Here is your Bonus Idea with links to the full Top Ten:

General Electric (N:GE) is a large conglomerate, meaning it has many different businesses. One is lighting, in Nela Park in Cleveland and they set up an excellent Christmas display.

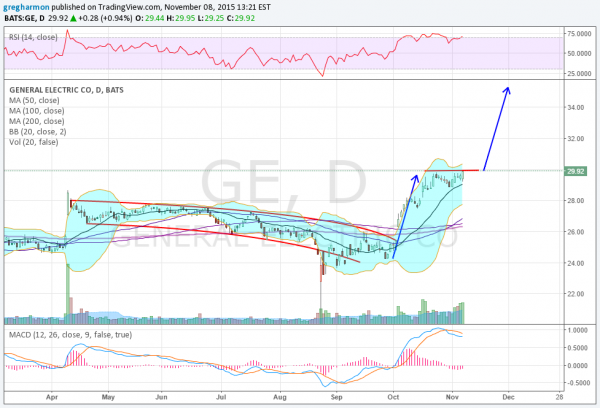

The stock went through a slow rounded decline from April through to the August low. It consolidated then for a month before jumping higher to start October. That met resistance at 30 mid month and has been consolidating since.

A break to the upside carries a target on a Measured Move to 35.25 and there is support for more upside from the bullish RSI. The MACD has been in a shallow decline during the consolidation but remains strong. A push through the signal line would bolster the bull case.

The Bollinger Bands® are turned higher as well, allowing a price rise. And there was a bullish Golden Cross just last week. There is resistance at 30 and then 31.50 before 33.50 and 36 then the 2000 high over 40. Support lower comes at 29 and 28 followed by 27.50. Short interest is low at 1.3%, and the company does not report earnings again until January 22, 2016.

Looking at the options chains, the November 13 Expiry shows large open Interest (OI) at 29 on the Put side and then 30 on the Call side. November monthly options also show 29 and 30 to be the biggest OI, but in much larger size. The January 2016 chain shows massive OI at 35 above on both sides with large OI at 30, 27, 25 and 23 below. On the Calls side, 30 and 31 are large.

General Electric, Ticker: GE

Trade Idea 1: Buy the stock on a move over 30 with a stop at 28.50.

A straight stock trade.

Trade Idea 2: Buy the November 30 Calls (offered at 48 cents late Friday).

A short term defined risk trade.

Trade Idea 3: Buy the November 29/30 bull Risk Reversal (25 cents).

Using leverage and a knowledge of the options open interest for a short term trade

Trade Idea 4: Buy the January 30 Calls (82 cents).

A longer term defined risk trade.

Trade Idea 5: Buy the January 30/November 31 Call Diagonal (70 cents).

Anchoring the trade with the January Calls and selling short term, higher strike calls over time to reduce your cost.