Here is your Bonus Idea with links to the full Top Ten:

CVS Caremark, Ticker: CVS

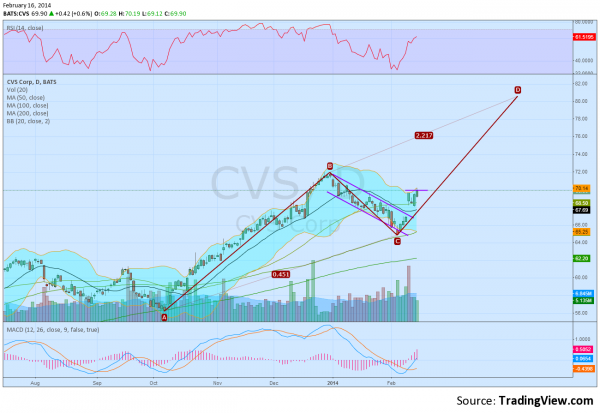

CVS Caremark (CVS) ran higher from October until a pullback with the market through January. It touched near the 50 day Simple Moving Average (SMA), breaking the downtrending channel to the downside and found support there bouncing higher. After breaking the channel higher following their earnings report it has been consolidating and now sees the Bollinger bands opening higher. The Relative Strength Index (RSI) is bullish and rising and the MACD is doing the same. The price action is creating an AB=CD pattern that targets a move to 80.55 above, and there is resistance at 71.90 along the way. Support lower is found at 68.10 and 67 followed by 64.75.

Trade Idea 1: Enter long on a move over 70.10 with a stop at 67.70.

Trade Idea 2: Buy the March 70 Calls (offered at 1.36 late Friday) on a move over 70.10.

Trade Idea 3: Buy the May 65/70 bullish Risk Reversal (1.48) on the same trigger.

Trade Idea 4: Sell the March/May 65 Put Calendar (66 cent credit).

Trade Idea 5: Sell the March/May 65 Put Calendar and buy the May 75 Call (free).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the holiday shortened President’s week sees the equity markets looking strong. Elsewhere look for Gold to continue in its uptrend while Crude Oil remains biased higher as it consolidates. The US Dollar Index looks better to the downside while US Treasuries look to be consolidating again. The Shanghai Composite and Emerging Markets are biased to the upside now. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite their strong moves higher this week. Their charts also look better higher with the QQQ and SPY perhaps a bit stronger looking than the IWM. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.