Trade Of The Day: AUD/CHF To Test Support

Trade Of The Day: AUD rebounded yesterday after slid to the day low of 0.6924 during the Australasia session, then turned higher on the PBoC fixing. Traders believe much of the recent weakness of the Aussie came after Beijing set erratic yuan guidance, leading markets to question China’s policy intentions. The Aussie, which is often used as a proxy for China yuan, slipped around 4.5 percent last week in its largest decline in four years. Retail sales in Switzerland dropped by 2.1 per cent year on year in November, a further acceleration from the 1.1 percent decline recorded in October.

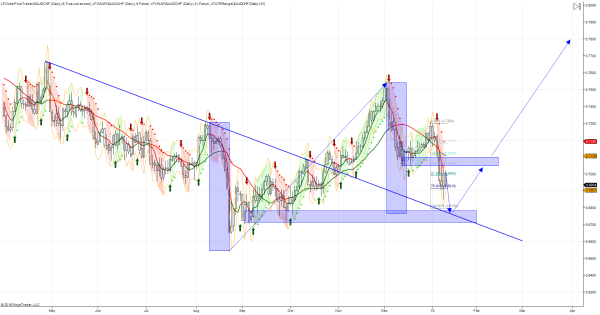

Trade Idea: While .7000 remains interim resistance, I am looking for the pair to trade lower to test the .6800 level where a confluence occurs, there is a a symmetry pattern with the last leg of decline into the prior low (depicted in the chart by the vertical blue boxes), there is also an AB=CD pattern which completes at the level the broader symmetry pattern completes and finally these to confluent factors coalesce at a throwback test of former descending trend line resistance to now act as support. Ultimately I am watching for an intraday reversal at the .6800 level to venture long against .6700 for an initial upside objective of .7100 and .7800 in extension.

Trading Update: Long .6841 Stops to entry