Sell GBP/CAD

GBP is exposed to further weakness ahead of the BOE meeting on Thursday as investors brace for further dovishness from the Central Bank in the wake of a deteriorating global growth outlook, underscored by last week’s dismal US jobs report, which saw a fourth consecutive low print. Key risk is on any Hawkish slant out of the BOE this week, which could undermine this trade idea.

CAD has the potential for a near term rebound following last week’s in-line GDP print and a small stabilization Chinese data, which has seen commodities trading firmer with CAD benefiting from firmer oil prices. Canadian Unemployment on Friday will be key domestic data to watch with a positive print supporting this trade idea.

Trading Idea

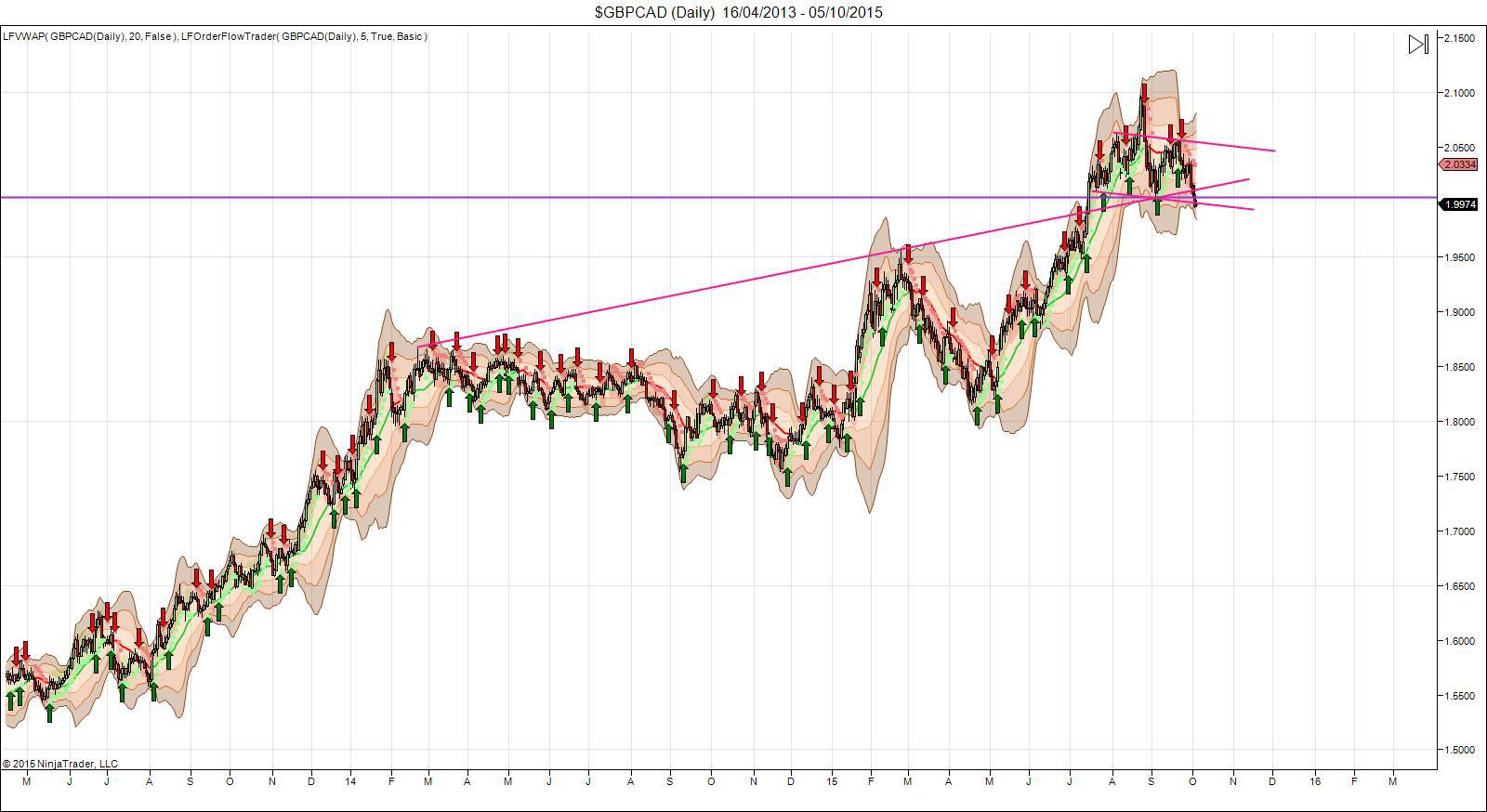

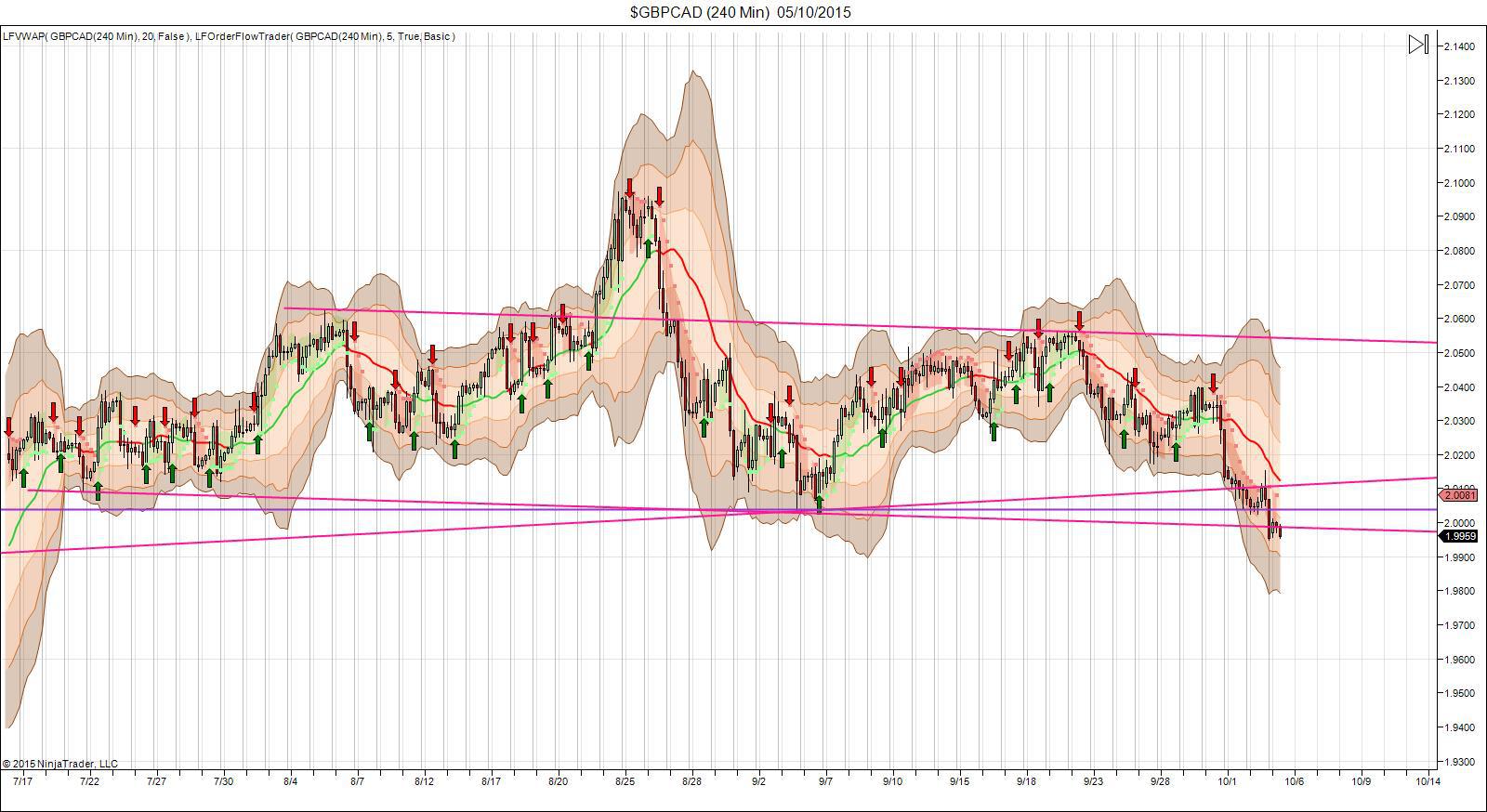

The daily chart shows that whilst we are still with in the confines of a longer term bullish trend there is potentially a medium term top in place with the formation of a head and shoulders pattern evident. Price has broken under key trend line support and is currently stalled at a retest of bearish channel support having moved under the September low.

With daily order Fflow bearish here and price moving below VWAP, encouraging further downside look to either sell a break down below the 1.9950 level or look to sell a retest of VWAP. Stop placement should consider structure (place above the last h4 swing high). Target a move back down into the 1.95 support area formed at the February 2015 high.