The top U.S. shale gas producers have seen their stock prices decimated from their highs reached in 2014. What’s even worse is that the horrible stock performance occurs even with a nearly doubling of these shale companies’ gas production.

While likely everyone heard the news that Chesapeake Energy (NYSE:CHK), the United States’ second-largest shale gas producer, declared bankruptcy last month, little is known about its competitors. For example, the country’s third-largest shale gas producer, Antero Resources (NYSE:AR) stock price lost 96% of its value from its high in 2014.

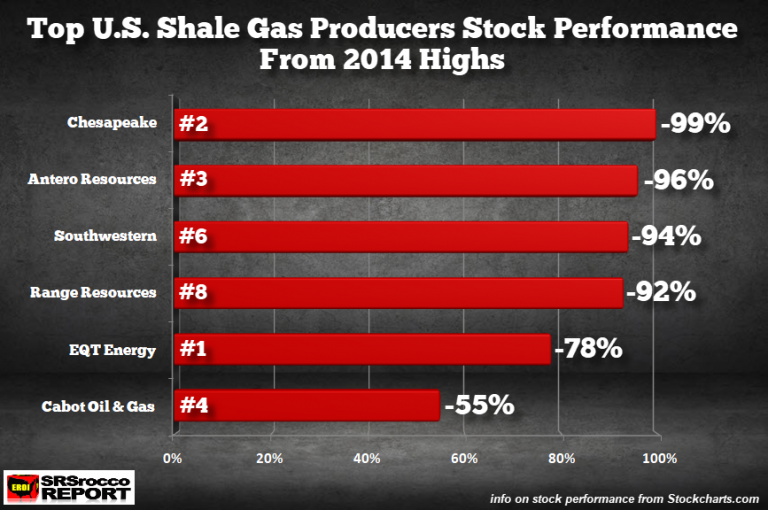

Here are the leading U.S. shale gas producers stock performance from their 2014 highs:

As we can see, Chesapeake stock lost 99% of its value since its high in 2014, Antero is down 96%, followed by Southwestern (NYSE:SWN) (-94%), Range Resources (NYSE:RRC) (92%), EQT (NYSE:EQT) (-78%) and lastly, Cabot Oil & Gas (NYSE:COG) (-55%). Cabot (NYSE:CBT) share price held up better than the competitors because it actually made some decent money and Free Cash Flow versus its rivals.

According to Shaleprofile.com, the rankings of these companies above are shown on the left of the RED BAR. EQT Energy is the largest shale gas producer shown as (#1). I didn’t include 5th ranked ExxonMobil (NYSE:XOM) because it is not a primary shale gas producer or 5th ranked Ascent Resources, headquartered out of London (it does not have a U.S. stock ticker on Stockcharts.com).

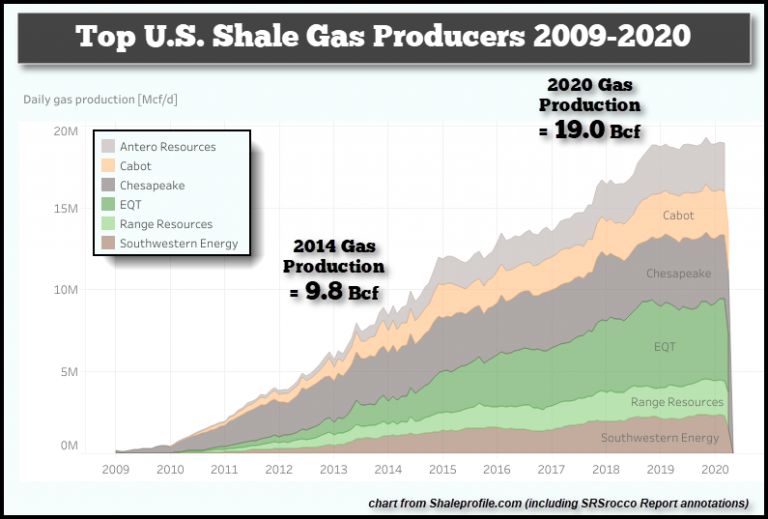

Regardless, these six companies have seen their share prices crushed even though the combined shale gas production nearly doubled:

Using a chart from Shaleprofile.com, the shale gas production from these six companies increased from 9.8 billion cubic feet (Bcf/d) in 2014 to the current 19 Bcf/d in 2020. Unfortunately, shale gas production from most of these companies has been an unprofitable and lousy investment for shareholders.

Again, the only company that made some decent profits was Cabot Oil & Gas. This is precisely why Cabot’s stock performance has held up better than its competitors.

Range Resources, ranked #8 in the U.S., had the highest stock price in 2014 at $92 a share. Currently, Range Resources is trading at a whopping $6.72 a share. I don’t believe we are going to see much of a turn-around in these companies’ share prices.

You've been warnedd.