Here are the Rest of the Top 10:

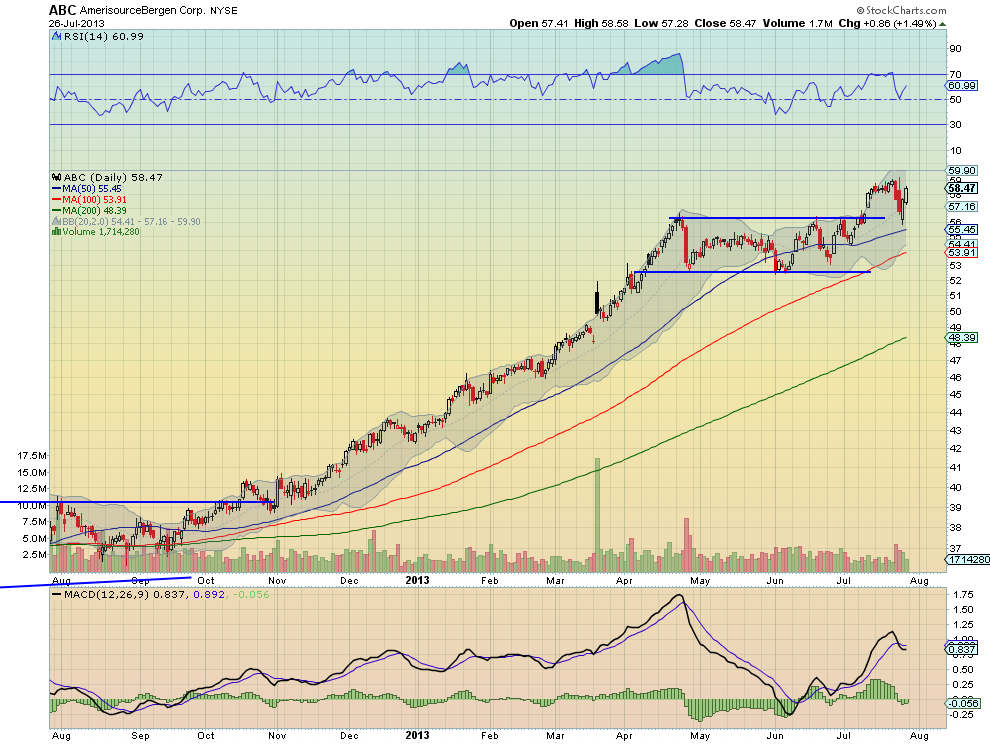

Amerisource Bergen, Ticker: ABC

Amerisource Bergen (ABC) is moving back higher after retesting the breakout level at 56.40. The Relative Strength Index (RSI) is rising again and the Moving Average Convergence Divergence indicator (MACD) is turning back higher after a brief downturn. The Measured Move higher takes it to 71.50.

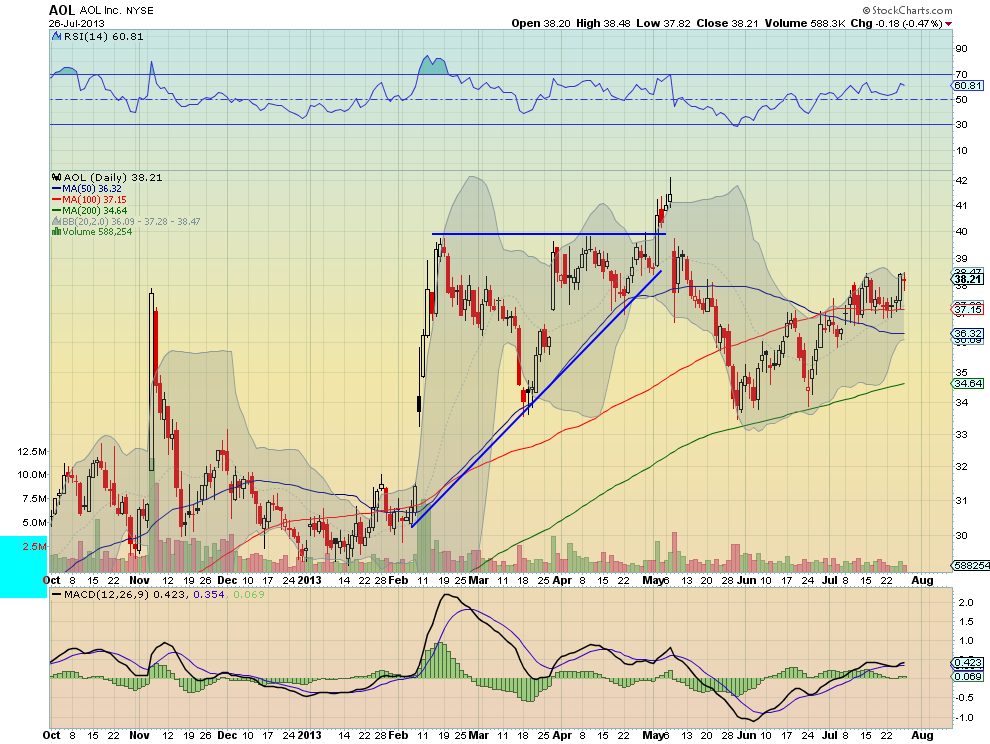

AOL, Ticker: AOL

AOL (AOL) is approaching resistance at 38.50 for the second time in a month. It has a bullish RSI and a rising MACD to support more upside. 7% short interest may help as well. This name reports August 7th.

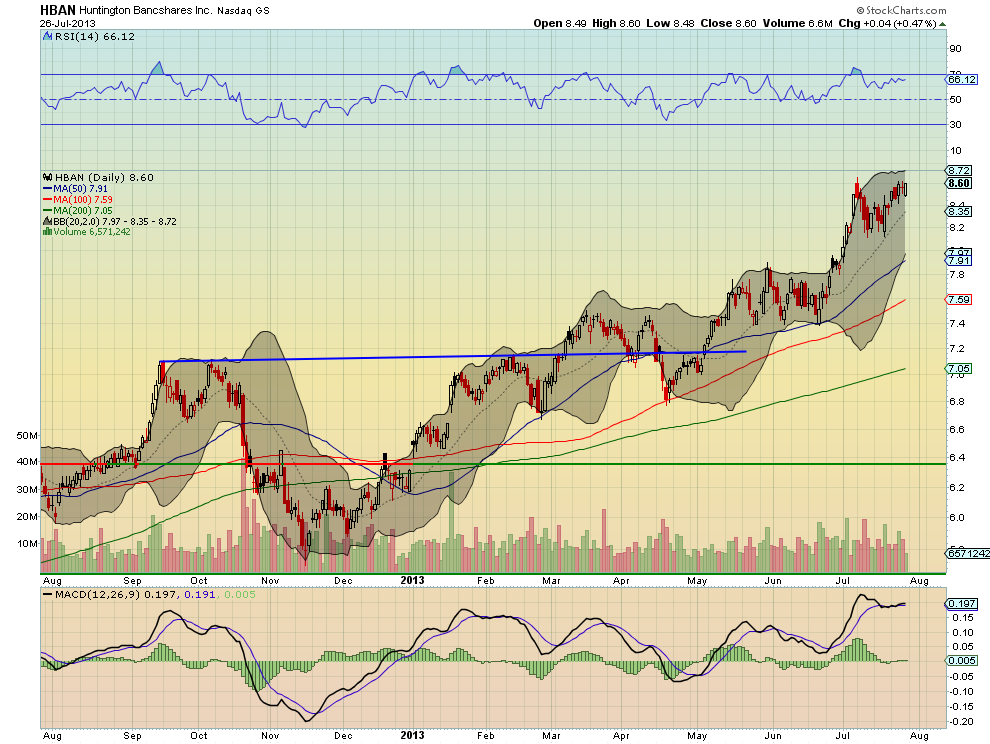

Huntington Bancshares, Ticker: HBAN

Huntington Bancshares (HBAN) is testing a double top at 8.60 after a pullback and consolidation at 8.20. It has a bullish RSI and a a MACD that looks to be averting a negative cross after a brief flat period.

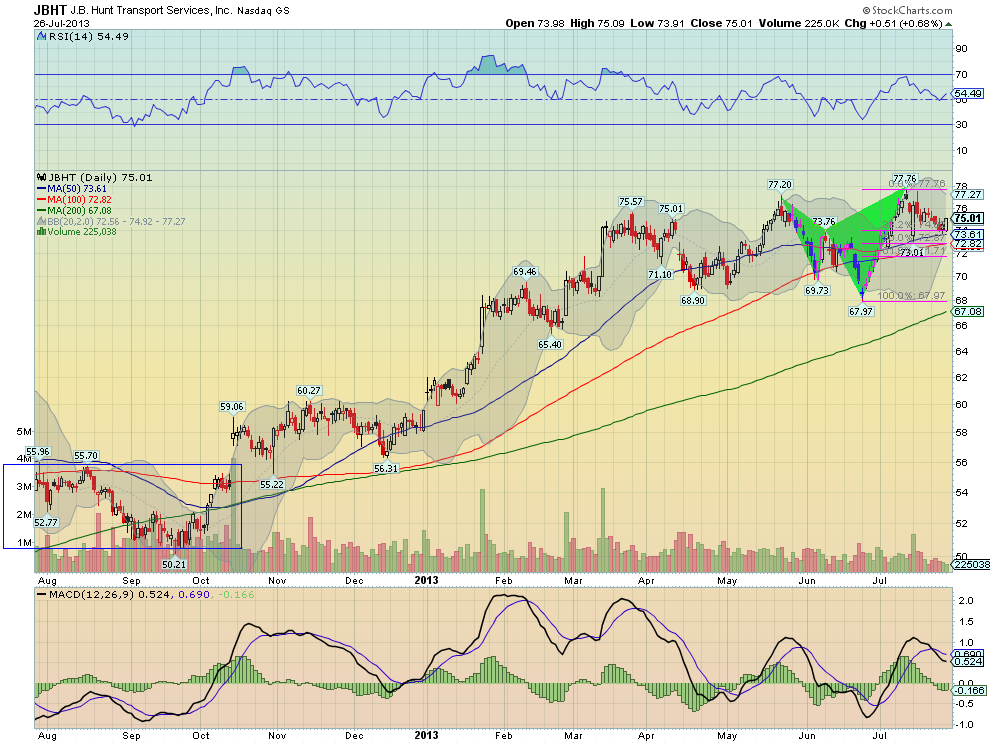

JB Hunt Transportation, Ticker: JBHT

JB Hunt Transportation (JBHT) completed a bearish Shark and then retraced a perfect 38.2% before finding support last week. The RSI is turning back higher, after holding over the mid line, and the MACD is turning back higher.

Valero Energy, Ticker: VLO

Valero Energy (VLO), is at resistance after finding support after a pullback from the May high. The RSI is rising and the MACD is also rising, both support more upside.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Saturday which, as July ends and we move into the dog days of August looks for Gold to continue the bounce in the downtrend while Crude Oil consolidates or pulls back in the uptrend. The US Dollar Index looks lower while US Treasuries may consolidate but are biased lower. The Shanghai Composite is biased to the downside but may continue to consolidate while Emerging Markets are biased higher in their downtrend. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The QQQ charts seem all for that while the SPY and IWM suggest there is still some downside risk in the short term. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Top Trade Ideas: Week Of July 29

Published 07/29/2013, 01:34 AM

Top Trade Ideas: Week Of July 29

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.