The Toro Company (NYSE:TTC) reported third-quarter fiscal 2017 (ended Aug 4, 2017) earnings of 61 cents per share, up 22% from 50 cents recorded in the year-ago quarter. Additionally, earnings comfortably beat the Zacks Consensus Estimate of 57 cents.

Toro’s net sales were up 4.5% year over year to $627.9 million in the quarter. The top line came in line with the Zacks Consensus Estimate.

Toro’s robust results were driven by positive momentum in the Professional segment. In addition, innovative offerings across the professional portfolio fueled the company’s growth.

Operational Update

Cost of sales in the quarter went up 4.4% year over year to $401 million. Gross profit came in at $226.8 million, up 4.7% year over year. Gross margin improved 10 basis points (bps) year over year to 36%, primarily supported by segment mix and productivity improvements.

Selling, general and administrative expenses were up 3% to $139 million. Operating profit improved 7% year over year to $87.8 million. Operating margin came in at 14%, expanding 40 bps year over year.

Segment Performance

The Professional segment’s sales increased 9.5% year over year to $468.6 million. The upswing was stemmed by strong momentum in the landscape contractor, international, and golf and grounds business. Operating profit recorded by the segment was $97.4 million, up 9.3% from $81.9 million recorded in the year-ago quarter.

Net sales at the Residential segment declined 9.3% year over year to $152 million. Operating profit at the segment was $11.4 million, down 11% year over year.

Financial Update

Toro had cash and cash equivalents of $335 million at the end of the fiscal third quarter compared with $277 million recorded in the prior-year quarter. The company generated cash flow from operations of $272 million for the nine-month period ended Aug 4, 2017, compared with $304 million recorded in the comparable period last year.

Long-term debt, excluding the current portion, was $308.8 million as of Aug 4, 2017, compared with $331.6 million as of Jul 29, 2016.

Outlook

Toro raised its outlook for fiscal 2017 earnings to $2.38 per share from the previous guidance of $2.35 per share. The company, however, maintained its revenue growth guidance of at least 4.5% for the current fiscal.

Toro remains confident about the retail trends, particularly across professional businesses, which are anticipated to drive its results in the next quarter.

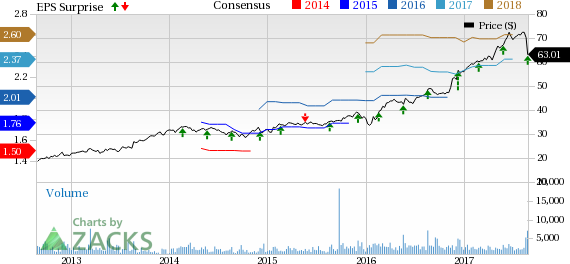

Share Price Performance

Shares of Toro have outperformed the industry which it belongs to in a year’s time. In fact, Toro’s shares have gained nearly 28%, while the industry logged in a return of around 9.3% over the same period.

Toro currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Consumer Discretionary sector include Activision Blizzard, Inc. (NASDAQ:ATVI) , Central Garden & Pet Company (NASDAQ:CENT) and Gray Television, Inc. (NYSE:GTN) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Activision Blizzard has expected long-term growth rate of 13.63%.

Central Garden & Pet has expected long-term growth rate of 10.00%.

Gray Television has expected long-term growth rate of 6.50%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Gray Television, Inc. (GTN): Free Stock Analysis Report

Central Garden & Pet Company (CENT): Free Stock Analysis Report

Toro Company (The) (TTC): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Original post

Zacks Investment Research