Toyota Motor Corporation (NYSE:TM) has signed an agreement with the Japanese multinational automaker, Mazda Motor Corporation (OTC:MZDAY) , to set up a new joint venture. Per the deal, the companies will collaborate to build a vehicle manufacturing plant in the U.S.

Total investment of $1.6 billion will be made to construct the plant with an annual production capacity of around 300,000 vehicles. The hub is expected to start operations in 2021 and provide up to 4,000 jobs.

Focusing on the North American market, Toyota will be independently manufacturing Corolla model in the new plant, whereas Mazda will be producing cross-over models for the same target market.

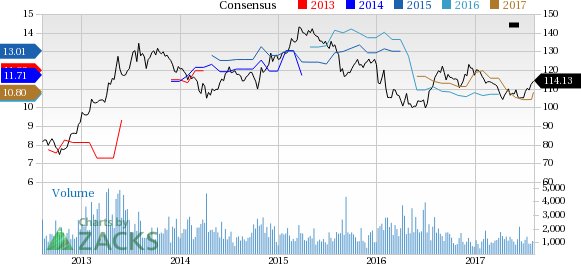

Toyota Motor Corp Ltd Ord Price and Consensus

With rise in demand for electric vehicles, Toyota and Mazda will be jointly developing new technologies for their ambitious electric vehicles segment. These developments will allow both the companies meet their changing market trends.

These collaborations and investment initiatives will help Toyota achieve sustainable growth and face future challenges.

Toyota’s new initiative — Toyota New Global Architecture (TNGA) — aims at improving the product development process and increasing the competitiveness of production sites. The automaker plans to shift half of its total manufactured vehicles to new cost-saving platforms by 2020. The company believes to be able to reduce development its costs by 20% through shifting production and use of common components.

Price Performance

Toyota’s shares have inched up 2% in the last six months, outperforming the 0.1% decline of the industry it belongs to.

Zacks Rank & Key Picks

Toyota currently carries a Zacks Rank #3 (Hold).

Some better-ranked automobile stocks are Cummins Inc. (NYSE:CMI) and Ferrari N.V. (NYSE:RACE) , both currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cummins has an expected long-term earnings growth rate of 12.1%.

Ferrari has an expected earnings growth rate of 14.1% over the long term.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Mazda Motor Corporation (MZDAY): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post