Just like a growing number of other major US companies, Hewlett-Packard (NYSE:HPQ) is heading back to China.

There is no telling what motivated the move - however, HP's decision matches a number of other US-based technology companies that, for reasons either political, profit-related, or possibly both, are checking out of President Donald J. Trump's trade war and back into business as usual in China. Now, with the latest chapter in the year-plus trade war set to be written this week as Chinese officials prepare to meet US administration negotiators to talk tariffs, a number of American companies are bucking the Trump-trend.

The first chart tracks HP's job postings in China, which rose more than 77% since the end of Q2. Globally, job postings have increased less than 5% for HP - making clear how aggressive its return to China has been as of late.

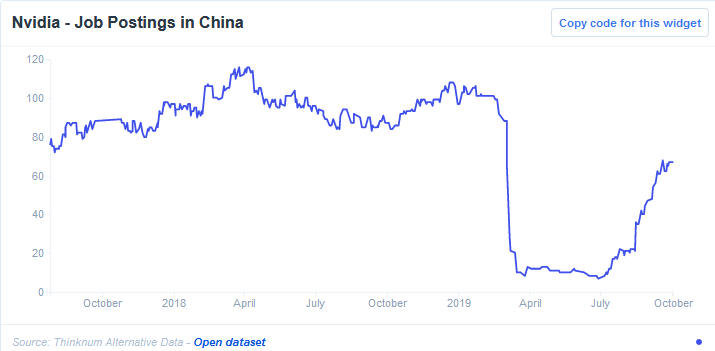

HP isn't alone in China - in fact, it's got a bit of company and the list continues to grow. NVIDIA (NASDAQ:NVDA) backed away from Chinese production plans as the trade war commenced late last year - but, after a break from operating in China, Nvidia, too, was back to business as usual. The company added 60 new job postings in China, reclaiming much of the momentum its data reflects having lost toward the end of 2018 and in early 2019.

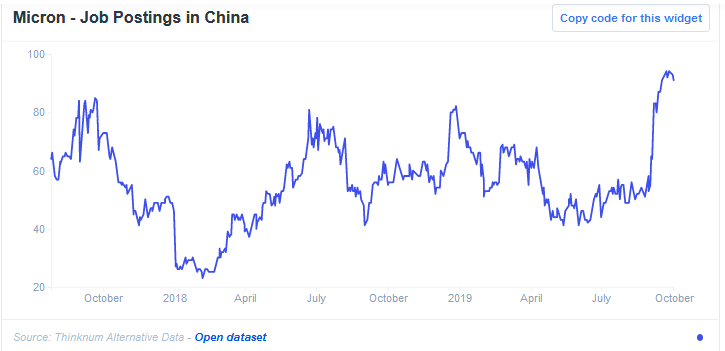

Micron (NASDAQ:MU), too, is back in China - the company more than doubled job postings there, for the second half of 2019 thus far.

As President Trump and his gaggle of trade advisors await the latest Chinese delegation waiting to talk trade, it signals that the US is losing out in the trade war as it continues to mount to ridiculous heights. Recent macro-economic reports covering manufacturing and farming paint bleak outlooks of the American economy. It comes as other American businesses (surprisingly, the Houston Rockets involuntarily entered the fray after one member of team management had the gall to speak out in support of Hong Kong protestors' free speech) are feeling increased pressure from Chinese officials to keep business flowing despite the beef with US leaders.

Right now, a growing number of American businesses are asking themselves: are they on President Trump's side, or would they rather make sneakers, or smartphone components, or jump-shots, and benefit from doing it in the largest growing economic superpower in the world? The answer is becoming increasingly clear.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.