I have a buddy that is a former block trader at a major firm. Now he’s an investment adviser in town, so I went over to say hi the other day. There were about five advisers there, all were older than dirt. One was actually napping. I felt like I should have brought something; like chest paddles or embalming fluid. Next time I’ll be more prepared.

I asked what these guys do. He said that have countless millions on their client money lines and about 90%-95% of the assets are in bonds, some preferred stocks. They really have no exposure to common stocks. Many of their clients aren’t older folks either; many are in their prime earning years. This is probably a microcosm of what is going on around the country. Chunks of this money will eventually go to stocks. It will have to.

The market made more highs last week on lighter volume, but the holidays are right around the corner. From my personal recollection, Thanksgiving week has always had a bullish bent. Lighter volume doesn’t mean you can’t see some really good action. Sometimes the action is actually better because of that fact.

Here are some setups to put on your radar for next week.

Keycorp. (KEY) is flagging on the daily, watch for a move through the 13.05 zone with volume.

McDonald's Corporation, (MCD) Mickey Dees may be attempting to break out of this down channel that started back in April. Watch for a move above the 99 level. Good volume will be important.

GREK I talked about this one (Greek market) at lower prices, but it looks like its setting up again for another run at higher prices. You can buy it here with a stop just below the 50 day ma.

Transition Therapeutics Inc. (TTHI) I originally recommended this one around 4.10. A potential breakout pattern is developing at 5.30. Target 6-6.50

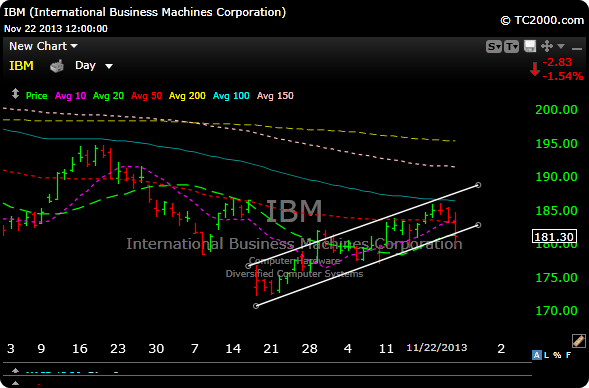

International Business Machines, (IBM) I put this out as short Thursday morning on Stocktwits. The stock is in an ugly bear wedge and is in the process of breaking lower. Friday’s volume was about 50% higher than its 50 day average.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trade Setups: Keycorp., McDonald's, IBM And More

Published 11/24/2013, 04:47 AM

Updated 06/21/2024, 01:30 PM

Trade Setups: Keycorp., McDonald's, IBM And More

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.