With a goal to further amplify its electronic fixed-income trading business, The Toronto-Dominion Bank TD closed the previously announced acquisition of Headlands Tech Global Markets, LLC.

Founded in 2013, Chicago-based Headlands Tech Global’s proprietary software delivers fully automated electronic market-making in municipal and investment-grade corporate bonds that will now augment TD Securities’ current infrastructure. Besides Chicago, Headlands Tech Global also has an office in San Francisco.

As per Toronto-Dominion Bank’s previous disclosure, Headlands Tech Global ‘s 15 employees, including Co-CEOs Martin Mannion and Matthew Schrager, will be joining TD Securities. Financial terms of the transaction, which will have minimal impact on Toronto-Dominion Bank’s capital levels, were not disclosed. TD Securities served as a financial advisor to Toronto-Dominion Bank. Moti Jungreis, vice chair and head of global markets of TD Securities, said, “This acquisition underscores our commitment to offer innovative technology that elevates and augments our suite of products and services. We welcome the Headlands team to TD Securities and I know that uniting our organizations will allow us to deliver continued innovation and value for our clients."

Toronto-Dominion Bank’s growth via strategic acquisitions is favored by its robust balance sheet and liquidity position. In May 2021, it closed the previously announced deal to acquire Wells Fargo (NYSE:WFC)’s WFC Canadian direct equipment finance business for an undisclosed amount.

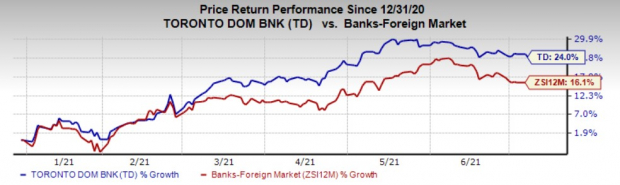

So far this year, shares of Toronto-Dominion Bank have rallied 24% on NYSE, outperforming the industry’s growth of 16.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, Toronto-Dominion Bank carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Similar Moves by Other Finance Companies

In March 2021, KeyCorp (NYSE:KEY) KEY acquired data analytics-driven consultancy firm AQN Strategies LLC. The acquisition is part of the company’s efforts to employ data-driven approaches, which will help it in expanding its customer reach.

In the same month, Moody’s MCO acquired Cortera, one of the leading providers of North American credit data and workflow solutions. The deal, announced in February, was funded with cash in hand, and is not likely to have material impact on the company’s 2021 results.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Moodys Corporation (NYSE:MCO): Free Stock Analysis Report

KeyCorp (KEY): Free Stock Analysis Report

Toronto Dominion Bank The (NYSE:TD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research