President Donald Trump is expected to announce a plan to lower drug prices today, which should put healthcare sector in focus on Wall Street. This group has struggled in 2018, illustrated by a recent email sent out by Schaeffer's Quantitative Analyst Chris Prybal showing the extreme underperformance of the 20 names that we cover in our "Pharmaceuticals and Biotechnology" category.

Prybal notes that this group's collective market cap has seen the biggest decrease in 2018 by far out of all the sectors we track, with only four of the 20 companies seeing their market caps climb year-to-date. One pharmaceutical stock that's managed to hold gains so far in 2018 is Abbott Laboratories (NYSE:ABT), but data shows bears are moving in.

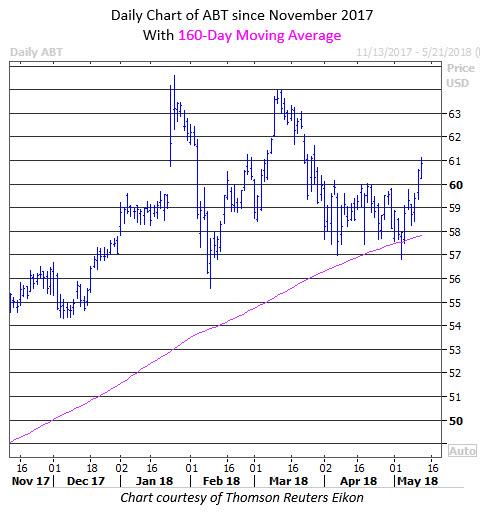

ABT stock was last seen trading up 0.6% at $60.92, pacing for a third straight win and its highest close since March 26. The shares took a sharp bounce off their 160-day moving average earlier this month, and have since pushed through recent resistance at the $60 level. Overall, the healthcare giant is up 6.7% year-to-date.

Analysts are extremely bullish on Abbott, with 17 of the 20 brokerage firms in coverage saying to buy the shares. Plus, the average 12-month price target is $68.56, representing a 12.7% premium to current levels and record-high territory. Looking elsewhere, however, shows increasing negativity around the stock.

In fact, short interest has been surging on the stock, rising almost 53% in the last reporting period alone -- one of the biggest increases among all stocks that trade more than one million shares per day or trade weekly options. At the same time, less than 1% of the total float is sold short.

But options traders have also been showing bearish tendencies. ABT's 10-day put/call volume ratio across the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands at 1.10, ranking in the 83rd annual percentile. This suggests put buying has been unusually popular in recent weeks, relative to call buying.