The US stock market offers a vast amount of stocks investors can purchase, from a diverse set of industries, spanning all sizes, from microcaps to mega caps. It can still be a good idea to take a look at stock markets from other countries, as they do offer highly attractive stocks from well-performing companies as well.

When it comes to large banking stocks, the US offers a large array of these, including Bank of America (NYSE:BAC), JPMorgan Chase (NYSE:JPM) and others. These banks can be attractive for investors as well, but the best Canadian banks, such as Toronto Dominion Bank (TSX:TD) offer some unique advantages.

High-yield Canadian banks widely offer higher dividend yields than their US-based peers, and their recession performance during the last financial crisis was stronger as well – many of them, including Toronto-Dominion, did not have to cut their dividend payouts during those troubled times, unlike most US-based large banks.

Toronto-Dominion offers a combination of relatively safe, above-average yielding dividend payments, while shares are also inexpensive and offer some share price growth potential over the coming years. This makes Toronto-Dominion one of the most attractive large Canadian banking stocks right now.

Business Overview And Growth Outlook

Toronto-Dominion Bank is, by market capitalization, the second largest bank in Canada. Toronto-Dominion was founded more than 150 years ago, in 1855, and has since grown into a global organization that offers all kinds of banking services to its customers. Toronto-Dominion has more than $1.3 trillion in assets and is currently trading with a market capitalization of $102 billion.

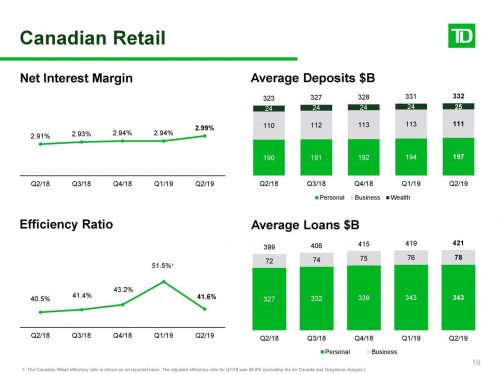

Toronto-Dominion Bank reported its most recent quarterly results, for Q2 of fiscal 2019, on May 23. The company achieved a revenue growth rate of 7.9% year over year, which is relatively attractive, and which was better than what the analyst community had expected.