Sell Rebounds In EUR/USD

Last week saw an incredibly Dovish turn of events for the euro with the ECB announcing that they are considering all options in their efforts to boost inflation, including further reduction of interest rates and expansion of their quantitative easing program. Markets were fairly bearish heading in to the meeting with most expecting Dovish rhetoric from the ECB but the reaction to the news shows that markets certainly were not expecting such comments from the European Central Bank.

With EUR short positioning greatly reduced from yearly highs early on in the year there is now plenty of room for further engagement to drive price lower. Similarly USD longs have seen consistent reduction in recent months leaving plenty of room for players to position for upside. The October FOMC rate decision on Thursday is not expected to see the Federal Reserve lift rates but traders will be keenly scrutinizing the statement for clues as to whether the December decision will herald a lift-off with any potentially hawkish remarks likely to see sharp USD buying.

Trade Idea

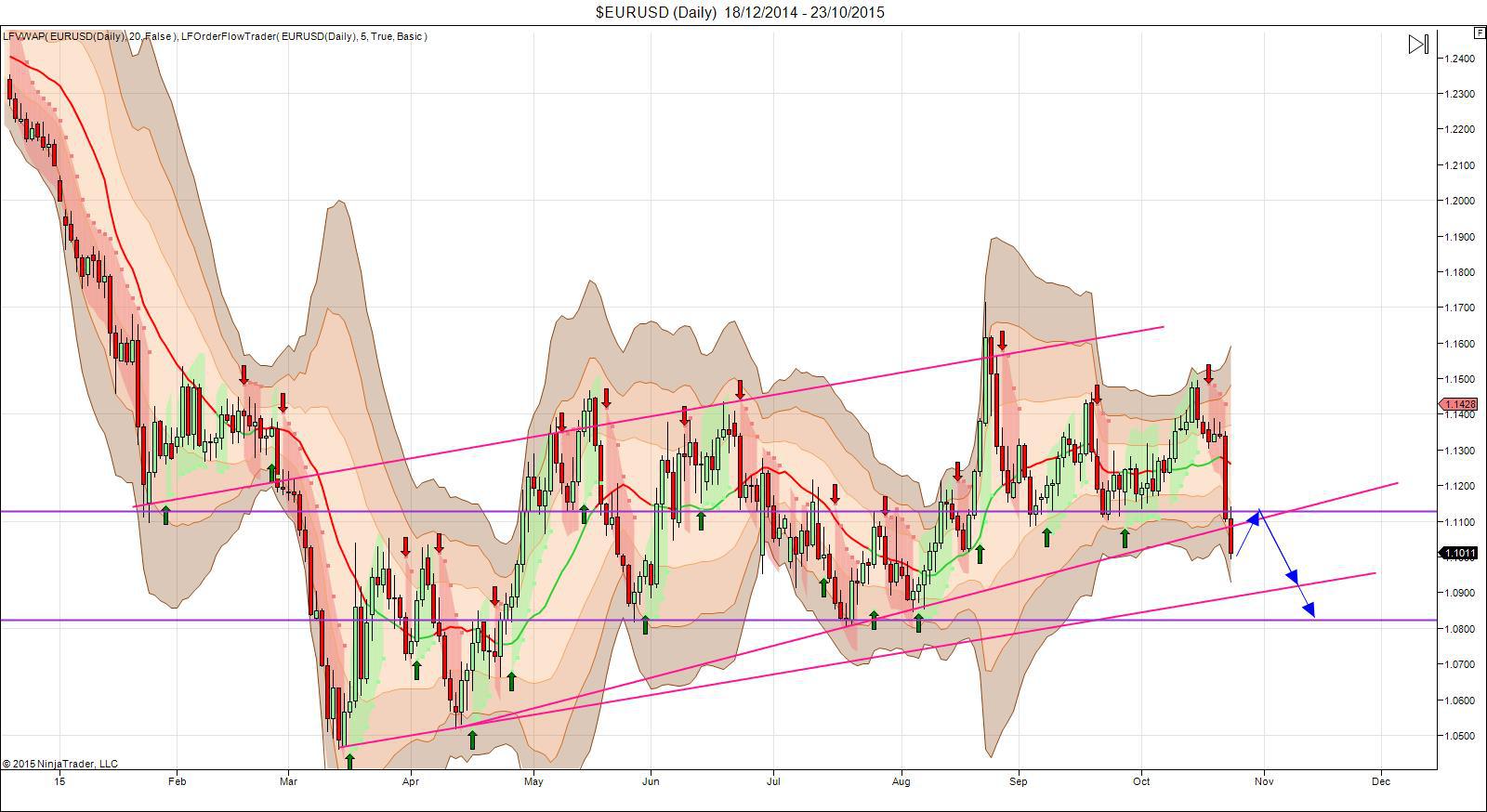

The year-to-date consolidation in EUR/USD is easily framed by some very key static and dynamic support & resistance levels. The break down through the 1.1130 support level and the rising trend line from the April, July and August lows highlights two clear targets now: 1) the rising trend line from year-to-date lows and 2) the horizontal support from the May and July lows at 1.0820.

With these targets in mind, look to sell rebounds back into a retest of the broken 1.1130 support level in line with bearish Order Flow and price moving under VWAP.