Navient Corporation’s (NASDAQ:NAVI) second-quarter 2017 adjusted core earnings per share (EPS) of 43 cents surpassed the Zacks Consensus Estimate of 41 cents. However, the figure came below the year-ago quarter tally. The reported EPS for the quarter includes the effect of regulatory-related costs.

Core earnings excluded the impact of losses from the derivative accounting treatment. It also excluded the impact of certain other one-time items, including unrealized, mark-to-market gains /losses on derivatives, and goodwill and acquired intangible asset amortization and impairment.

Better-than-expected results of Navient reflect higher non-interest income and lower provision for credit losses. However, on the downside, the company recorded reduced net interest income (NII).

Net income came in at $123 million in the second quarter, down from $154 million in the prior-year quarter.

GAAP net income for the quarter was $112 million or 39 cents per share compared with $125 million or 38 cents per share in the year-ago quarter.

Rise in Fee Income and Lower Provisions More than Offset by Decline in NII (on core earnings basis)

Net interest income declined 15.9% year over year to $343 million.

However, non-interest income jumped 5.1% year over year to $185 million. Asset recovery revenues rose while servicing revenues declined.

Further, provision for credit losses decreased 4.5% year over year to $105 million.

Total expenses were flat year over year at $230 million.

Segment Performance

Federally Guaranteed Student Loans (FFELP): The segment generated core earnings of $57 million, down 16.2% year over year. The underperformance was mainly due to lower net interest income owing to amortization of the portfolio and also a decrease in net interest margin (NIM), partially offset by a decline in operating expenses.

FFELP loan spread contracted 4 basis points (bps) year over year to 0.89%.

During the quarter, Navient acquired FFELP loans of $4 million. As of Jun 30, 2017, the company’s FFELP loans were $86.1 billion, down 6.9% year over year.

Private Education Loans: The segment reported core earnings of $39 million, down 31.6% year over year. The decrease was due to lower net interest income owing to amortization of the portfolio and lower NIM.

Total delinquency rate came in at 6%, down 1 bp. Charge-off rate of 2.3% of average loans in repayment was 1 bp higher on a year-over-year basis. Student loan spread contracted 18 bps year over year to 3.48%.

As of Jun 30, 2017, the company’s private education loans totaled $24.2 billion, down 2% year over year.

Business Services: The segment reported core earnings of $81 million, same as the prior-year quarter figure.

Currently, Navient services student loans for over 12 million customers. This includes 6 million customers on behalf of the U.S. Department of Education.

Other: The segment reported a net loss of $54 million compared with a net loss of $52 million in the prior-year quarter.

Source of Funding and Liquidity

In order to meet liquidity needs, Navient expects to utilize various sources, including cash and investment portfolio, issuance of additional unsecured debt, repayment of principal on unencumbered student loan assets and distributions from securitization trusts (including servicing fees). It may also issue term asset-backed securities (ABS).

During the reported quarter, Navient issued $1 billion in FFELP Loan ABS and $552 million in unsecured loan debt. Also, the company retired or repurchased $254 million of senior unsecured debt during the quarter.

Share Repurchase

During the quarter, Navient repurchased 10.9 million shares of common stock for $165 million.

Our Take

Navient’s top line continues to remain under pressure. However, we believe that the company will maintain its leadership position in the student-lending market through various growth avenues, including acquisition of loan portfolios. Additionally, economic recovery and declining unemployment rate are likely to fortify its business prospects as well as help borrowers in repaying their loans.

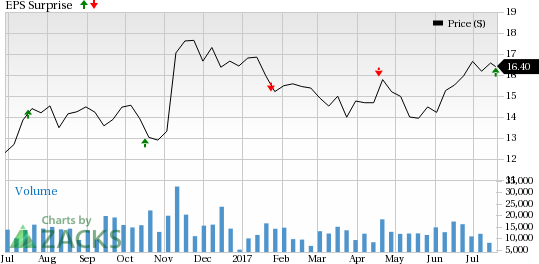

Navient Corporation Price and EPS Surprise

Navient currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the finance space, Ally Financial Inc. (NYSE:ALLY) is slated to release results on Jul 27 while Trustmark Corp. (NASDAQ:TRMK) and T.Rowe Price Group, Inc. (NASDAQ:TROW) will release their earnings on Jul 25.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Trustmark Corporation (TRMK): Free Stock Analysis Report

Navient Corporation (NAVI): Free Stock Analysis Report

Ally Financial Inc. (ALLY): Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

Original post

Zacks Investment Research