Here is your Bonus Idea with links to the full Top Ten:

Biogen Idec, Ticker: BIIB

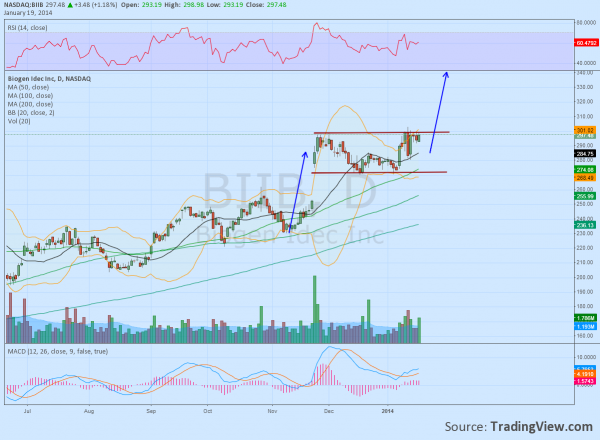

Biogen Idec (BIIB), gapped higher before Thanksgiving and has been consolidating in a range between 272 and 299 since. The Relative Strength Index (RSI) remains bullish and the MACD is moving higher, both supporting an upside move, were it to come. The recent price action broke above the Bollinger bands but is now back inside and they are opening higher. A break of the consolidation higher carries a Measured Move to 340. The company reports earnings January 29th and the January 31 Expiry At the Money Straddles are pricing $18.50 move as of Friday’s close.

Trade Idea 1: Buy the stock on a break over 300 with a stop at 290.

Trade Idea 2: Buy the January 24 Weekly 300 Strike Calls (offered at $4.00 late Friday) on the same trigger.

Trade Idea 3: Sell the January 24 Weekly 300 Straddle ($8.70).

Trade Idea 4: Buy the January 31 Weekly 300 Straddle ($19.80) and sell the January 24 Weekly 300 Straddle ($8.70, net $11.10).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, as the new week begins sees the equity markets look mixed but biased higher. Look for Gold to continue higher short term in its downtrend while Crude Oil rises in the consolidation zone lower. The US Dollar Index seems ready to move higher while US Treasuries are also biased higher in consolidation. The Shanghai Composite and Emerging Markets remain biased to the downside. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are mixed with the SPY the weakest and looking like consolidation at best in the short run, with the QQQ next and the IWM the strongest looking higher. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.