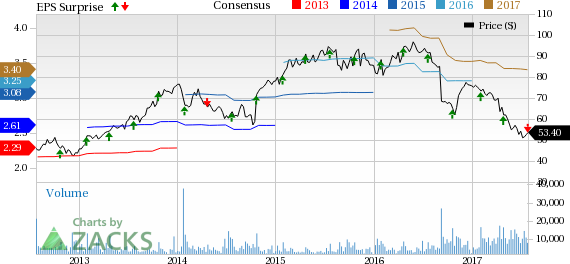

Tractor Supply Company (NASDAQ:TSCO) reported second-quarter 2017 results, wherein both the top line and the bottom line fell short of our estimates. Also, the company lowered its full-year outlook, on account of an unimpressive overall first-half performance. In fact, an unsatisfactory first half also caused this Zacks Rank #4 (Sell) stock to plunge 29.6% on a year-to-date basis, as compared with the industry’ decline of 10.5%.

However, shares of this farm and ranch store retailer climbed 1.6% on Jul 26 aftermarket trading session, as both the top and the bottom line grew year over year. Further, management is pleased with the early third-quarter trends and constant efforts to integrate physical and digital operations. However, it remains to be seen if these factors can continue to boost investors’ sentiment and revive the stock.

Q2 Highlights

Though the company’s earnings of $1.25 per share were below the Zacks Consensus Estimate of $1.27, it increased 7.8% year over year.

The top line advanced 8.9% to $2,017.8 million, while it missed the Zacks Consensus Estimate of $2,020.7 million. Comps improved 2.2%, against a 0.5% drop witnessed in the year-ago period. Well, comps growth was hurt to an extent of about 60 basis points (bps) due to lesser sales days this quarter, as compared to second-quarter 2016.

The rise in comps was backed by 2.2% growth in comparable transaction count, while average ticket remained flat year over year. Further, comps growth was fueled by improvement in several product categories, with Livestock and Pet topping the list. Also, transaction count growth across all geographic regions contributed to comps.

Margins & Costs

The gross profit rose 8.5% year over year to $704.7 million, while gross margin declined 10 bps to 34.9%. The Gross margin was hampered by greater freight costs, stemming from higher diesel fuel prices as well as mix shift toward products that are more freight intensive.

Selling, general and administrative (SG&A) expenses, including depreciation and amortization, as a percentage of sales, increased 50 bps to 22.1%. This increase was primarily due to increased payroll expenses, infrastructural and technological investments and costs related to Petsense integration. In dollar terms, SG&A expenses (including depreciation and amortization) escalated 11.7% to $446.8 million.

Consequently, operating income margin contracted 60 bps to 12.8% in second-quarter 2017. Nonetheless, operating income, in dollar terms, jumped 3.5% to nearly $257.9 million.

Financial Position

Tractor Supply ended the quarter with cash and cash equivalents of $67.8 million, long-term debt of $433.7 million, and total stockholders’ equity of $1,382.6 million.

The company repurchased 2.2 million shares for $134 million in the quarter. With this, Tractor Supply bought back 3.8 million shares for $248 million on a year-to-date basis. Further, the company incurred capital expenditure of $96.6 million in first-half 2017, while it generated cash flow from operating activities of about $227.5 million.

Store Update

During the second quarter, Tractor Supply opened 14 namesake stores and closed one Del’s store. Further, the company opened eight Petsense stores during the reported quarter.

Including these, the company inaugurated 38 namesake stores, closed one Del’s store and converted two Hometown Pet stores to Petsense stores in first-half 2017. During this time frame, Tractor Supply opened 17 Petsense outlets (including the aforementioned conversions). As of Jul 1, the company operated 1,630 Tractor Supply stores in 49 states, and 160 Petsense stores across 26 states.

The Road Ahead

As mentioned earlier, management remains impressed with the early third-quarter trends, given the continued solid demand for spring season products – thanks to favorable weather. Thus, the company is set to exploit the advantages of this extended spring selling period. Additionally, the company remains on track with its “One Tractor” initiative that is strengthening the connection between its physical and digital operations, thus augmenting the top line. Evidently, the company closed the rollout of its Buy Online Pick Up in Store program and continued to expand its Neighbor’s Club customer rewards program in the second quarter. Notably, the Buy Online Pick Up in Store program was well-received and contributed more than 55% to online sales.

However, based on the overall first-half 2017 results, the company lowered its 2017 guidance.

Updated Numbers

Management now projects net sales in a band of $7.13–$7.19 billion, compared with $7.22–$7.29 billion expected earlier. Comps growth is now guided in a range of 1.1–1.7%, down from the previously guided range of 2–3% growth. The updated comps view includes a negative impact of about 30% from deflation.

Gross margin is anticipated to be flat to down in 2017, owing to the dismal numbers in the first half. Both, SG&A expenses (including depreciation and amortization) and operating margin are expected to decline by 80 – 100 bps.

Finally, Tractor Supply now envisions earnings per share in a band of $3.22–$3.27, as against its old forecast of $3.44–$3.52. Moreover, the current forecast compares unfavorably with the Zacks Consensus Estimate of 3.40. Tractor Supply also updated its capital expenditures target for the year, from $270–$290 million to $250–$270 million.

Still Interested in Retail? Check these 3 Trending Stocks

Build-A-Bear Workshop, Inc. (NYSE:BBW) , with long-term EPS growth rate of 22.5%, sports a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Barnes & Noble, Inc. (NYSE:BKS) carries a Zacks Rank #2 (Buy). The stock has long-term EPS growth rate of 10%.

Five Below, Inc. (NASDAQ:FIVE) , also with a Zacks Rank #2 flaunts a splendid earnings surprise history. Also, the company’s long-term EPS growth rate of 28.5% bodes well.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Tractor Supply Company (TSCO): Free Stock Analysis Report

Barnes & Noble, Inc. (BKS): Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Original post