Here are four stocks with buy rank and strong value characteristics for investors to consider today, July 13th:

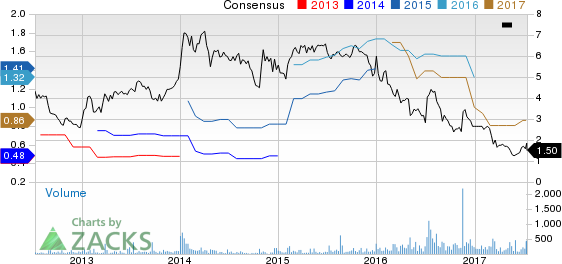

Danaos Corporation (DAC): This containerships operator has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 6.2% over the last 60 days.

Danaos’ has a price-to-earnings ratio (P/E) of 2.15, compared with 42.90 for the industry. The company possesses a Value Score of A.

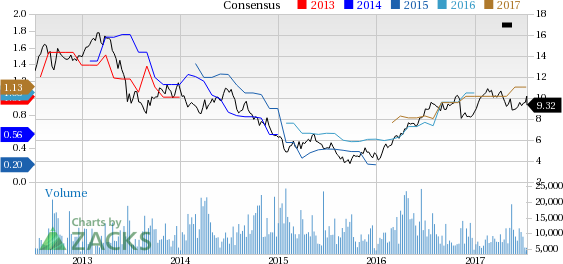

SABESP (SBS): This environmental sanitation services provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 10.8% over the last 60 days.

SABESP’s has a price-to-earnings ratio (P/E) of 9.01, compared with 26.80 for the industry. The company possesses a Value Score of A.

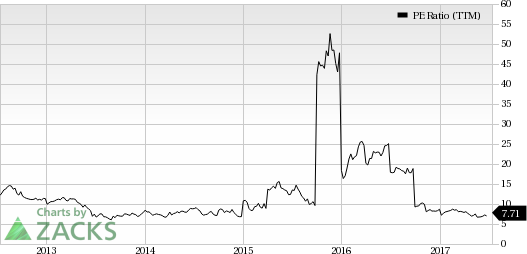

Ashford Hospitality Prime, Inc. (AHP): This real estate investment trust has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 0.6% over the last 60 days.

Ashford Hospitality Prime’s has a price-to-earnings ratio (P/E) of 6.05, compared with 32.50 for the industry. The company possesses a Value Score of A.

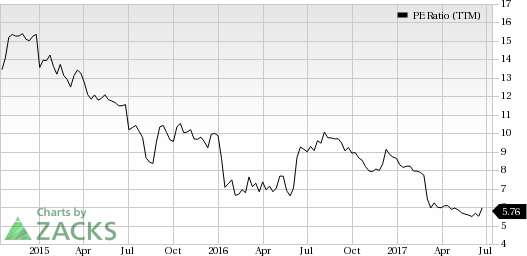

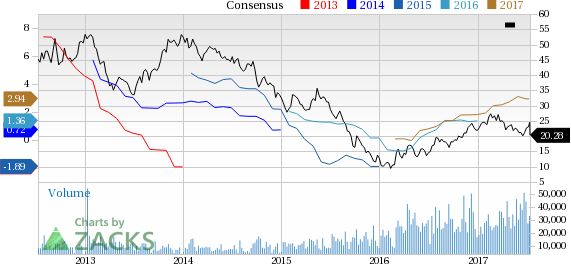

ArcelorMittal (MT): This steel company has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 3.9% over the last 60 days.

ArcelorMittal’s has a price-to-earnings ratio (P/E) of 8.36, compared with 14.30 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Now See All Our Private Trades

While today's Zacks Rank #1 new additions are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks' private buys and sells in real time from value to momentum . . . from stocks under $10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for all Zacks trades >>

Companhia de saneamento Basico Do Estado De Sao Paulo - Sabesp (SBS): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Danaos Corporation (DAC): Free Stock Analysis Report

Ashford Hospitality Prime, Inc. (AHP): Free Stock Analysis Report

Original post

Zacks Investment Research