Here are the Rest of the Top 10:

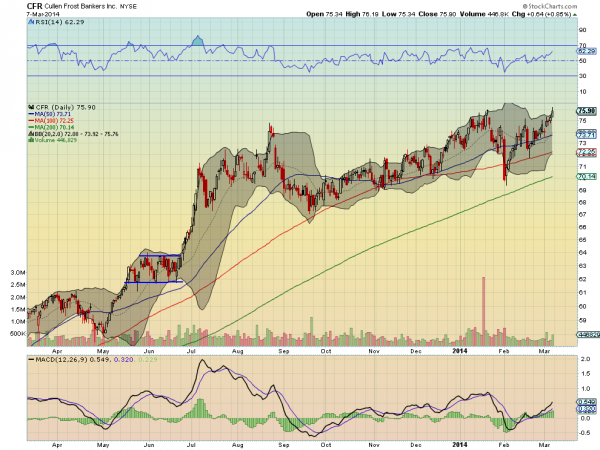

Cullen/Frost Bankers, Ticker: CFR

Cullen/Frost Bankers (CFR) reached prior resistance Friday. The move higher seems to be carrying some momentum as the Relative Strength Index (RSI) and MACD are also rising, supporting more upside.

Diamond Offshore Drilling, Ticker: DO

Diamond Offshore Drilling (DO) had been collapsing since July before finding a bottom to start February. The higher low last week makes it attractive as it reaches prior resistance.

Emerson Electric, Ticker: EMR

Emerson Electric (EMR) has made a series of higher lows as it reaches resistance again. a positive sign with support from the rising RSI and MACD.

Stericycle, Ticker: SRCL

Stericycle (SRCL) blew through the confluence of Simple Moving Averages (SMA) last week. It has support for more upside from the rising RSI and MACD.

TearLab, Ticker: TEAR

TearLab (TEAR) is consolidating under the 50 day SMA and perhaps starting to break higher. It also has support for more upside from the rising RSI and MACD. With 22% short interest it could also benefit from a short squeeze.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the next week sees the equity markets looking positive. Elsewhere look for Gold to consolidate with an upward bias while Crude Oil remains on the short term upward path. The US Dollar Index looks weak and ready to move lower while US Treasuries are also biased lower in their consolidation zone. The Shanghai Composite and Emerging Markets are set up to continue their consolidations from this week with Emerging Markets holding an upward bias. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts favor the upside as well, fairly strongly in the SPY and IWM and less so in the QQQ, with all at risk for a very short term intra-week pullback. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.