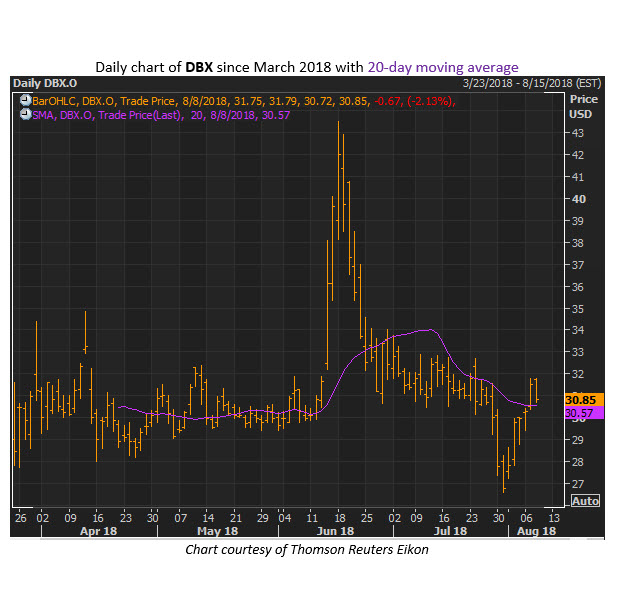

DBX Traded As High As $43.50 Back In Mid June

Cloud storage specialist Dropbox (NASDAQ:DBX) is about to release earnings for the second time since going public in March, with the company set to report after the close tomorrow, Aug. 9. The first time around, DBX shares dipped 2.2% the day after earnings, even though the company topped estimates. Going by options data, Wall Street is expecting a much more explosive move this time, with implied volatility data pricing in a 15.2% swing for Friday's session.

A quick check at the numbers on the equity from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows that put buying has outpaced call buying during the past 10 days. During this time frame, the October 30 put saw the largest increase in open interest, with heavy buy-to-open activity confirmed. To be even more recent, the September 27 put led the way in the past five sessions, and traders were mostly buying to open positions here, as well.

For the most part, DBX shares have traded in a tight range since their IPO, save their dramatic mid-June rise to $43.50, which, for what it's worth, coincided with massive gains in the cloud sector as a whole. The stock also recently dipped below the $27 mark, though analysts labeled this a buying opportunity. Dropbox was last quoted at $30.85, just above its 20-day moving average.