Here are the Rest of the Top 10:

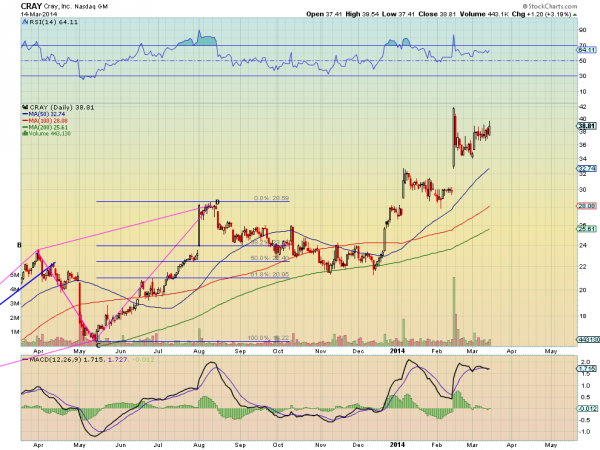

Cray, Ticker: CRAY

Cray (CRAY), completed an AB=CD pattern in August and pulled back through mid January and then launched higher. It is now moving up out of a second stair step with support from a bullish Relative Strength Index (RSI) and a positive MACD.

Carrizo Oil & Gas, Ticker: CRZO

Carrizo Oil & Gas (CRZO) moved higher off of a low in February into the start of march. It is now starting higher again out of a bull flag with a bullish RSI and a MACD leveling after a pullback.

Hanesbrands, Ticker: HBI

Hanesbrands (HBI) is moving higher in a tightening consolidation range. The RSI is bullish and the MACD leveling after pulling back some as the Bollinger bands are tightening, foretelling a move shortly.

Home Bancshares, Ticker: HOMB

Home Bancshares (HOMB) pulled back from the late December high and has now rebounded to the prior consolidation zone as resistance. The RSI is bullish and the MACD leveling but generally rising, both supporting more upward price action.

The Bancorp, Ticker: TBBK

The Bancorp, (TBBK) continues to move higher with rising trend support. The RSI is bullish and holding in that range with a MACD that is level and positive.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the March Options Expiration week and ahead of the widely expected invasion of the Ukraine sees the markets are jittery if not tired or weak. Specifically look for Gold to continue higher in its uptrend while Crude Oil slows in its pullback and may be ready to reverse higher. The US Dollar Index looks to continue lower while US Treasuries are biased higher and near a break of major resistance. The Shanghai Composite and Emerging Markets are biased to the downside with risk of the Chinese market consolidating and then a possible reversal. Volatility looks to remain low but moving higher cutting the breeze at the back of the equity index ETF’s SPY, IWM and QQQ. Their charts suggest that the SPY and IWM are a bit stronger than the QQQ and may be ready to consolidate and reverse higher, while the QQQ is biased lower. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.