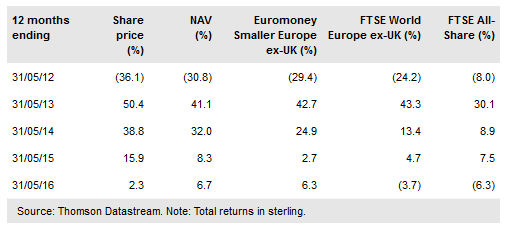

TR European Growth Trust (LON:TRG) holds a diversified portfolio of European (ex-UK) small and mid-cap companies, with the aim of achieving long-term capital appreciation. Set up in 1990, the trust has been managed by Ollie Beckett (assisted by Rory Stokes) at Henderson Global Investors since July 2011, over which time it has comfortably beaten the benchmark Euromoney Smaller Europe ex-UK index in share price and NAV total return terms, as well as outperforming larger-cap European stocks and the FTSE All-Share index. The portfolio is biased towards value situations and companies at the smaller end of the market cap spectrum. While focused on capital growth, the trust has also grown its ordinary dividend by a compound 15.5% a year over the past five years.

Investment strategy: Value-focused, research-driven

TRG holds a diversified portfolio of European small and mid-cap stocks, chosen by managers Ollie Beckett and Rory Stokes for their growth or recovery potential. The managers have a value bias and seek to invest in companies whose worth is underappreciated by the market. The large universe of stocks (c 1,300) is filtered using quantitative screens, and the managers meet or speak with hundreds of companies each year in their search for compelling investment ideas. The portfolio is biased towards the smaller end of the market (c 70% is in sub-£1bn companies), with diversification across a large number of names (c 145) to mitigate risk.

To read the entire report Please click on the pdf File Below