Here are four stocks with buy rank and strong value characteristics for investors to consider today, February 5th:

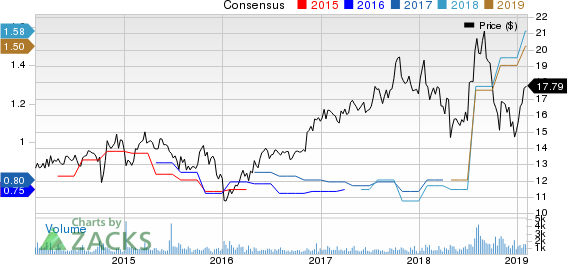

AVX Corporation (AVX): This electronic products manufacturer has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 9.7% over the last 60 days.

AVX has a price-to-earnings ratio (P/E) of 11.26, compared with 15.30 for the industry. The company possesses a Value Score of A.

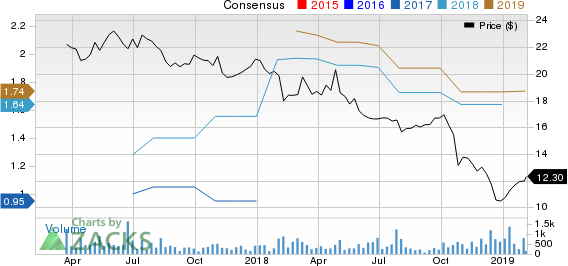

Ardagh Group S.A. (ARD): This rigid packaging solutions manufacturer has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 1% over the last 60 days.

Ardagh has a price-to-earnings ratio (P/E) of 7.09, compared with 10.90 for the industry. The company possesses a Value Score of A.

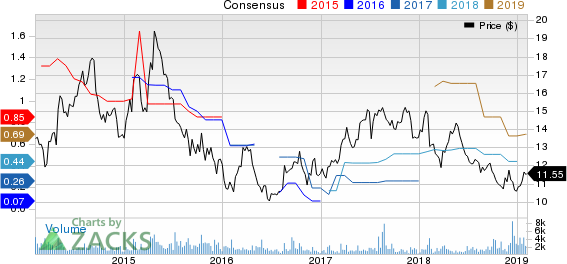

China Unicom (Hong Kong) Limited (CHU): This telecommunications services provider has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 1.5% over the last 60 days.

China Unicom has a price-to-earnings ratio (P/E) of 16.74, compared with 61.50 for the industry. The company possesses a Value Score of A.

Cigna Corporation (NYSE:CI) (CI): This health services company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 5.3% over the last 60 days.

Cigna has a price-to-earnings ratio (P/E) of 11.27, compared with 17.40 for the industry. The company possesses a Value Score of B.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

Cigna Corporation (CI): Free Stock Analysis Report

China Unicom (Hong Kong) Ltd (CHU): Get Free Report

AVX Corporation (AVX): Get Free Report

Ardagh Group S.A. (ARD): Free Stock Analysis Report

Original post

Zacks Investment Research