We wake up Tuesday morning to major losses in Asian and European markets. The S&P 500 futures were off more than 45 points at the low. Trade Wars they say is the cause, with Trump ramping up the amount of Chinese goods that may be subject to tariffs and China saying they will do the same. Whether you believe this is posturing or negotiation or the start of a real trade war a few things are certain. First, the US imports about $550 billion in goods from China, whereas on $150 flow the other way. The Chinese cannot put tariffs on $200 billion of goods.

In other areas, the US economy is very strong. The Atlanta Fed estimates the 2nd Quarter GDP to come in over 4%. Interest rates in the US are rising. The debate continues as to how fast they will rise but they are going up. And with the ECB meeting last week it looks like European rates are not far from following suit. All of these have added to the strength of the US Dollar.

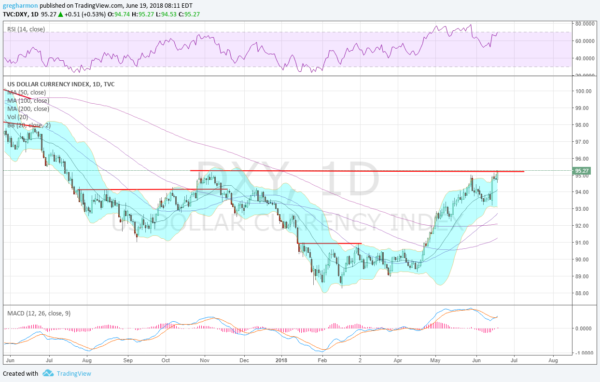

The chart above shows the US Dollar Index moving up over last November’s high, and closing in on a 52 week high. Momentum is strong and building as well. The RSI is rising in the bullish zone with the MACD crossing up, rising and positive. The Bollinger Bands® are also opening to the upside. All of this points to continued strength in the Dollar technically as well. Trade Wars, rising rates or whatever the US Dollar is the big winner.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.