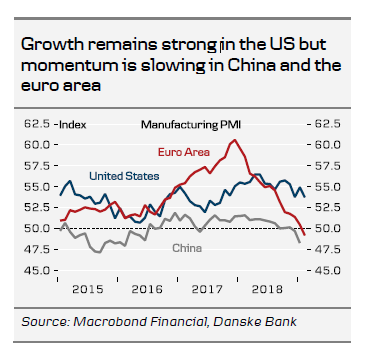

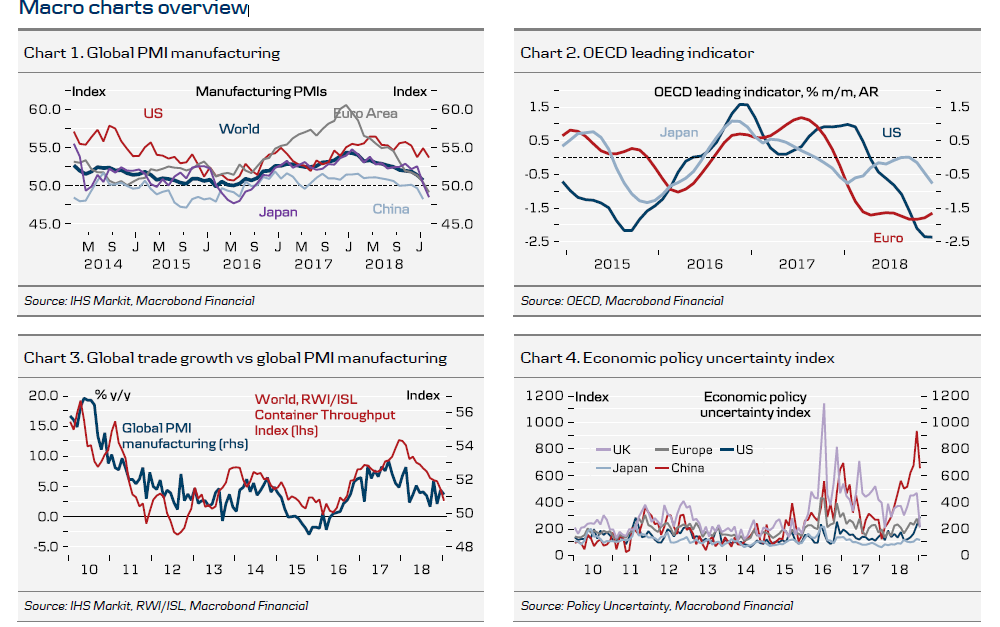

Data through February confirmed that we remain in a fragile economic growth environment. It is still too early to call a global rebound, as the rays of light in the global economic cycle in January did not brighten in February. Euro area manufacturing PMI was dreadful and we are yet to see the trough, although the services PMI rebounded in February, suggesting a stabilisation of the domestic euro area environment. In both the US and China, manufacturing PMI fell back slightly in February compared with January. The PMI level still points to weak growth in China in Q1 but we see some tentative signs of stabilisation.

The US-China relationship holds one of the keys for a rebound in global trade and the economic outlook. Most recently, trade talks have shown positive signs. For three consecutive weeks high-level delegations from the US and China have met to negotiate a trade deal, which suggests the strong commitment on both sides. Furthermore, US President Donald Trump has delayed the introduction of tariffs on Chinese goods planned for 1 March. Our base case remains that the two sides will agree a trade deal, with a 75% probability of this occurring by the end of Q2. However, as we expect Trump and Xi Jinping to meet at the end of March it could happen earlier. We see the trade negotiations getting a bit noisier towards the end, as China is unlikely to meet all US demands. Ultimately, however, we believe Trump wants to agree a deal soon, before the 2020 election campaign really begins.

On the Brexit front, things still look uncertain with Prime Minister Theresa May's promise to hold three votes on 12-14 March (on a Brexit deal, a no deal and an extension of Article 50, respectively). While we have talked a lot about the Cooper amendment recently, it may be pulled if MPs have faith in May's promise. Accordingly, we have changed our probabilities and now assign a 30% probability to a new vote, 45% to decent Brexit, 10% to a no-deal Brexit, 10% to a 'Norway deal' and 5% to a new election. See more in Brexit Monitor - 'No deal' risk has declined but not disappeared , 28 February.

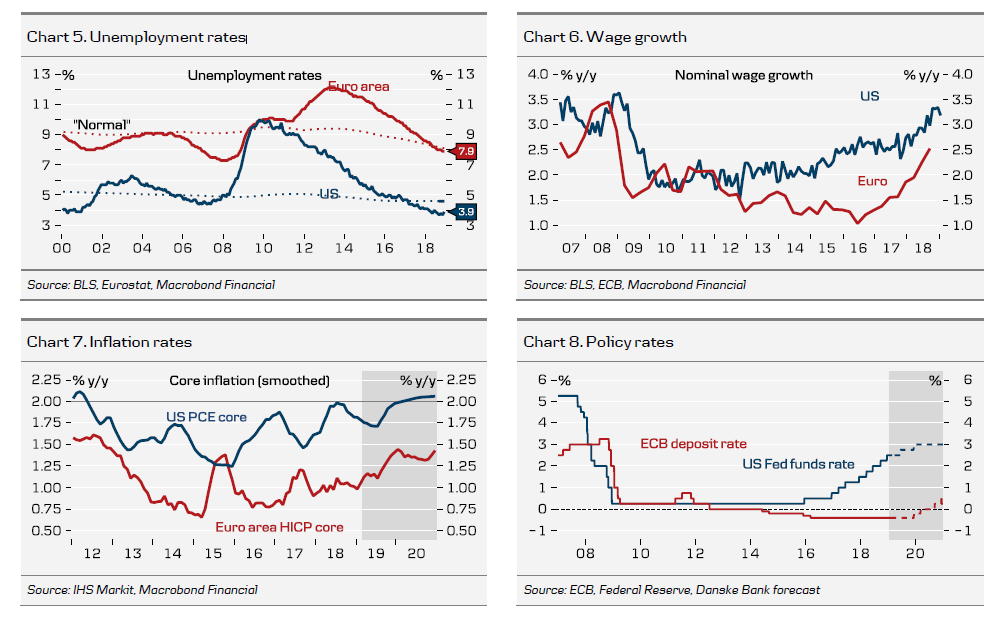

The two major central banks, the ECB and the Fed, have one key point in common: they await further data. Based on our still-positive macro outlook for the US and the global economy (and hence financial markets), we expect the Fed to hike policy rates this year but it is no longer a given that the first one will be as early as June, which is our current base case. The Fed seems focused on wanting to see higher inflation and market-based inflation expectations, before announcing another hike. Importantly, the Fed has turned cooler on balance sheet normalisation and could announce an end to the reduction by the end of the year. The ECB's near-term inflation outlook is looking challenged, as growth has lost momentum. While the ECB flagged downside risks to its growth forecast in January, some indicators have shown signs of stabilisation. We continue to expect a pickup in Q2, so expect the ECB to hike rates later this year.

Towards the end of the month, oil prices stabilised somewhat after a strong rise through most of February. Brent Crude has risen c.7% compared with January. The Venezuelan crisis and Russia fulfilling its OPEC+ agreement have been offset by President Trump tweeting that 'oil prices are getting too high' and 'OPEC should relax'.