I recently penned an article entitled "3 Major Risks To The 4th Quarter" wherein we discussed the impact of the Eurozone recession, and slowdown in China, on the domestic economy. In it we stated "The continued recessionary drag across the Euro zone is dampening revenues and slowing demand for exports from the U.S. Recent corporate reports from key transportation related companies have all warned of weaker outlooks due to slowdowns in the Euro zone."

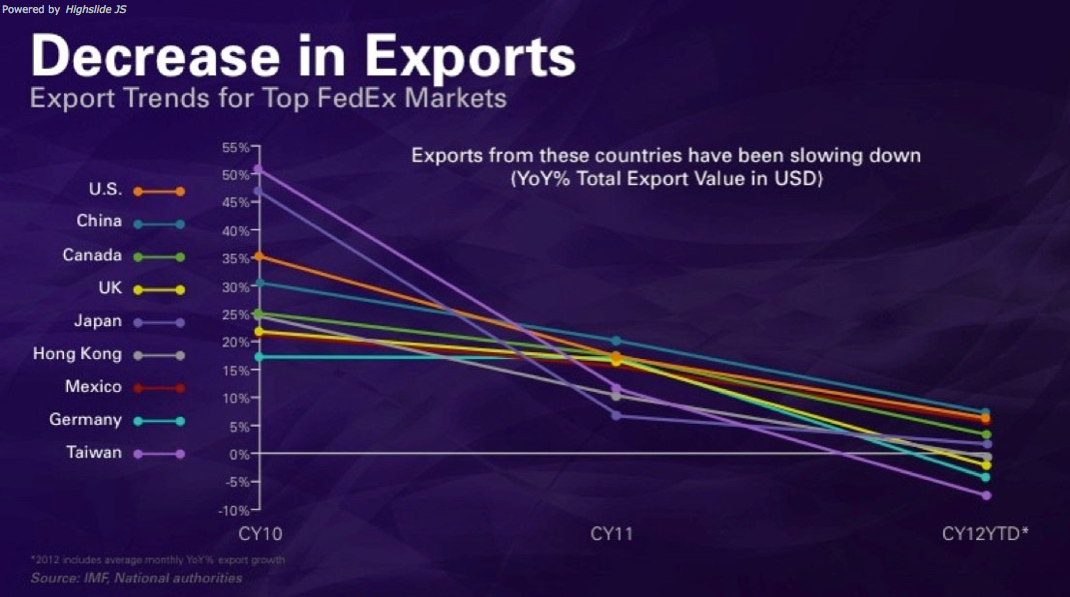

The chart below was presented recently by the Frederick Smith, the President and CEO of FedEx Corp., which shows the clearly negative trends in the year-over-year exports including the U.S.

These very negative trends are important to understand because it is the source of revenue for businesses worldwide. As consumer demand slows it reduces the need for production ultimately reducing profitability. Furthermore, this delcline in production and consumption leads to higher unemployment, lower incomes and ultimately an economic recession. Domestically, exports are more crucially important than ever as they now comprise more than 13% of GDP and 40% of corporate profits.

Historically, when exports have turned down the economy was either in, or slipping into, a recession. The recent drop in durable goods orders and industrial production have been clear warnings that this could already be in the works.

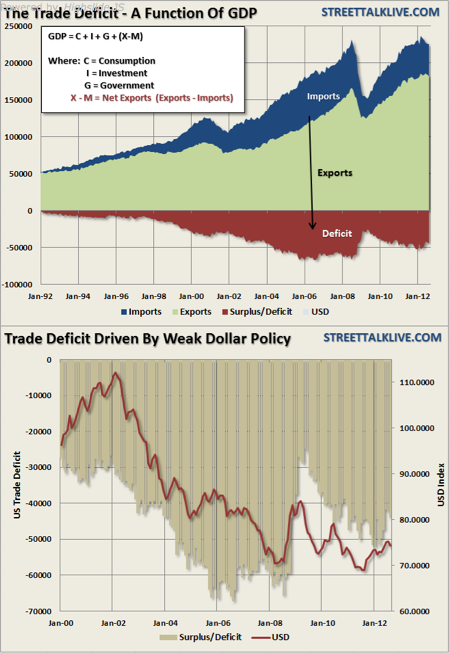

Today's release of the trade data provides further recessionary warning signs. In August, the U.S. trade balance worsened as exports declined reflecting economic weakness in Europe and slower growth in Asia. Also, oil and petroleum product imports jumped on higher prices due to a weaker U.S. Dollar.

The trade deficit expanded to $44.2 billion from $42.5 billion in July (originally $42.0 billion). Exports fell 1.0%, following a 1.1% decrease in July. Imports slipped 0.1% after a 0.6 percent dip the prior month. The decline in exports was again was led by a decline in industrial supplies, foods, feeds and beverages with minor slippage in autos and consumer goods. None of this data is good for corporate earnings heading into the fourth quarter particularly as higher oil prices impact consumer demand.

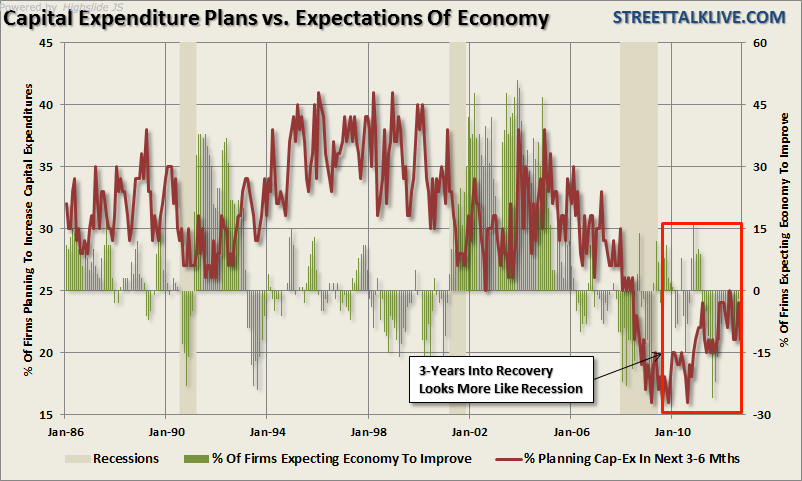

Furthermore, this data is clear evidence as to why businesses are remaining cautious about equipment investment as demand for consumer goods, and capital goods excluding autos, continue to weaken. The decline in consumer goods leads to concerns about future demand putting businesses on the defensive which was clearly evidenced in our recent report on the NFIB Survey: "The ongoing problem remains 'poor sales' which is the driver for all other business actions from increased capital expenditures to future employment.

From the report: 'Weak sales continue to be an albatross for the small-business community. The net percent of all owners (seasonally adjusted) reporting higher nominal sales over the past three months was unchanged at a negative 13%, cementing the 17-point decline since April and affirming weak GDP growth for the second quarter. Twenty-one (21) percent still cite weak sales as their top business problem -- historically high, but down from the record 34% reached in March 2010.

Consumer spending remains weak and high energy costs continue to 'tax' consumer disposable income. The net percent of owners expecting higher real sales was unchanged at one percent of all owners (seasonally adjusted), down 11 points from the year high of net 12% in February. The weak reading is unlikely to trigger orders for new inventory or business expansion. Not seasonally adjusted, 24% expect improvement over the next three months (down four points) and 31% expect declines (up three points).'

The chart below shows capital expenditure plans versus future expectations about the economy. The importance here is that companies are primarily spending on maintenance of plants, property and equipment rather than expansion and upgrades. In the most recent report only 34% reported spending on new equipment which was down seven points from August. Only 16% acquired vehicles - a decline of five points, and just 14% improved or expanded facilities which remained unchanged from the previous report. Overall, there was a substantial reduction in capital spending activity with the percent of owners planning capital outlays in the next three to six months falling three points to 21%.

The outlook, and ultimately actions taken, by businesses are driven by demand for their products, goods and services. Unfortunately the Fed's bond buying program does not impact these core issues.

However, what QE programs do have an impact on is the value of the dollar relative to other currencies. Historically, the dollar has declined during stimulus programs as money is pulled out of safehaven investments and moved into risk assets such as commodity and stock markets. During the third quarter as the markets advanced in expectation of the Fed's announcement of QE3 -- the dollar declined sharply. Therefore, as shown in the chart below, the recent increase in the trade deficit occured as stated in our last report. "The continuation of the Eurocrisis has created a capital flight into the US dollar for 'safety.' However, since July, the strong dollar trend has reversed on the announcement by the ECB 'do whatever is necessary' to save the Euro zone. Therefore, the trade deficit will increase in the next couple of months as the dollar weakens making imports more expensive for already cash strapped consumers."

The overall backdrop from the trade report does not bode well for a reversal of fortune for corporations domestically. The increase in the deficit will subtract from GDP in the coming quarter, as shown in the chart above, as Net Exports are a part of the GDP calculation. The issues is that with the economy currently growing at an already very weak 1.25% in Q2 -- there simply isn't much wiggle room between growth and contraction.

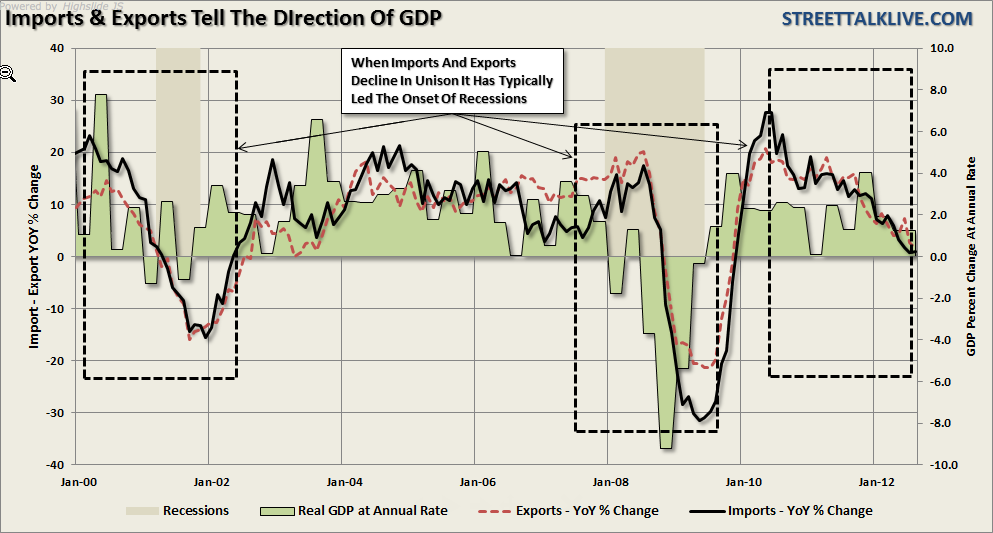

The risk to the current expectations of continued growth in 2013 is that the annualized rate of growth in both imports and exports is not supportive of those expectations. With exports now making up such a large percentage of GDP, and imports reflecting a weak consumer, the implications are for further weakness in GDP. The chart below shows the year-over-year change in imports and exports. Historically speaking, when both imports and exports have declined in unison it has indicated the onset of a recession. With the current decline in both imports and exports close to going negative the outlook is worrisome.

The recent trade report does not provide much support for the economic and stock market bulls. As we have stated many times -- the current fundamental and economic backdrops are not supportive of higher asset prices at current levels. However, while the market may advance due to the injections of liquidity into the financial system -- it doesn't make it a "healthy" market.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trade Deficit: Recession Risks Increase

Published 10/11/2012, 02:48 PM

Updated 02/15/2024, 03:10 AM

Trade Deficit: Recession Risks Increase

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.