Against a challenging retail sector environment and ongoing economic uncertainty, Town Centre Securities PLC (LON:TOWNT) (TCS) delivered a robust underlying performance in FY19 while continuing to re-position its portfolio for the long term. Earnings and NAV were lower than in FY18 but the fully covered DPS was maintained, now held or improved in each of the last 59 years. Already below 50%, TCS plans to reduce retail and leisure exposure further and continue to recycle capital into more attractive opportunities, including the group’s significant pipeline of development opportunities.

Robust underlying performance in FY19

With its increasingly diversified portfolio and lack of exposure to the big high street names in its retail portfolio, TCS delivered a robust underlying property performance including a 2.6% increase in like-for-like passing rents and occupancy at 96% (FY18: 95%). CitiPark increased recurring profits by c 10% to c 30% of the group total. EPRA earnings and EPS were 7.9% lower y-o-y, due to investments, the short-term impact of CVAs and one-off expense movements. EPRA NAV per share was 7.8% lower at 354p and LTV increased to 49.4% despite a reduction in net debt. Retail and leisure assets are now less than 50% of the total (2016: 70%) and management signals it will accelerate divestment despite the potential short-term impact on income to de-risk the portfolio and free up capital for reinvestment. This is not reflected in our reduced forecasts (page 6) with lower net revenue in FY20e driven by refurbishment of The Cube, rebounding in FY21e on completion.

Weighing divestment and re-investment options

TCS is a family-run business with a strong focus on dividends, increasing or maintaining DPS in each of the last 59 years while recycling capital and actively managing assets for long-term growth. An extensive pipeline of potential development projects with an estimated gross value – once funded and developed – of more than £600m, represents both a significant long-term growth opportunity not captured by stated NAV and a differentiating factor for the group. Borrowing headroom of £26m and proceeds from further retail divestment is likely to be targeted at development investment and/or acquisitions. Management signals it is also open to potential accretive share repurchases.

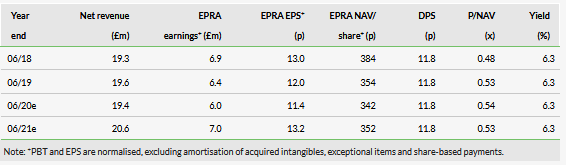

Valuation: Strong dividend commitment

TCS has a strong dividend commitment while continuing to invest for growth. The fully covered FY19 DPS represents a yield of 6.3%, while the share price discount to NAV per share is c 47%.

Share price performance

Business description

Town Centre Securities is a UK real estate investment trust operating across the UK, but with a regional focus, primarily in Leeds, Manchester, Scotland and (mainly suburban) London. It also has a car parking operation (CitiPark). The investment portfolio is intensively managed for income and capital growth

Active asset management with a regional focus

TCS is a UK real estate investment trust (REIT) operating across the UK with a regional focus, primarily in Leeds and Manchester, which are both strong local economies where management has the opportunity to exploit its strong and detailed knowledge of the local markets, Scotland and (mainly suburban) London. The company is family run with strong income focus and a 59-year record of increased or maintained DPS. It owns a mixed-use portfolio, valued at c £394.2m at 30 June 2019 (end-FY19), including key development sites in Leeds and Manchester. It also has a car park operation (CitiPark), which provides a growing and complementary revenue and earnings stream while monetising what would in some cases be empty, non-income producing development assets. Intensive asset management and active capital recycling are used to acquire new investment assets and invest in a substantial pipeline of development opportunities, repositioning and optimising the portfolio to drive long-term income growth and capital returns. TCS estimates the gross development value (GDV) of the development pipeline at more than £600m, which represents a valuable opportunity not captured by stated NAV and is a differentiating factor for the group. This note updates on the FY19 results, recent strategic developments and revisions to our financial forecasts. For an in-depth overview of TCS, please see our March 2019 outlook note.

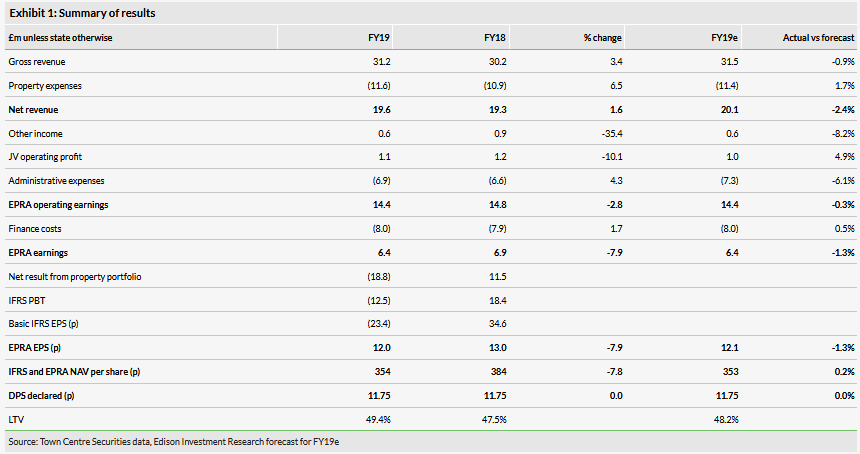

FY19 results summary

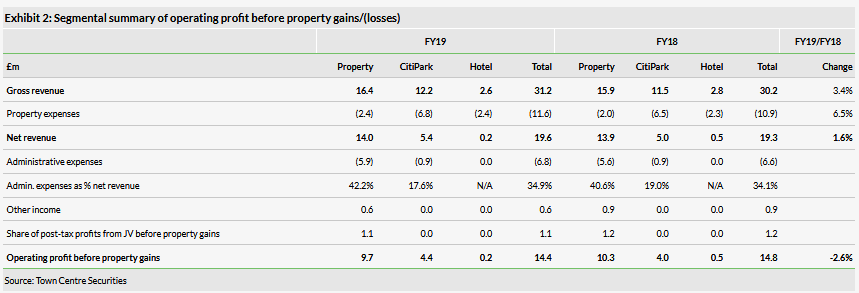

Against a challenging retail sector environment and ongoing economic and political uncertainty, TCS delivered a robust underlying performance in FY19, broadly in line with our forecasts, while continuing to re-position its portfolio for the long term. The property investment portfolio saw a 2.6% like-for-like increase in passing rents and overall occupancy improved to 96% (FY18: 95%), although divisional earnings were lower, primarily as a result of the short-term impact of retail company voluntary arrangements (CVAs) and administrations and one-off expenses. The car parking operation (CitiPark) increased operating profits before valuation movements by c 10% to represent c 30% of the total. TCS benefits from a secure mix of debt funding, which was strengthened in FY19 by the complete renewal or extension of the bank debt facilities. Additionally, the £26.4m net inflow from the Merrion House refinancing had a significant positive impact on the funding position. Net financial liabilities reduced to a three-year low while portfolio investment continued, although unrealised valuation losses on investment properties saw the loan to value ratio (LTV) increase.

Noting the current sector challenges and the increased gap between the share price and management’s estimation of the underlying value of the business, TCS says it continues to examine strategic options. These are likely to include an accelerated disposal of ex-growth retail properties, which despite the potential short-term impact on income will de-risk the portfolio and free up capital for reinvestment. Consequently, the group is reviewing its priorities within the development pipeline and indicates that it is giving consideration to a share buy-back. Given the significant share price discount to NAV, the latter would be earnings NAV enhancing but would limit investment options.

The key financial highlights of FY19 were:

Gross revenue increased by £1.0m or 3.4%. The main drivers were:

A net positive impact from acquisitions/disposals of £1.1m, including a beneficial timing impact of acquisitions ahead of divestments. Significant transactions affecting FY19 revenues were the acquisitions of The Cube in Leeds (acquired in October 2018) and Ducie House in Manchester (acquired in July 2018) and the disposal of Rochdale Retail Park (in January 2019).

Continued organic growth at CitiPark (5.5%), which added £0.6m to gross revenues.

A negative impact from CVAs and bad debts of £0.4m.

The void at Milngavie for much of the year, reducing income by £0.2m.

A £0.2m reduction in ibis Styles Hotel revenues where the hotel room performance was robust but the previous restaurant operation proved disappointing and was repositioned.

Group property expenses increased by 6.5% or £0.7m, including:

Higher than average property expenses at Ducie House, reflecting the historical lease structures at acquisition, which are predominantly inclusive of costs with no service charge. This had an impact of £0.3m.

The growth in CitiPark added £0.3m to group property expenses, although the rate of property expense growth within CitiPark (3.5%) was below the (5.5%) rate of growth of gross revenue.

The changes in the restaurant operations at ibis Styles Hotel, which included a one-off payment to terminate the agreement with the previous operator, contributed to a £0.1m increase in hotel property expenses despite slightly weaker revenues.

Underlying administrative expenses were well controlled but were negatively affected by some one-off costs in FY19 relating to refinancing and the renewing of old certificates of title for the group’s development land, and the non-repeat of a £0.5m provision release in FY18. Reported administrative expenses thus increased by £0.3m or 4.3%, ahead of inflation and the 1.6% increase in net revenue.

Operating earnings from JVs was £0.1m lower reflecting the effective interest costs in respect of the Merrion House financing agreement in July 2018, which accelerated the release of £26.4m in cash to the group. Other income was lower as a result of FY18 dilapidation receipts in respect of the Milngavie property not recurring.

Interest costs were slightly higher, mainly due to the impact on the floating rate portion of borrowings from higher average Libor during the year, despite a reduction in average borrowings.

EPRA earnings were £6.4m (FY18: £6.9m) and on an unchanged share count, EPRA EPS was 12.0p (FY18: 13.0p).

A final dividend per share of 8.5p has been proposed, for payment on 7 January 2020 to shareholders on the register on 6 December 2019. This will comprise an ordinary dividend of 4.0p and a property income distribution (PID) from tax exempt income of 4.5p.

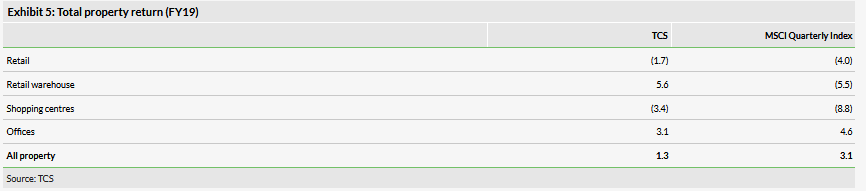

The statutory results showed an IFRS loss of £12.5m compared with £18.4m profit in FY18, primarily reflecting an £18.3m unrealised negative revaluation movement. Additionally, the £13.2m sale of Rochdale Retail Park generated a loss on disposal of c £0.7m and there was a small £0.2m reversal of impairment on car parking assets. The like-for-like revaluation movement on assets held throughout the year was -3.8%. Although it is continuing to reduce, the share of retail assets in the TCS portfolio is above that of the MSCI Quarterly Index and, as a result, the TCS total property return of 1.3% (FY18: 9.4%) was below the index despite the TCS retail assets outperforming Index returns (see Exhibit 5 on page 7).

IFRS and EPRA net assets fell by 7.8% and EPRA EPS by a similar amount to 354p (FY18: 384p).

Net financial liabilities reduced to £182.0m compared with £192.6m at end-FY18, the lowest level in the past three years, but the loan to value ratio increased to 49.4% (FY18: 47.5%) as a result of the negative unrealised movement in property values which added 3.7%. During FY19 TCS refinanced all of its bank debt facilities, extending maturities with no material impact on margins and improving borrowing flexibility. The £26.4m net inflow from the Merrion House refinancing had a significant positive impact on the funding position and management indicates c £26m borrowing headroom at end-FY19.

Portfolio and strategic update

Increasingly diversified, mixed use portfolio

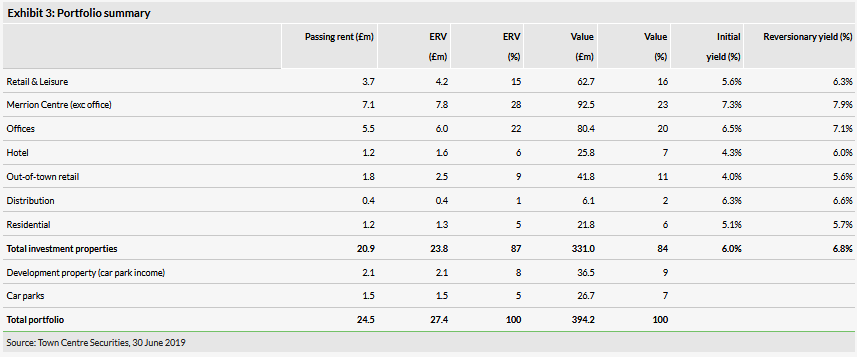

TCS has an increasingly diverse, mixed-use portfolio with an end-FY19 value, including investment properties, developments, joint ventures and car parks, of £394.2m (FY17: £403.5m). The investment properties were valued at £331.0m, reflecting a net initial yield of 6.0%, with a passing rent of £20.9m, and 96% occupancy. The full occupancy estimated rental value (ERV) was £23.8m. Including the car parking assets and car parking income on development assets, the end-year passing rent increases to £24.5m.

Retail and leisure remains the single largest sector weight in the portfolio but has been actively reduced to 50% from 55% at end-FY18 and 70% at end-FY16. Pure retail exposure is now down to 36%. As retail has been reduced, offices, hotels and private rented sector (PRS) residential assets have increased share are likely to do so. Geographically, the emphasis remains on Leeds and Manchester which together represent 77% of the portfolio by value.

Active management in FY19

Active management of the portfolio and capital recycling (ie disposing of ex-growth assets to reinvest in new opportunities for long-term growth) are key elements of management’s strategy. Since FY14 TCS has sold over £101m of assets and in FY19 £14m of retail property was disposed of, including the Rochdale Retail Park for £13.2m. Reinvestment included the acquisition of The Cube in Leeds (mixed office/leisure) and completion of the development of TCS’s first private rented sector asset, Burlington House in Manchester.

The Cube is a high-yielding mixed use property situated opposite the Merrion Centre in Leeds. The £12m purchase price represented an immediate yield of 12.5% on the passing income and is expected to remain above 9.0% after lease expiries in 2019 and 2020. Since acquisition, TCS has re-let 20% of the office space and is in the process of redeveloping the remaining space at an expected cost of £4m for improved longer-term returns.

The Rochdale sale, at £1.0m below the end-FY19 valuation, was consistent with the company’s strategy of recycling mature assets, especially given the mounting pressures on out-of-town retail assets, and reduces retail income and valuation risk further.

Burlington House, comprising 91 apartments with a projected net rental value of £1.1m (yield on cost of 5%) was completed in June 2019 and was 99% let by September.

The out-of-town retail site at Milngavie, a former Homebase, was split in two during the year at a cost of £1.5m and re-let to Aldi and Home Bargains. Compared with previously, the contracted rent increased by 8% to more than £600k pa and the valuation increased by 23% to £11.1m.

The July 2018 acquisition of Ducie House extended TCS’s presence in the Manchester’s Piccadilly Basin and mitigated a right of claim (estimated at £1.5m) by the previous owners in relation to TCS’s adjacent Eider House development. TCS has now commenced a significant £2m refurbishment aimed at improving common parts and creating some larger offices to drive demand and rents.

TCS’s very significant pipeline of development opportunities from within its current portfolio, much of it with detailed planning consent or forming part of the local strategic framework, now has an estimated gross development value of more than £600m. Most of the projects by value are situated within two strategic development sites in Manchester (Piccadilly Basin) and Leeds (Whitehall Road), two strong regional markets. Other projects include further developments at the Merrion Centre. The pipeline represents a significant opportunity for future value creation, subject to market conditions and financing, and management continues to explore how best to achieve this and unlock the value. As discussed in the financial section, our forecasts allow for the development of a second PRS scheme at Eider House and the George St aparthotel JV with Leeds City Council.

CVAs actively managed

Although not immune to the pressures of the high street and the strong increase in company voluntary arrangements, TCS was able to significantly mitigate the impact through active asset management. Eight tenants either went into administration or launched CVAs during the year, and of the eight properties affected four have been re-let to new tenants and in three the incumbent tenant has chosen to remain at the same rent. On average, rents on the re-let properties have at least been maintained and the remaining void unit, representing c 0.4% of rent roll, is in the process of being re-let.

TCS’s success in limiting its exposure to and mitigating their effects in part stems from the nature of its assets and a lack of exposure to department stores or high street fashion retailers. Half of the value of the retail portfolio relates to the Merrion Centre, a mixed-use site in Leeds, TCS’s largest asset, and in its 55th year of operation. With £70m invested in the past 10 years, it continues to achieve strong occupancy (96% in FY19) and income generation. Around 50% of Merrion Centre rents are retail and leisure, of which half is derived from the supermarket let to Morrisons. Most of the other Merrion Centre retail tenants operate in the more resilient discount and convenience segments.

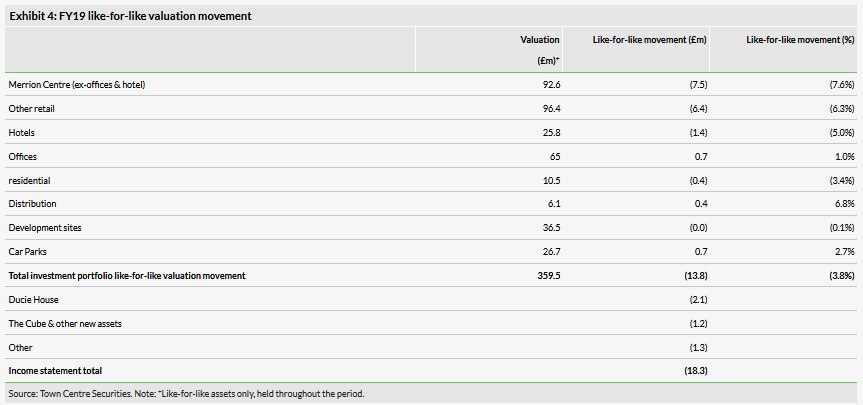

Retail drove FY19 revaluation losses

The portfolio value reduced by 4.6% in FY19. On a like-for-like basis (properties held throughout the period) the decrease was c £13.8m or 3.8%, with H219 showing a smaller decline than H119 (H119: £8.1m or 2.2%). The negative revaluation was driven by retail and leisure assets while positive valuation was recorded in offices, distribution and car parks. With good levels of portfolio occupancy maintained, and like-for-like rental growth being achieved, the revaluation changes were predominantly driven by yield shifts. The £7.5m reduction in Merrion Centre retail valuations was driven by a 100bp yield shift in the shopping mall element of the centre. Vicar Lane in Leeds also experienced a 130bp yield shift and £2.5m valuation reduction and Wood Green in London a 150bo yield shift and £1.8m valuation reduction. More related to the underperformance of the restaurant, the ibis Styles Hotel in Leeds saw a £1.6m in reduction valuation. As noted above, the successful redevelopment and re-letting at Milngavie, resulting in a 23% value increase was a notable bright spot.

In addition to the like-for-like movement in values, the income statement revaluation movement on investment properties of negative £18.3m includes c £2m of post-acquisition valuation adjustments at Ducie House, primarily driven by the right of light adjustment, and c £1.2m at The Cube, both including a small amount of acquisition costs. The post-acquisition adjustment at The Cube reflected the approach of the anticipated lease expiry, and the valuation does not capture any potential benefit from TCS’s asset management plans. Similarly, the valuation of Ducie House reflects its investment property value without reflecting the future potential upon which its acquisition has been based.

Compared with the MSCI Quarterly Index, the total return generated by the TCS retail assets during FY19 was stronger than for the MSCI Quarterly Index, with retail warehouse performance benefitting from the Milngavie revaluation and shopping centre performance benefitting from the defensive nature of the Merrion Centre retail assets. The post-acquisition adjustments at The Cube and Ducie House had a negative effect on TCS’s office performance.

Financials

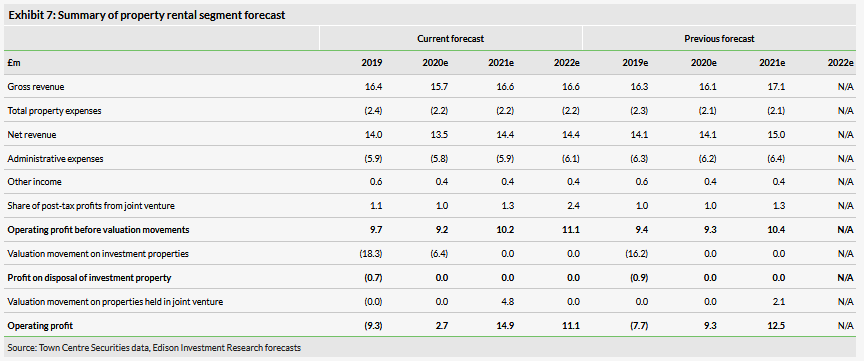

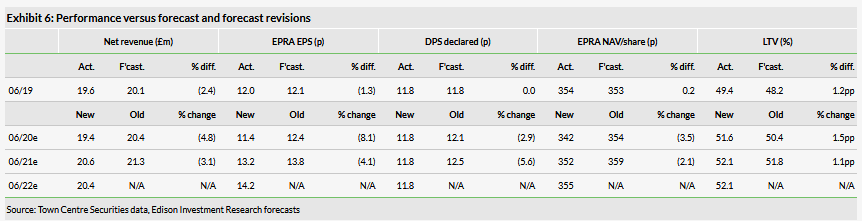

In this section we provide an update on the multi-year financial analysis that we last set out in detail in our outlook note published in March. A summary of the FY19 performance compared with our forecasts and our forecast revisions, including a first-time FY22 estimate, is shown in Exhibit 6. Other than our inclusion of specific development projects, our forecasts are based on an unchanged portfolio. Although management indicates that it is likely to accelerate the sale of ex-growth retail assets we have not assumed this, nor the likely reinvestment of proceeds. Although disposals would be likely to have a negative short-term impact until the proceeds can be reinvested, we expect management to pay close attention to mitigating the effects.

The FY19 variances versus our expectations were relatively modest and our forecast revisions predominantly reflect our revised assumptions about TCS’s asset management and development plans. FY20e revenues and EPRA (recurring) earnings are reduced although we expect a rebound in FY21 and further growth in FY22. Our FY20 NAV forecast is negatively affected by our slightly more cautious near-term view on retail capital values, but FY21 benefits from the development profits that we anticipate at completion from the Eider House PRS residential development. Given the more uncertain market environment, as well as the opportunities for investment in the extensive development pipeline, we now assume that DPS is held at the current level during the forecast period. Our forecasts indicate a slight shortfall in cover in FY20, and further retail disposals (not included in our forecasts) have the potential to reduce income further before reinvestment can take place, but note both management’s commitment to maintaining its long-term dividend track record as well as the availability of liquidity to support dividend payments. As our forecast EPRA earnings rebound in FY21 and FY22 there appears to be scope for an increase in DPS.

Asset management at The Cube a temporary drag in FY20

The property rental division operating profit before valuation movements of £9.7m was ahead of our £9.4m forecast due to a better cost performance. Negative revaluation movements were slightly higher than we had allowed for. Although FY19 gross revenue was slightly ahead of our forecast, the underlying end-FY19 annualised contracted rent was slightly lower than we were looking for and this has an impact on our FY20 gross revenue forecast in addition to the temporary loss of income that will result from the expected lease expiry at The Cube and planned void period during refurbishment. We expect gross revenue to rebound in FY21 as refurbished space is re-let.