Total System Services, Inc.’s (NYSE:TSS) first-quarter 2019 earnings per share of $1.15 surpassed the Zacks Consensus Estimate by 2.9% and also surged nearly 4.5% year over year. Strong performances by all three segments — Issuer Solutions, Merchant Solutions and Consumer Solutions — have contributed to the favorable results.

Total revenues were $1.03 billion, up 5.6% year over year, led by growth across all its three segments. Net revenues (which excludes reimbursable items) of $980.3 million were up 5.6% year over year, but missed the Zacks Consensus Estimate by 1.7%.

Total expenses of $811.3 million were up 1.5% year over year, led by 3.1% increase in cost of services.

The company reported adjusted EBITDA of $357.3 million, up 8% from the year-ago quarter.

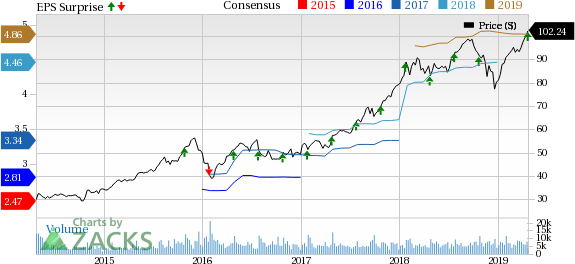

Total System Services, Inc. Price, Consensus and EPS Surprise

Impressive Segment Results

Issuer Solutions

Net revenues for this segment improved 2.3% year over year to $433.5 million, driven by a 7.2% rise in total transaction year over year and 8.6% growth in traditional accounts on file.

Adjusted EBITDA of $204.9 million was up 4.7% year over year.

Merchant Solutions

Net revenues jumped 8.1% to $343 million, mainly backed by 13.8% higher point-of-sale transactions. Dollar sales volume for the segment expanded 8% year over year to $40.2 billion.

Adjusted EBITDA of $128.8 million increased 8.3% year over year.

Consumer Solutions

Net revenues for this segment amounted to $219.2 million, up 4.1%. This upside is attributable to 3.8% growth in GDV (gross domestic value).

Adjusted EBITDA of $63.7 million increased 18.7% year over year.

Strong Financial Position

Total assets increased 4.1% from the level as of Dec 31, 2018 to $7.8 billion as of Mar 31, 2019.

Total shareholders’ equity declined 9% from Dec 31, 2018 levels to $2.59 billion on Mar 31, 2019.

For the quarter, the company generated free cash flow of $147.2 million, down 11% year over year.

2019 Guidance Affirmed

The company backed its earlier provided guidance for 2019 which calls for total revenues on a GAAP basis in the range of $4.19-$4.29 billion, up 4-6%. On a non-GAAP basis, net revenues are anticipated in the $3.99-$4.09 billion band, reflecting 5-7% year-over-year growth.

GAAP EPS will likely be within $3.48-$3.63, up 11-16% from the comparable quarter last year. Adjusted EPS is forecast between $4.75 and $4.90, translating into an improvement of about 6-10%.

Zacks Rank

Total System Services carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Some stocks worth considering in the same space are Diebold Nixdorf, Inc. (NYSE:DBD) , FleetCor Technologies, Inc. (NYSE:FLT) and Worldpay Inc. (NYSE:WP) . Each of these stocks carries a Zacks Rank #2 (Buy).

Diebold Nixdorf’s and FleetCor Technologies’s Earnings ESP of +5.71% and 0.38% and a Zacks Rank #2 makes us confident of an earnings beat this quarter.

Worldpay has surpassed estimates in each of the four reported quarters with an average positive surprise of 5.1%.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Diebold Nixdorf, Incorporated (DBD): Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT): Free Stock Analysis Report

Total System Services, Inc. (TSS): Free Stock Analysis Report

Vantiv, Inc. (WP): Free Stock Analysis Report

Original post