China’s economy continues to struggle 15 months after “reopening” from their COVID lockdowns (December 2022).

Now, back then, many media pundits expected a booming Chinese recovery as pent-up savers splurged. Inflation was set to re-surge amid all this Chinese demand. And Chinese stocks looked primed to rise.

Oh, how wrong they were.

But that shouldn’t come as a surprise.

Why?

Because, as I highlighted before on China’s anemic economy in August 2023 – you can read here – China is dealing with many structural issues. Ones that cannot be fixed easily.

Long story short, it appears China is dealing with its version of the 2008 Financial Crisis as property prices sink, banks and corporations tumble, and deflation spreads.

But the real story here is how China is trying to fend off this crisis. . .

Because it will likely have global ripple effects.

So, let’s take a closer look at some of this potential contagion.

China Tries to Offset a Property Slowdown by Flooding Money Into The Manufacturing Sector

Here’s a bit of context on how we got here: Beijing in 2018-19 began cracking down on the rampant property sector (which is estimated to have made up roughly 30% of the total GDP). A big reason was the excessive amount of debt being used to overbuild.

I’m sure you’ve heard of “ghost cities” in China – aka the eerie towns that are full of unoccupied buildings decaying away.

All this excessive construction created growth. For instance, just imagine all the labor, concrete, copper, etc that went into building these ghost cities.

The catch? Well, it was fueled with debt and led to overcapacity – meaning too much supply relative to demand. Hence prices have been declining as all this excess can’t be absorbed by buyers. And even worse is that prices are declining against debt (imagine taking out debt to buy an asset, only for the asset price to decline – what an ugly combination).

To highlight this point, He Keng – a former deputy head of the statistics bureau – recently said at a forum that China’s 1.4 billion population “probably can’t fill” all the vacant homes.

So, it’s safe to assume there’s too much property supply. Thus, China’s short-term focus on boosting growth is now showing its dark side.

But what has Beijing decided to do about this?

Well, as the property sector reels, they have pushed for investment in the manufacturing sector to offset it.

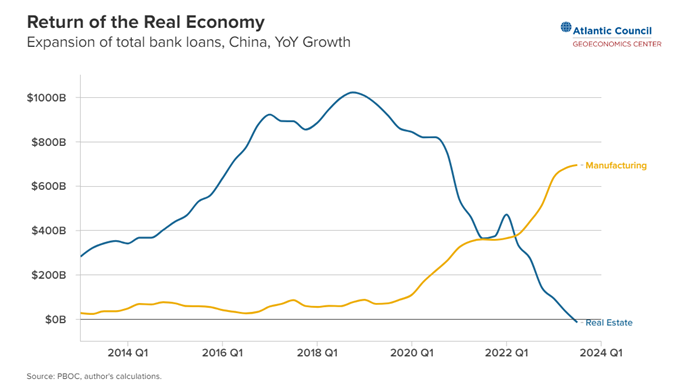

For instance – according to the Atlantic Council – Chinese banks are facilitating massive new borrowing for China’s manufacturers as property loans collapse.

In fact, in Q3 2023 Chinese banks extended nearly $700 billion in new loans— often lent at below-market interest rates — to the sector compared to the previous year.

Keep in mind this is a massive increase in an economy that already overproduces manufactured goods.

To put this into perspective – according to the Carnegie Endowment For International Peace – global manufacturing contributes 16% of GDP, fluctuating between 13% and 17% in recent years. But China stands out significantly, with manufacturing constituting a whopping 28% of its GDP.

Thus, this further surge in excess manufacturing to try and stave off declining growth is the real problem.

Drowning in Overcapacity: China’s Manufacturing Excess Is Now a Global Problem

I believe there are two fundamental issues with China pouring gas on an already over-produced manufacturing sector.

1. Chinese consumers have an excessively high savings rate to GDP (meaning they save a tremendous amount). I’m talking roughly 50% – compared to the U.S.’s 17%. This implies anemic Chinese consumption (you can’t do two things with the same currency: either save or spend). Thus, higher savings necessarily means less spending. I detailed this dynamic more in-depth before while dissecting the overhyped BRICS economies (read here).

Now, if Chinese consumer spending was increasing, then manufacturers may find it more worthwhile to invest in expansion. But, alas, it’s not. This is just creating more of a glut.

2. Chinese companies are already struggling with overcapacity which has pushed prices negative (aka deflation). We have already seen “price wars” break out in China as producers try and undercut each other to sell inventory. Although this is good for consumers, it’s not a great recipe for corporations with lots of debt to see their margins shrink (annual profits in China declined 2.3% in 2023 as demand and margins remained anemic).

A recent piece by the South China Morning Post (SCMP) covered a story about the 2024 China Corporate Payment Survey recently conducted by Coface which found that “increased competition was deemed the biggest cause of financial difficulties among customers, due in part to excessive capacity in some industries.”

So even more forced capacity in the face of a glut will only make problems worse.

These two issues are why – I believe – China’s economy won’t get any relief from increased manufacturing investment.

Sure, it may stave off an economic slowdown. But it will only cause longer-term problems. Simply put, Chinese policymakers are kicking the can down the road.

Now, you may be wondering:

“Alright, China seems stuck in a rut. But what does that mean for the global economy?”

Well. Let’s break it down.

If the Chinese consumer remains anemic (which it is). And manufacturers keep increasing supply (which they are), there’s really only one option to prevent a deflationary collapse.

They need to export the glut of supply. Or putting it another way, dump it on foreign markets.

And this is exactly what China has been doing.

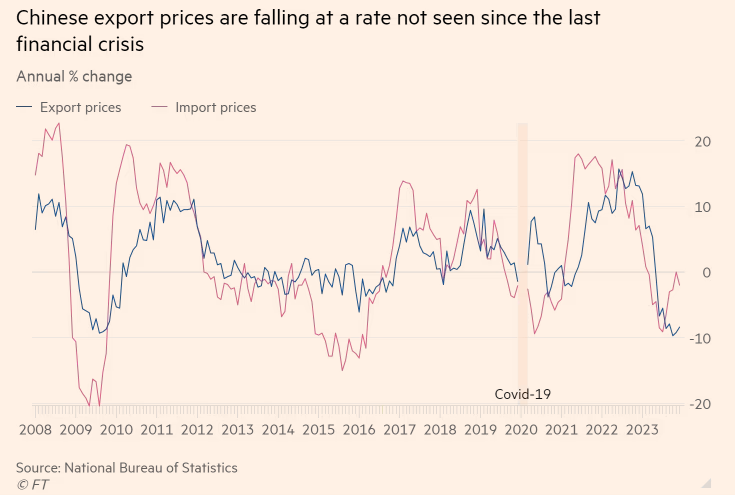

To point out how serious this is, Chinese export prices are plunging at rates not seen since 2008 amid all this excess (aka too much supply relative to demand)

They’re literally flooding major economies – such as the eurozone, India, Russia, Latin America, etc – with their over-supplied manufacturing goods. And this has re-sparked trade tensions with China.

For example:

1. Brazil – Latin America’s largest economy – recently opened probes into how Chinese imports have surged amid this flood of cheap goods.

2. The Eurozone is looking to place tariffs on Chinese goods – specifically electric vehicles – after they have seen imports affect their own sales (remember Germany is a huge automotive exporter themselves).

3. And according to CNBC, even without direct sales in the U.S. Chinese automakers are increasingly threatening American counterparts as Chinese vehicle exports soar. For instance, last year, China exported over 5 million vehicles, surpassing Japan as the world’s leading car exporter.

Don’t be surprised if a trade war ramps up as the global economy tries to fend off a glut of Chinese imports.

The Pros and Cons of China Flooding the World with Goods

As always, it’s a double-edged sword.

PROS:

China ramping up cheaper exports essentially means they’re exporting their deflation abroad (or rather, the cheaper-priced goods are flowing into global markets, which can ease price pressures).

Because of this, it may allow central banks – like the Federal Reserve, the European Central Bank (ECB), and the Central Bank of Brazil – to cut interest rates sooner rather than later to prevent further banking stress and slowing growth.

CONS:

Surging imports from China could cause domestic issues – such as declining manufacturing competitiveness, rising unemployment, larger deficits, and more debt.

For example, if Chinese imports (specifically EVs), in the eurozone keep rising, manufacturers could suffer from diminishing sales and production levels, trickling into bankruptcies and layoffs, and a very upset populace. One has to wonder: will the rest of the world deal with these issues in order for China to export its way out of a slowdown? I don’t believe so.

Meanwhile, it’s possible (historically speaking) that China may retaliate against any moves that block their exports – such as tariffs and quotas on Chinese goods. Put simply, if the U.S. or Europe put tariffs (taxes) on Chinese goods, China would likely do the same back.

As China struggles to find its footing and turns to the global economy to eke out what it can, this will have big implications for global trade.

Remember: declining Chinese imports take away from global demand and growth (since China is buying less, which means fewer sales from other countries). And cheaper Chinese exports take away from global manufacturing (making domestic producers them less competitive).

So, keep an eye on this.

Because it will have profound ripple effects – both economically and politically – all over the world.