After a poor start to the quarter, the Treasury market rebounded nicely over the month of December, providing positive performance across the Treasury curve as the equity market suffered from negative sentiment pertaining to geopolitical risk and concerns over the Fed’s path toward raising short-term interest rates. Political bickering over building “the wall” and threats of a government shutdown intensified the negativity, leaving equity investors bearish and running for safe-haven assets such as gold and Treasury securities.

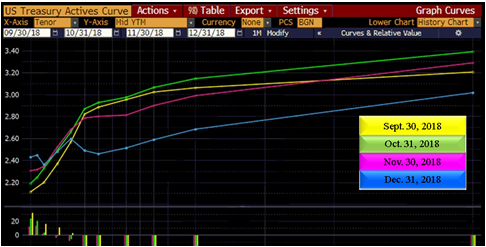

The bearish outlook in the equity market created a nice opportunity in the fixed-income space, as a “flight to quality” sent yields across the Treasury curve lower. After the high on the 30-year Treasury, at 3.455%, on November 2, the yield dropped 49.5 basis points to 2.96% on December 20. The 30-year yield has since settled in around 3.04%. The drop in yield was even more pronounced for the 10-year Treasury, which dropped 51.8 basis points, from 3.238% to 2.72%, and has settled in around 2.78% currently. This December rally in the Treasury market has added a nice boost to the performance of the long end of our barbell strategy and is a testament as to why we continue to manage portfolios using this approach. Below is a graph of the Treasury actives curve, showing monthly dates within the fourth quarter of 2018.

Source: Bloomberg

Not all taxable fixed-income asset classes benefited from the flight to quality. One that suffered during the fourth quarter was the corporate bond market (both investment-grade and high-yield). Corporate bonds tend to be more correlated than other taxable fixed-income sectors to the equity market, and as negative sentiment grew, spreads widened, causing underperformance versus the other sectors. The Bloomberg Barclays (LON:BARC) US AGG Corporate OAS Index widened 45 basis points from +105 to +150. Allocating only a small portion of our assets to the corporate space helped our taxable fixed-income strategy, as taxable municipal spreads did not suffer widening to the extent that the corporate space did. The lower historical default rate and higher overall credit quality of the municipal space helped limit the spread widening in comparison with corporate issues.

At the December 19 FOMC meeting, the Fed raised the fed funds target rate 25 basis points to a target range of 2.25–2.50%. This marks the ninth hike in the cycle and puts the fed funds rate at the highest level since October 2008. The Summary of Economic Projections seen in the Fed’s “dot plot” provided a dovish surprise as the baseline for rate hikes in 2019 dropped from 3-1 in September to 2-1. The post-meeting statement continued to point out “strong” growth and job gains, with the inflation projection unchanged at near 2%. The upper-bound drop in rate hikes from three to two is in line with our projection for 2019. There is the risk that an inverted yield curve could threaten economic growth, and the Fed will need to be cautious and data-dependent in its approach to raising short-term interest rates in order to avoid putting too much pressure on the market.

As for Cumberland’s Taxable Total Return portfolios, we will continue to implement our barbell strategy and look to take advantage of opportunities on the long end of the yield curve when they are available. We are still in a rising-interest-rate environment, but we no longer expect the Fed to hike rates at the pace that it did in 2018. While we continue to navigate this rate environment, the story remains the same. Our goal is to remain defensive in our approach to investing while making our investment decisions conservatively and extending durations to pick up additional yield as opportunities in the market become available.