The Aussie dollar is staring down the barrel of further rate cuts as the economic slowdown in China flows on to Australia. China’s recent round of stimulus will support the Aussie, but this will only go so far and a cut from the RBA will likely see the recent lows tested.

Over the weekend China announced a cut to its Reserve Requirement Ratio (RRR) by 100bp to 18.5%. This will likely encourage the banks to lend to businesses which (in theory) will lubricate the wheels of the economic machine. There is plenty of speculation that this will not be the last time we see a cut to the RRR and the next one could be bigger. Some of this liquidity will likely find its way to Australia and the Aussie will benefit, especially if the Chinese construction sector keeps demanding Australian Iron Ore.

The bad news for Australia is that this will not be enough and Australian unemployment is expected to climb. Last week we saw a surprise dip in Unemployment from 6.3% to 6.1%, but a year ago we were down at 5.8% and the trend is slightly worrying. The RBA has said it wants to assess the effect of the last rate cut before deciding whether to cut again, but the market sees through this and is pricing the cut in.

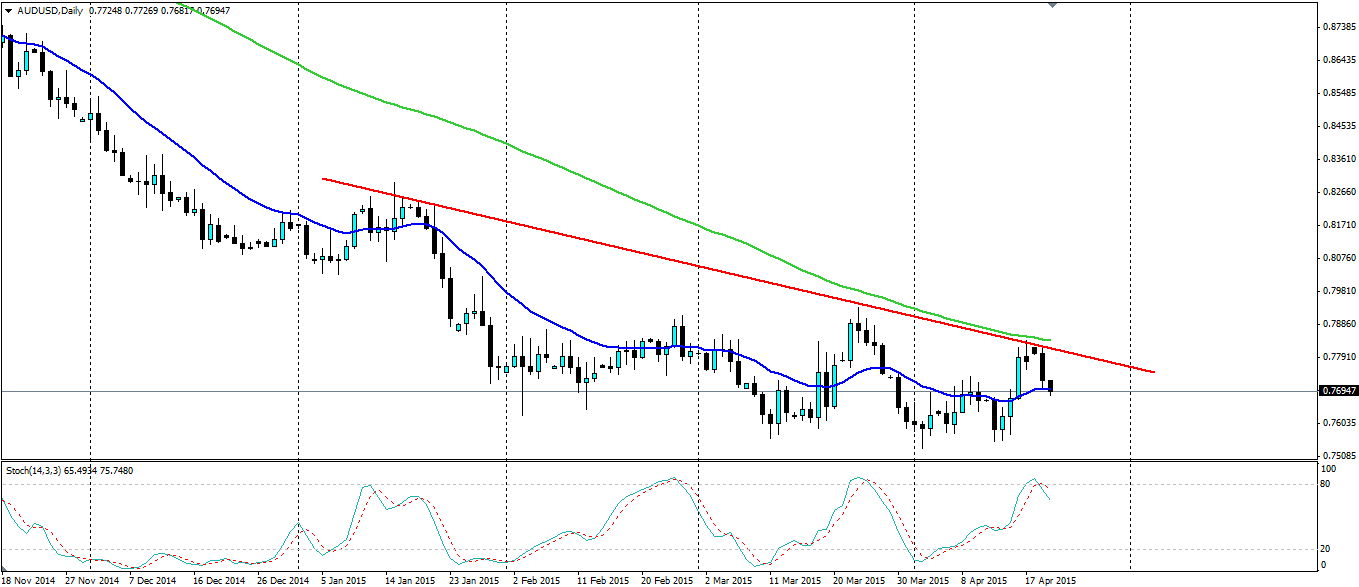

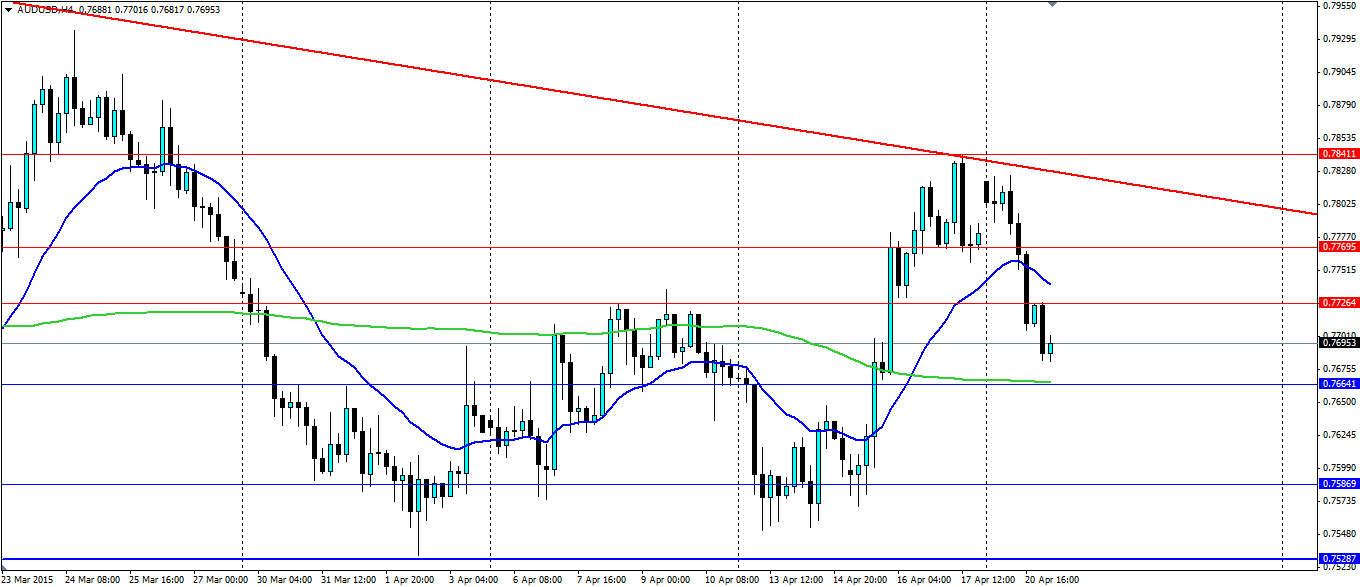

The trend line has held firm on the daily chart for the Aussie as the US dollar demand picks up and the Aussie is sold off. The latest bearish wave that is forming should take the AUDUSD pair down towards the recent lows just above the 0.75 cent mark and that could be put under serious pressure if the RBA does cut rates in two weeks. Keep an eye on inflation figures later this week. If they miss the mark the speculation of a rate cut will only ramp up.

As the Aussie drifts lower, look for support to be found at 0.7664, 0.7586 and 0.7528. The latter being the recent lows that will certainly come under pressure if a rate cut looks imminent. Resistance is found at 0.7726, 0.7769 and 0.7841 with the bearish trend line acting as dynamic support.