Toyota Motor Corporation (NYSE:TM) recalled around 64,900 units of Toyota Tundra and Sequoia, per Associated Press. This recently made safety-related announcement is due to the unexpected closing down of electronic stability control systems, which will put the vehicles in danger.

The latest recall includes 2018 models of Tundra and Sequoia, which were unveiled in 2017. The former is a pick-up truck, while the latter is a full-size SUV.

At the same time, another Japanese automaker Hyundai Motor Company announced recalling 43,900 units of 2018 Hyundai Santa Fe and Santa Fe Sport models. The recalled vehicles are at risk of breaking steering wheel from its column.

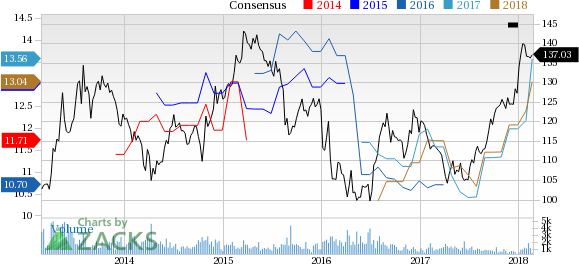

Toyota Motor Corp Ltd Ord Price and Consensus

In March, both the companies will inform its affected clients to get their vehicles checked and if required, the vehicles will be repaired without any additional costs.

Earlier in January, Toyota announced recalling an additional 601,300 vehicles due to flawed Takata airbags. The recall comprises of Toyota and Lexus models. Later, at the January end, it reported another 645,000 unit recall of Toyota Prius and Lexus RX and NX SUVs. The affected vehicles have an electrical problem, which might stop air bags from inflating in a crash.

Over the last few years, Toyota has been recalling vehicles in large numbers. Frequent recalls not only negatively affect the company’s reputation, but also result in significant expenses and lower vehicle resale value.

Price Performance

Shares of Toyota have outperformed the industry in the last 30 days. During the period, the company’s stock declined 1.8% in comparison with industry’s slump of 3.1%.

Zacks Rank & Key Picks

Toyota has a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are General Motors Company (NYSE:GM) , PACCAR, Inc. (NASDAQ:PCAR) and Penske Automotive Group, Inc. (NYSE:PAG) each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

General Motors has an expected long-term growth rate of 8.4%. In the last six months, shares of the company have gained 15.2%.

PACCAR has an expected long-term growth rate of 10%. In the last six months, shares of the company have gained 10.7%.

Penske Automotive has an expected long-term growth rate of 10%. In the last three months, shares of the company have gained 3.4%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geopolitics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Penske Automotive Group, Inc. (PAG): Free Stock Analysis Report

PACCAR Inc. (PCAR): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Original post

Zacks Investment Research