Here are four stocks with buy rank and strong value characteristics for investors to consider today, August 18th:

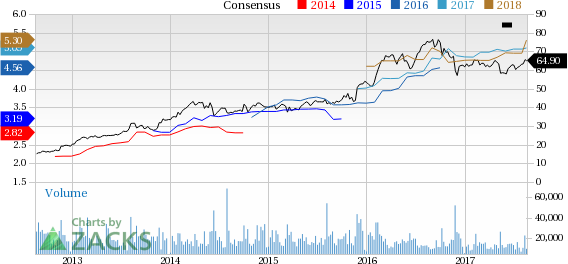

Pilgrim's Pride Corporation (PPC): This chicken company has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 13.2% over the last 60 days.

Pilgrim's Pride’s has a price-to-earnings ratio (P/E) of 11.92, compared with 14.60 for the industry. The company possesses a Value Score of A.

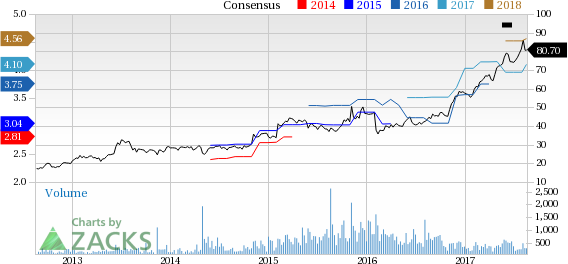

ePlus inc. (PLUS): This engineering-centric technology solutions providerhas a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 3.5% over the last 60 days.

ePlus’s has a price-to-earnings ratio (P/E) of 19.68, compared with 32.90 for the industry. The company possesses a Value Score of A.

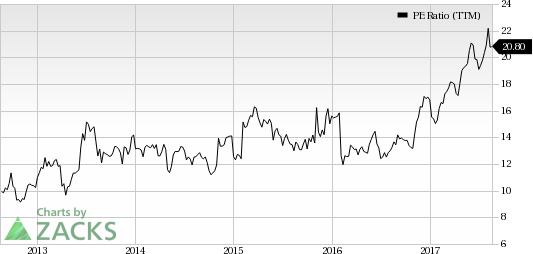

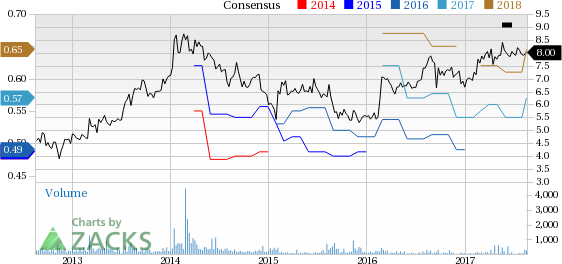

Tyson Foods (NYSE:TSN), Inc. (TSN): This food companyhas a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 1.6% over the last 60 days.

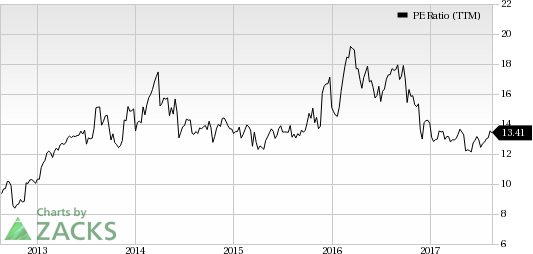

Tyson Foods’ has a price-to-earnings ratio (P/E) of 12.90, compared with 14.60 for the industry. The company possesses a Value Score of A.

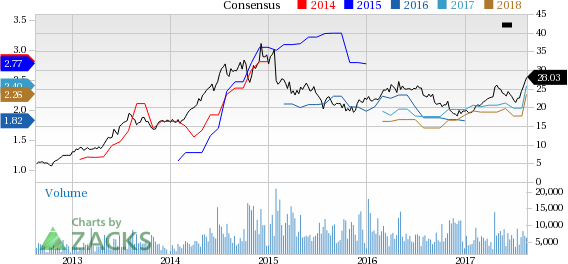

MGIC Investment Corporation (MTG): This private mortgage insurance services provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 5.6% over the last 60 days.

MGIC Investment’s has a price-to-earnings ratio (P/E) of 14.03, compared with 37.10 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.See Stocks Now>>

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC): Free Stock Analysis Report

ePlus inc. (PLUS): Free Stock Analysis Report

MGIC Investment Corporation (MTG): Free Stock Analysis Report

Original post