Here are the Rest of the Top 10:

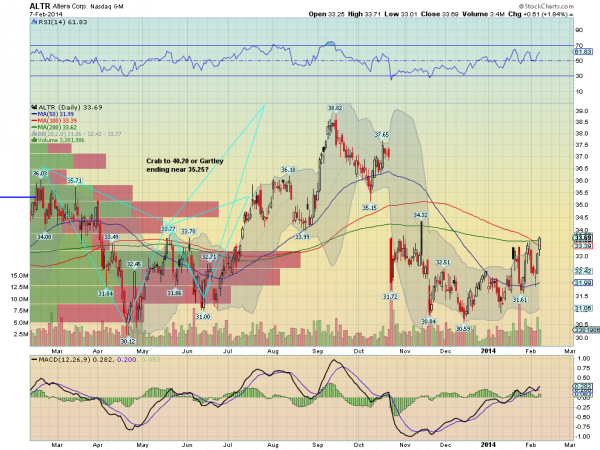

Altera (ALTR) has been slowly grinding higher off of the bottom at 30.59. Friday it broke above the 100 day Simple Moving Average (SMA) for the first time since October, and is near the 200 day SMA. It failed last time, but a continuation higher sees a gap to fill at 36.82 above.

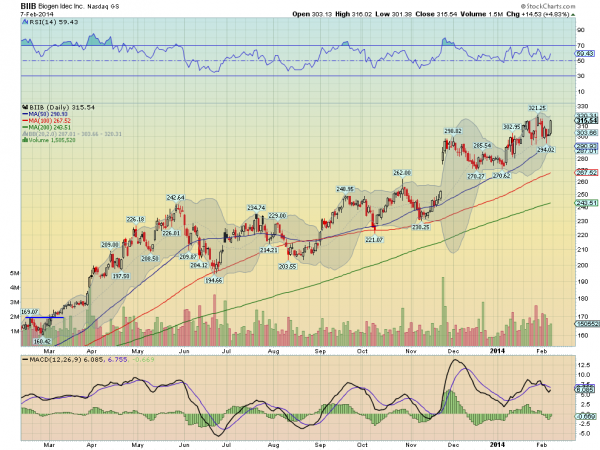

Biogen Idec (BIIB) is consolidating over the 20 day SMA after touching the 50 day SMA last week. All of the SMA are trending higher and this looks promising for more upside on a break of the consolidation.

Dupont (DD), moved lower with the market and found support under the 100 day SMA. Now back over the 20 and 50 day SMA it looks ready for more.

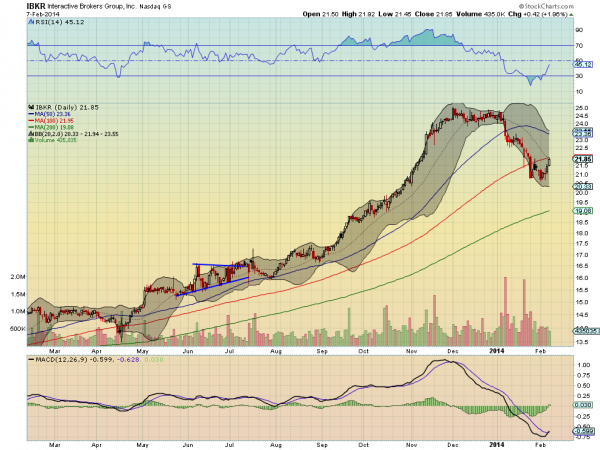

Interactive Brokers, Ticker: IBKR

Interactive Brokers (IBKR) has been consolidating under the 20 day and 100 day SMA’s, poking back at the top of the range. A break higher could have a lot of upside in it.

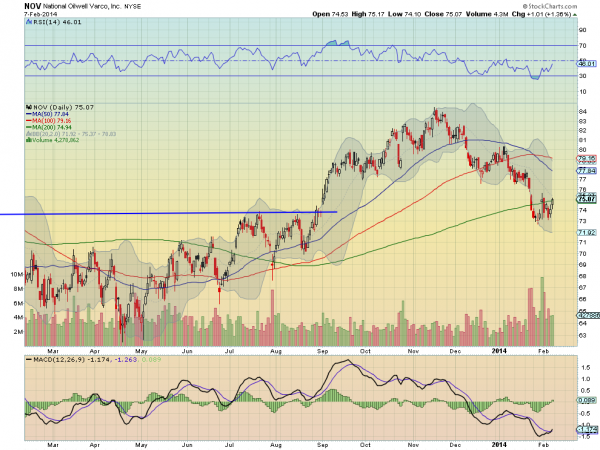

National Oilwell Varco, Ticker: NOV

National Oilwell Varco (NOV), is consolidating at the 200 day SMA after a pullback from the November high. A break of the recent range higher has the 50 and 100 day SMA’s overhead.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into next week sees the markets are giving a sigh of relief but not as strong as they could be. Look for Gold to continue to consolidate with a slight upward bias while Crude Oil continues higher. The US Dollar Index seems content to continue to move sideways while US Treasuries are biased higher in the very short term in their broad consolidation. The Shanghai Composite and Emerging Markets are biased to the upside with the Emerging Markets warranting some caution initially. Volatility looks to remain subdued and biased lower adding a breeze to the backs of the equity index ETF’s SPY, IWM and QQQ. Their charts show a desire for some short term caution to prove the recent moves hold, although the tone is bullish. The QQQ looks the strongest followed by the SPY and then the IWM. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.