Trade of the Day: AUD/JPY retreated with risk off sentiment developing since Friday’s mixed NFP data. With China out for New Year and local data light, expect some consolidation after the sharp moves last week. The risk would be for an extension of the move from Friday as London trade desks digest the NFP data and the China FX reserve data, which demonstrated a less than expected decline in China’s domestic FX reserves.

Comments from BoJ over the weekend stating that the BoJ should reinforce QQE and increase available options for further easing in future by implementing additional measures in order to sustain credibility fro monetary policy. Adopting QQE with negative interest rates will enable the BoJ to demonstrate there is plenty of room for pursuing additional easing.

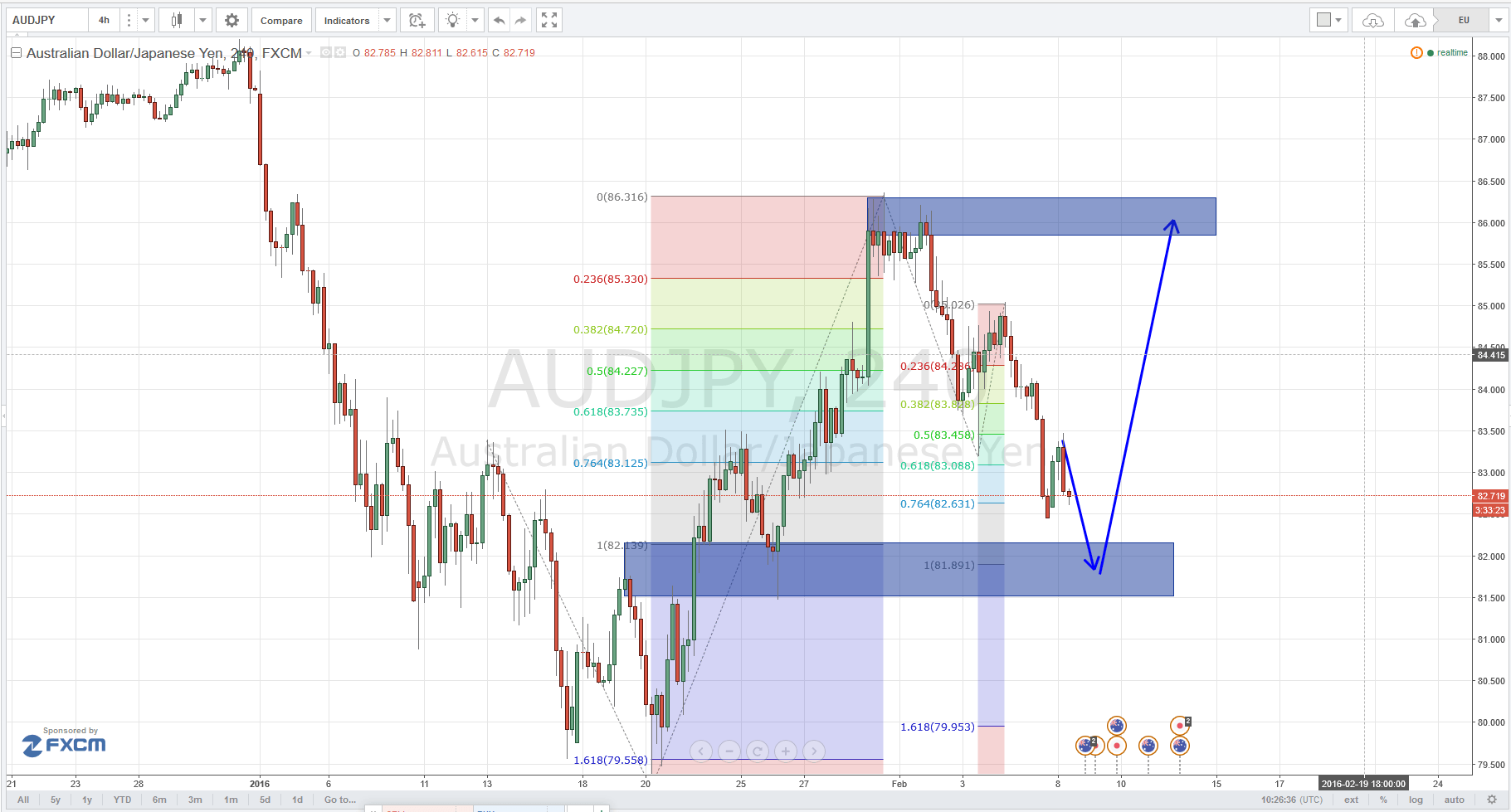

Trade Idea: I am monitoring the retracement in the AUD/JPY, which appears to be developing an AB=CD pattern against the impulsive move up from January lows, the completion of the AB=CD pattern coincides with a symmetry target at 82.00 which is also the 61.8% retracement of the prior upside move. I will be monitoring intraday reversal patterns at the 82.00/81.80 levels to set longs, risking 85 pips, initially targeting a retest of the prior highs at 86.20 with 89.30 as an extension objective.