I’m sure you probably know this—but it is usually a really bad idea to pay 43-times sales for a stock.

Note that I did not say earnings. I said sales. Revenues. The ol’ top line. Before everything.

Scott McNealy, the co-founder of Sun Microsystems, famously told investors it was insane to pay 10-times sales for Sun’s stock. Ten!

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends.

That assumes I can get that by my shareholders. That assumes I have zero cost of goods… that assumes I have zero expenses… that assumes I pay no taxes… assumes zero R&D.

An amazing explanation by Scott. Don’t ask me why my stock is down… ask yourselves why it was so high in the first place!

Scott made his now-famous comments two years after Sun’s top. I wonder if we’ll be reading a rhyming phrase from Jensen Huang, CEO of NVIDIA Corp (NASDAQ:NVDA), two years from now.

If Sun’s valuation was on the moon, then NVIDIA’s price is way out there in the Kuiper Belt. NVDA trades for forty three times revenues—43!—which means:

- To give investors a 43-year payback (which is roughly a measly 2% per year), Jensen must pay 100% of revenues as dividends for 43 years.

- This assumes he can get it by his shareholders.

- It assumes zero costs, expenses and future R&D. And no taxes. Ha!

And oh by the way, NVDA pays $0.04 per share per quarter today—so we’re only asking for a $2.50 dividend increase. A cool sixtyfold hike.

Obviously not going to happen.

It’s ironic that the hottest stock in the solar system doesn’t have a plausible path to this 2% annual return. Now could someone buy it sky high today and sell it even higher next month? Possibly. But buy and hope isn’t our game.

We income investors demand a surer path. And oh, do we ever have one in the utility sector today!

Stop me if you’ve heard this before, but the Federal Reserve is hiking rates until we see a recession. It’s the only way they can get inflation down below their stated 2% target.

The recent “dovish” inflation readings have been partially Fool’s gold, thanks to favorable year-over-year comparisons. Remember, oil prices spiked in spring 2022 and then faded. In the months ahead, we’ll be comparing prices with post-drop numbers from this same time last year.

The recession will eventually arrive. When it becomes obvious, we’ll hear about “flight to safety” days in which investors ditch their tech and AI darlings and buy safe stocks.

Like utilities that pay dividends.

Yes, our grandparents’ playbook will be dusted off once again when the recession arrives. Which is why we’re looking ahead so that we can cherry pick the best utility dividends now.

A popular, but lazy, “go to” like Utilities Select Sector SPDR ETF (NYSE:XLU) won’t do. At least for us.

First, XLU yields 3.3%. Pile a million dollars into XLU and we have $33,000 a year. Not enough income.

Second, XLU holds 30 utility stocks. Why take all 30 when we can cherry pick the best?

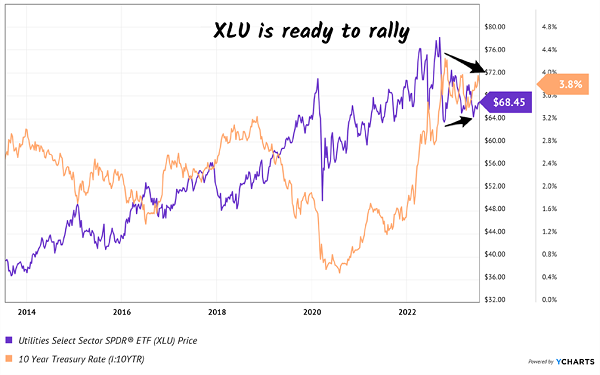

Yes, XLU is likely to rally in the months ahead. It trades opposite long rates. Look at these two lines below—the 10-year Treasury rate and XLU’s price. They are often allergic to each other! But let me call your attention to the right side of the chart, where the 10-year is topping as XLU is bottoming:

As the 10-Year Tops, Utility Stocks Bottom

The closer we get to that recession, the more the 10-year rate (orange line) will come down. At the same time, we’ll see utility stocks rise. A flood of vanilla investors will trade in NVDA for Dominion Energy (D), the cheapest blue-chip utility on the board today.

Dominion yields 5%. It rarely pays this much!

Why the deal? D’s in the dividend dog house because the company cut its payout in late 2020.

Why the chop? Too much debt, of course. Dominion had embarked on an acquisition binge in the name of growth. Which, ironically, backfired.

The result was a rare payout slash from a utility—an income investors’ worst nightmare. First-level investors keep Dominion in the doghouse today.

Which intrigues us here at Contrarian Outlook. Did we hear doghouse? And a dividend cut in the rear-view mirror?

You have our full attention, D!

Chief financial officers (CFOs) are like carpenters. It’s best to measure twice and cut only once.

As a result, the safest dividend is often the one that has recently been cut. Unless management is a complete clown show, the last thing they want is to have to cut twice!

Which is why the recent dividend raise from Dominion is encouraging. It shows confidence that the current dividend is being paid comfortably.

From a “dividend magnet” standpoint, the stock has more upside from here. Over the past 10 years, even net of the cut, Dominion’s dividend is up 19%. Not great, but the stock has been unfairly punished. From a price-only standpoint, the stock trades below where it did a decade ago!

D’s Dividend Magnet is Due

Over the long run, stock prices track their payouts—higher and lower. They can overshoot and undershoot for months, sometimes years at a time. Eventually they find their way home.

As we speak today, Dominion’s price is lagging its payout. Which is why we want to lock in its 5% yield here. We’ll enjoy a bit of upside, too, as this stock eventually gets up off the mat.

Five percent plus upside? Scott McNealy would be proud.

Need more yield than 5%? I get it—and I’ve got you covered.

Five percent on a million is $50,000 in dividend income per year. Not bad, but isn’t $80,000 better?

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."