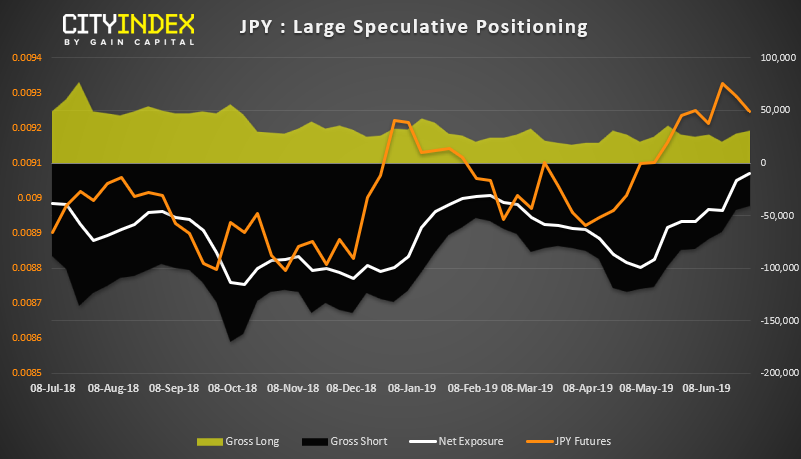

- Bearish exposure on Japanese yen futures is at its least bearish level since June 2018.

- Bearish exposure on Canadian dollar futures is at its least bearish level since December 2018.

CAD: With net-short exposure being reduced by -23.3k contracts, it’s the largest weekly change this year. However, whilst bears are clearly less confident in further CAD downside, bullish positions are yet to pick up, making the change in sentiment less bullish than otherwise it first appears. However, that hasn’t stopped CAD from being the best performing major this year so far.

JPY: Traders are now their least bearish on the Japanese yen since June 2018, as risk-off sentiment has seen bears close short contracts for 9 consecutive weeks. However, over that same period, only 3k long contracts have been added so, like CAD, doesn’t make for a compelling bullish argument from large speculators. This makes JPY a prime candidate for bears if/when geopolitical tensions subside.

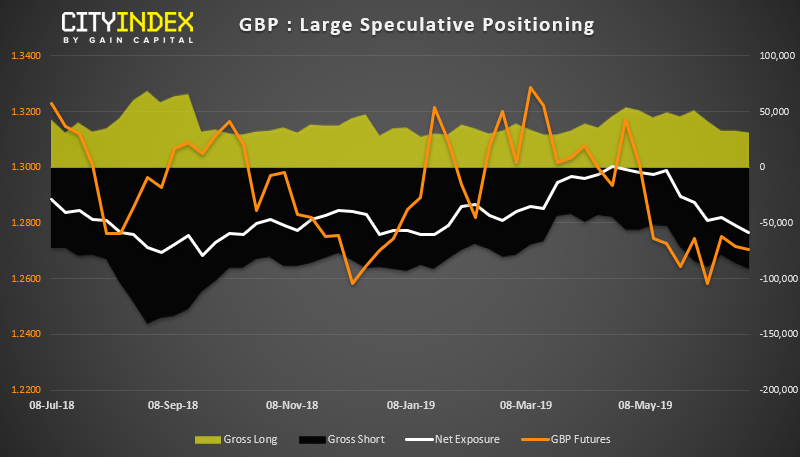

GBP: Large speculators are their most bearish on cable since mid-January. Moreover, open interest (volume) has increased notably since hitting multi-year lows in May, showing an appetite to be bearish on GBP as opposed to de-risking.

As of Tuesday 25th June:

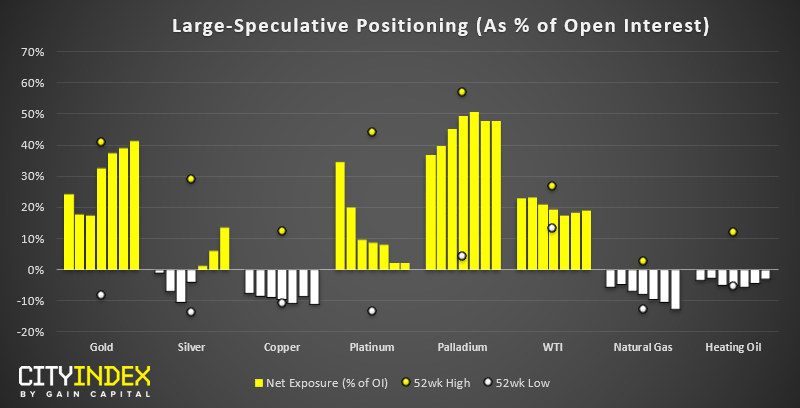

- 82.9% of large speculators are bullish on gold, making it the highest long to short ratio since September 2016.

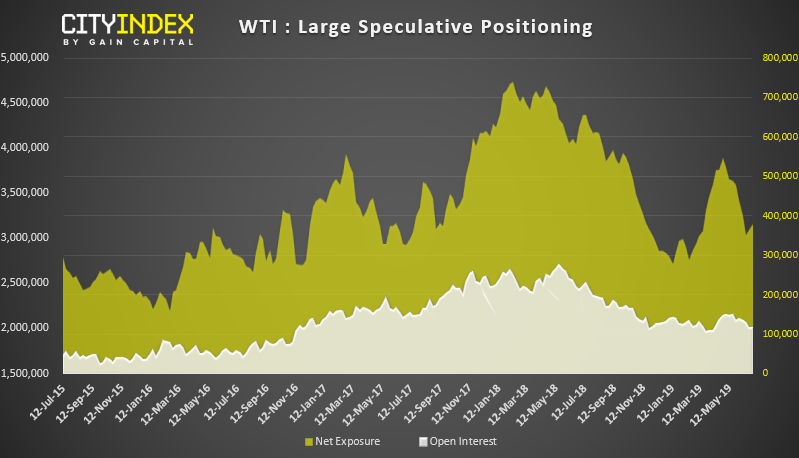

- WTI bulls reduced gross long positions for a 9th consecutive week, yet net-long exposure has increased as shorts were covered at a faster pace.

- Traders are net-long on Silver for a third consecutive week, and at their most bullish level since early March.

Gold: Whichever way you look at it, gold has been overwhelmingly bullish. However, too much of anything isn’t always a good thing, so we’re cautious in the yellow metal whilst we wait for prices to pause for breath below $1,400. Still, the underlying dynamics are what we like to see for a strong move; bears are closing out and bulls are loading up. So we remain bullish on gold but would prefer to see prices stabilise and form a new level of support first.

WTI: Volumes have mostly been in decline whilst prices have fallen, to show that traders have been de-risking on crude oil as opposed to becoming outright bearish. Net-long exposure has ticked higher for a second consecutive week, although once again both longs and shorts have reduced exposure. Until we see a firm commitment for the bull or bear camp, it’s difficult to have confidence in a directional move. But for now, the message is clear, traders are wary on WTI.