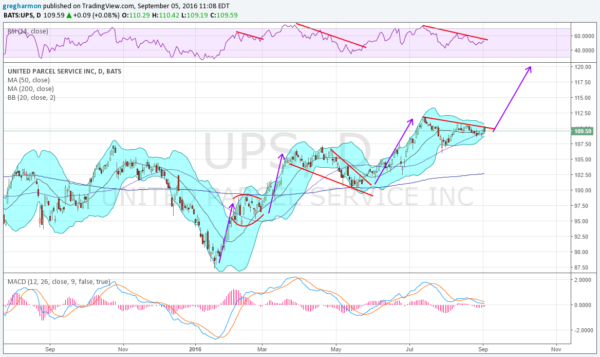

Since making a low in January, United Parcel Service (NYSE:UPS) has stepped higher in 3 moves. The first ended with a rounding consolidation in February, the second with a falling wedge into May and the third just ran into falling trend resistance.

Each pullback has been marked by a pullback in the RSI and the last two also saw a reset lower in the MACD. Each move finished when the RSI reversed and pushed back to the upside through the falling trend resistance. That may be about to happen again. The RSI did turn to the upside last week as price pushed to a high outside of the short-term consolidation before falling back.

The Bollinger Bands® have squeezed in, often a precursor to a move and the MACD remains positive. There is resistance at 110.40 and 111.85 then free air. Support lower comes at 108.60 and 106.90. Short interest is low at 1.9%. The company is expected to report earnings October 27.

The options chain for this week shows large open interest at the 115 Call Strike -- well above the current price. Moving to the September monthly, the biggest open interest is at the 110 Strike, with more than 4,400 contracts over both puts and calls. The October monthly chain shows a slight upward bias with large open interest at the 110 and 115 calls. And moving to January, the first chain beyond earnings sees a strong upward price bias. Here the largest open interest is at the 110 and 120 calls.

- Trade Idea 1: Buy the stock on a move over 110.50 with a stop at 108.50.

- Trade Idea 2: Buy the stock on a move over 110.50 and add a September 110/105 Put Spread ($1.00) while selling the October 14 Expiry 112 Calls (80 cents).

- Trade Idea 3: Buy the October 105/110/115 Call Spread Risk Reversal (86 cents).

- Trade Idea 4: Buy the January 100/110/120 Call Spread Risk Reversal ($1.65).

Trade 1 is a straight buy and the trade looks wrong if the short-term support at the 20-day SMA breaks. Trade 2 protects the downside on a long position in the stock to 105 and lowers the cost of protection by selling a covered call. Trade 3 is a levered way to participate in a move higher with a possible entry to the stock at 105 in October. Trade 4 is similar but with a possible entry at 100 in January.