Friday morning's release of the April Wholesale and International Trade data continued to support our views of continued deterioration in the underbelly of the economy. Wholesale inventories rose 0.6 percent in April which was stronger than the 0.4 percent estimate.

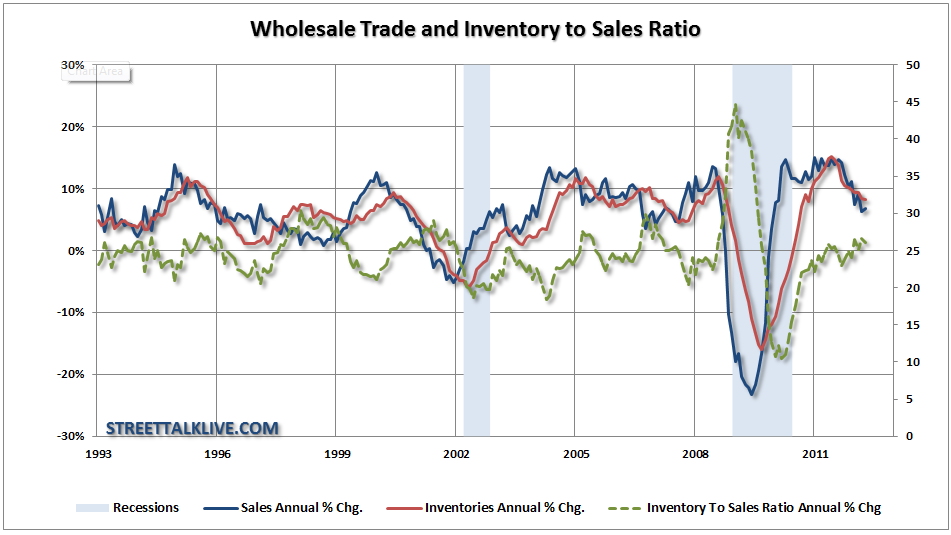

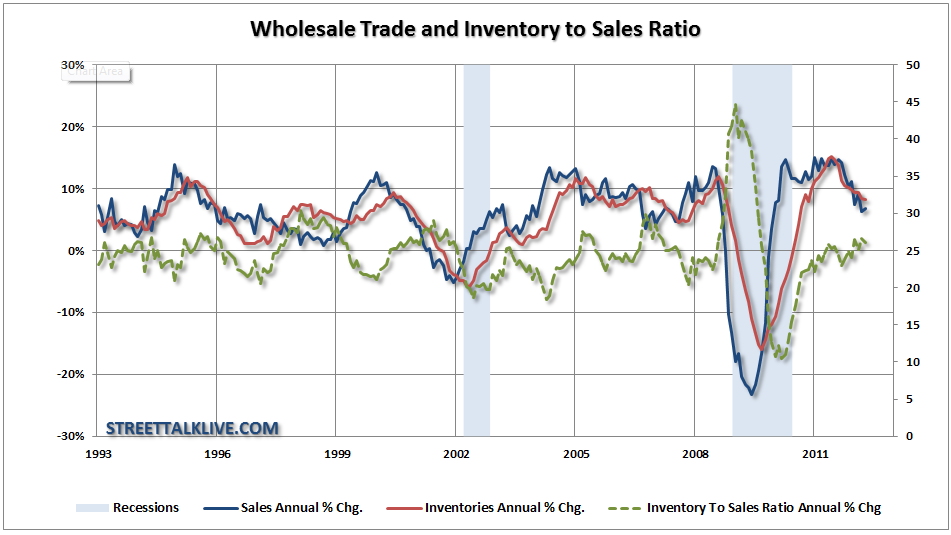

However, on a year-over-year basis the rise was 8.24%. A steady increase in inventories over the last few months has been evident as economic deterioration has appeared in many of the manufacturing reports. Sales increased at a 1.1% clip but on an annual basis remained soft at only a 6.85% increase.

However, the numbers don't tell the story that the chart does. Sales and inventories, on an annual change basis, track fairly closely together. After the rebound from the lows of the recession, due to pent up demand and inventory restocking, both components have now shown signs of weakness. This corresponds with the year-over-year decline in corporate earnings as well.

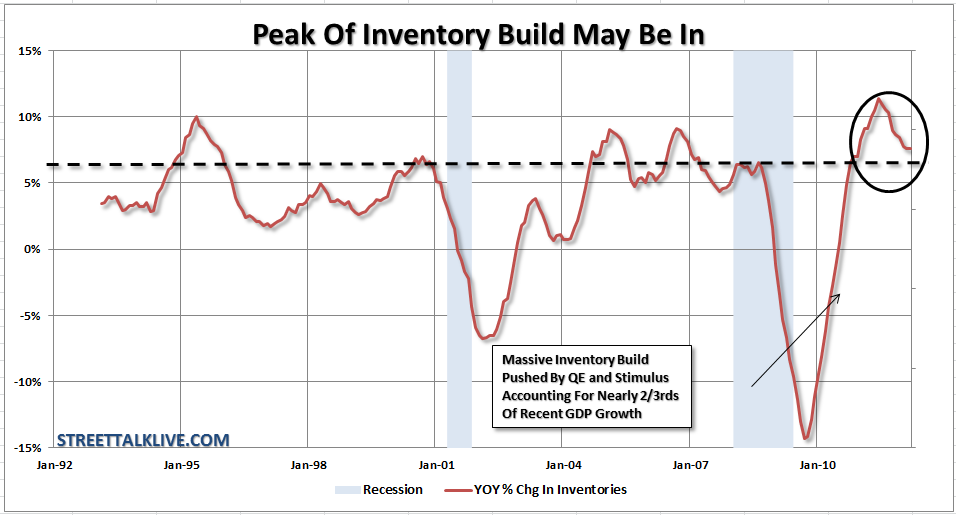

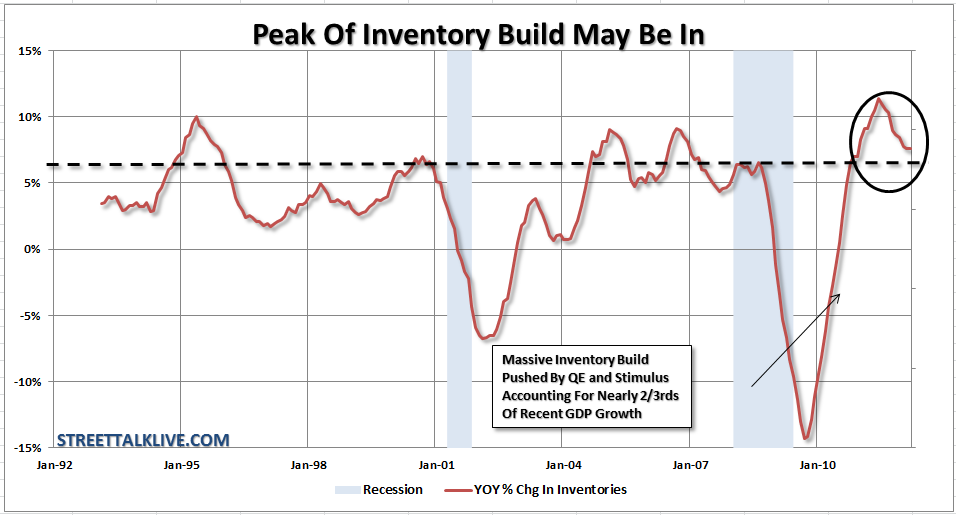

With the risk that economic growth may be slowing the management of inventories takes on special importance in order to protect profit margins. The year-over-year change in inventories, and recent reductions in backlogs in the manufacturing reports, suggest companies see weakness in demand and are reducing inventory stock levels accordingly.

One of the issues that relate to those levels of sales and inventories is the trade balance data. With the eurozone already in a recession, and emerging economies showing significant weakness as well, it is not surprising that we see businesses taking a more defensive stance in regards to inventory management.

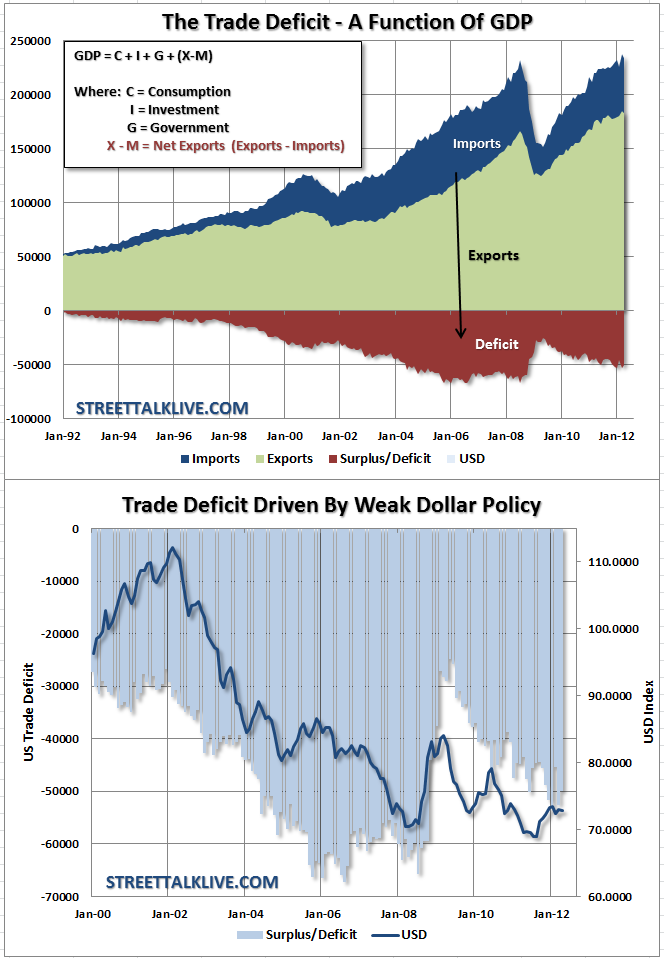

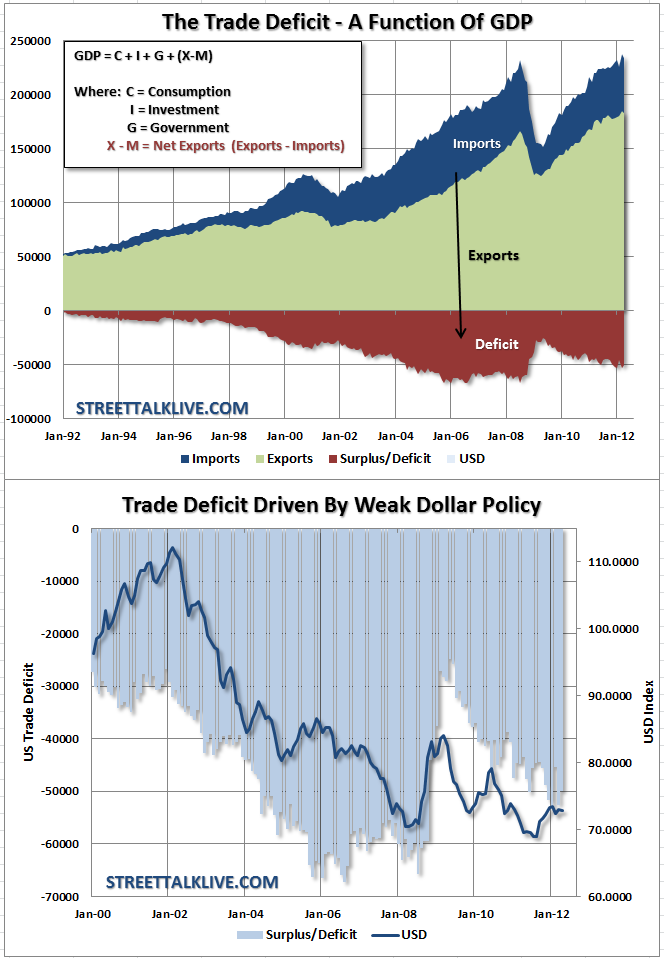

The trade balance in April improved due to strength in the U.S. dollar and a drop in imports. The strength in the dollar is due to the weakness in the eurozone as money flows into the U.S. for safety from a flagging euro. This "flight to safety" is dragging on exports from the U.S. to the eurozone. However, the weakness in the U.S. economy is also showing up in the drop in imports as well.

In April, the U.S. trade gap shrank to $50.1 billion from $52.6 billion in March (originally $51.8.0 billion). The consensus projected a deficit of $49.3 billion. Exports dipped 0.8 percent after a 2.5 percent boost in March. Imports fell 1.7 percent after a 5.2 percent jump the prior month.

What is concerning is that the bulk of the drop in the trade deficit was due to a much larger drop in imports relative to exports. With imported goods cheaper in price, due to a stronger dollar, the large drop in imports certainly doesn't reflect a stronger domestic economy.

The drop in goods imports in April was led by a $2.0 billion decrease in capital goods excluding autos, following a $3.2 billion jump the month before. Also declining were foods, feeds & beverages, capital goods excluding autos, automotive, industrial supplies, and consumer goods. No major import category gained which, again, is not a sign of strength for the U.S. economy.

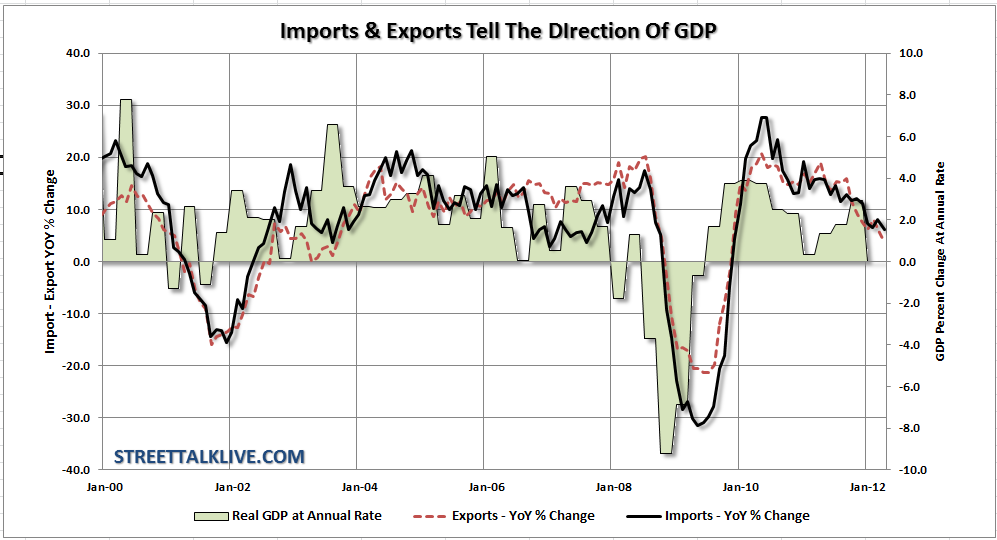

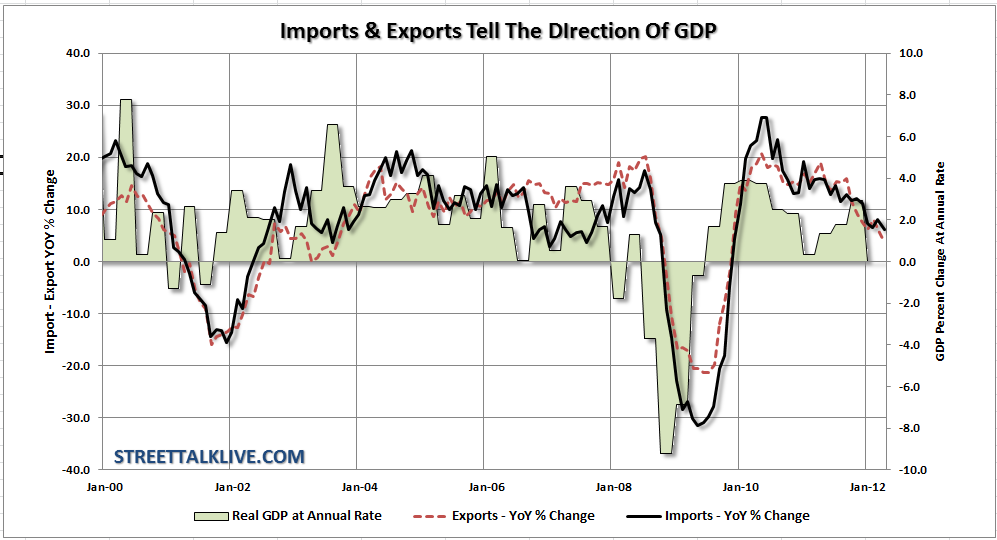

While net exports declining may be a positive for GDP in the short term - the real story is businesses are cutting back on imports due to worries about demand as exports are down on weak global demand. The reality is that the economy is slowing, and most likely weaker, than the mainstream media and economists currently expect.

Furthermore, the trend of exports and imports further support the idea of a weakening economic environment. Since the peak set in 2010 on the back of QE 1 the annual trend of exports and imports has been on the decline. Furthermore, the trend of exports and imports have been corresponding to a weakening economic trend in the U.S. Had it not been for the intervention of "Operation Twist" combined with LTRO's in Europe it is likely that the U.S. would have already been in a recession. Without further intervention in the near future by the Fed it is likely that the negative trend in imports and exports will manifest itself once again into weaker economic numbers.

As we stated earlier the trends across many of the manufacturing reports as of late have shown signs of increased economic stress. The trade and wholesale numbers are confirming those reports. While there is certainly reason to believe that the Fed will not institute further easing at the current time due to the inflationary implications of such programs - the reality is that he may not have much of a choice.

However, on a year-over-year basis the rise was 8.24%. A steady increase in inventories over the last few months has been evident as economic deterioration has appeared in many of the manufacturing reports. Sales increased at a 1.1% clip but on an annual basis remained soft at only a 6.85% increase.

However, the numbers don't tell the story that the chart does. Sales and inventories, on an annual change basis, track fairly closely together. After the rebound from the lows of the recession, due to pent up demand and inventory restocking, both components have now shown signs of weakness. This corresponds with the year-over-year decline in corporate earnings as well.

With the risk that economic growth may be slowing the management of inventories takes on special importance in order to protect profit margins. The year-over-year change in inventories, and recent reductions in backlogs in the manufacturing reports, suggest companies see weakness in demand and are reducing inventory stock levels accordingly.

One of the issues that relate to those levels of sales and inventories is the trade balance data. With the eurozone already in a recession, and emerging economies showing significant weakness as well, it is not surprising that we see businesses taking a more defensive stance in regards to inventory management.

The trade balance in April improved due to strength in the U.S. dollar and a drop in imports. The strength in the dollar is due to the weakness in the eurozone as money flows into the U.S. for safety from a flagging euro. This "flight to safety" is dragging on exports from the U.S. to the eurozone. However, the weakness in the U.S. economy is also showing up in the drop in imports as well.

In April, the U.S. trade gap shrank to $50.1 billion from $52.6 billion in March (originally $51.8.0 billion). The consensus projected a deficit of $49.3 billion. Exports dipped 0.8 percent after a 2.5 percent boost in March. Imports fell 1.7 percent after a 5.2 percent jump the prior month.

What is concerning is that the bulk of the drop in the trade deficit was due to a much larger drop in imports relative to exports. With imported goods cheaper in price, due to a stronger dollar, the large drop in imports certainly doesn't reflect a stronger domestic economy.

The drop in goods imports in April was led by a $2.0 billion decrease in capital goods excluding autos, following a $3.2 billion jump the month before. Also declining were foods, feeds & beverages, capital goods excluding autos, automotive, industrial supplies, and consumer goods. No major import category gained which, again, is not a sign of strength for the U.S. economy.

While net exports declining may be a positive for GDP in the short term - the real story is businesses are cutting back on imports due to worries about demand as exports are down on weak global demand. The reality is that the economy is slowing, and most likely weaker, than the mainstream media and economists currently expect.

Furthermore, the trend of exports and imports further support the idea of a weakening economic environment. Since the peak set in 2010 on the back of QE 1 the annual trend of exports and imports has been on the decline. Furthermore, the trend of exports and imports have been corresponding to a weakening economic trend in the U.S. Had it not been for the intervention of "Operation Twist" combined with LTRO's in Europe it is likely that the U.S. would have already been in a recession. Without further intervention in the near future by the Fed it is likely that the negative trend in imports and exports will manifest itself once again into weaker economic numbers.

As we stated earlier the trends across many of the manufacturing reports as of late have shown signs of increased economic stress. The trade and wholesale numbers are confirming those reports. While there is certainly reason to believe that the Fed will not institute further easing at the current time due to the inflationary implications of such programs - the reality is that he may not have much of a choice.