Here are four stocks with buy rank and strong value characteristics for investors to consider today, June 28th:

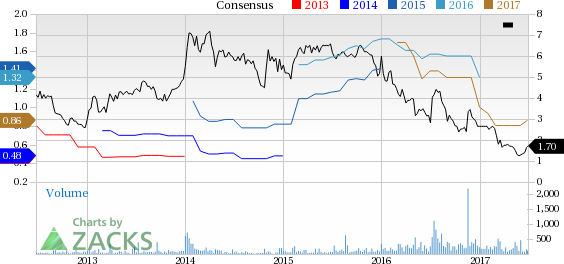

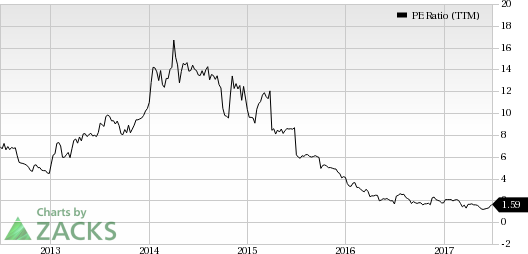

Danaos Corporation (DAC): This containerships operator has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 6.2% over the last 60 days.

Danaos’ has a price-to-earnings ratio (P/E) of 1.98, compared with 22.30 for the industry. The company possesses a Value Score of A.

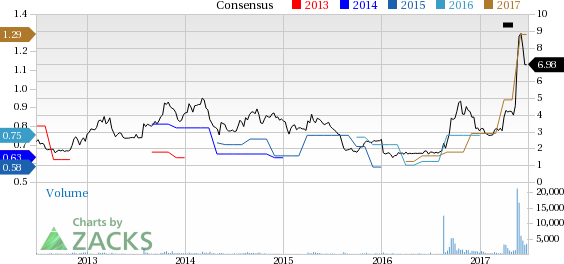

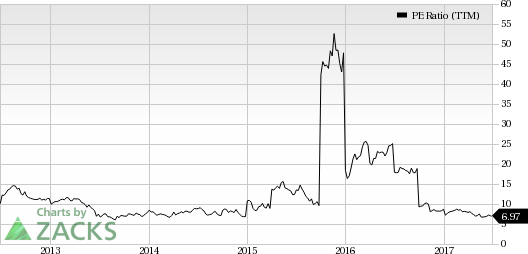

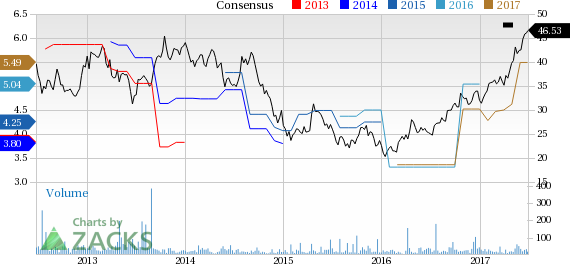

SORL Auto Parts, Inc. (SORL): This automotive brake systems distributor has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 37.2% over the last 60 days.

SORL Auto Parts’ has a price-to-earnings ratio (P/E) of 5.10, compared with 11.00 for the industry. The company possesses a Value Score of A.

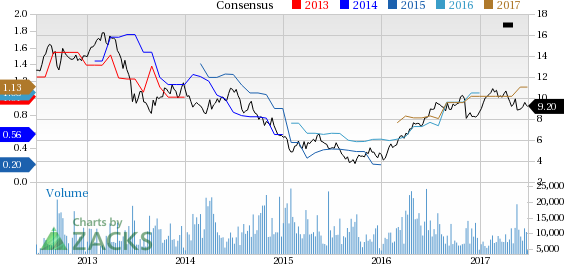

Companhia de Saneamento (SBS): This environmental sanitation services provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 9.7% over the last 60 days.

Companhia de Saneamento’s has a price-to-earnings ratio (P/E) of 8.14, compared with 26.70 for the industry. The company possesses a Value Score of A.

Woori Bank Co., Ltd. (WF): This financial holding companyhas a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 18.8% over the last 60 days.

Woori Bank’s has a price-to-earnings ratio (P/E) of 8.48, compared with 8.50 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Long-Term Buys You Won't See in the News

New Zacks Rank #1 Strong Buys are likely to be far outpace the broader market for the next 60-90 days. If you prefer investing for maximum long-term profits, you’ll want to see which stocks Zacks experts are sharing with our private members. These moves have double and triple-digit profit potential and are rarely available to the public. Starting now, you can look inside our stocks under $10, home run and value stock portfolios, plus more. Want a peek at this private information? Click here >>

Woori Bank (WF): Free Stock Analysis Report

SORL Auto Parts, Inc. (SORL): Free Stock Analysis Report

Companhia de saneamento Basico Do Estado De Sao Paulo - Sabesp (SBS): Free Stock Analysis Report

Danaos Corporation (DAC): Free Stock Analysis Report

Original post

Zacks Investment Research