Here are three stocks with buy rank and strong momentum characteristics for investors to consider today, March 26th:

American Assets Trust, Inc. (AAT): This real estate investment trust (REIT) has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.9% over the last 60 days.

American Assets' shares gained 3.7% over the last one month more than S&P 500’s gain of 0.2%. The company possesses a Momentum Score of B.

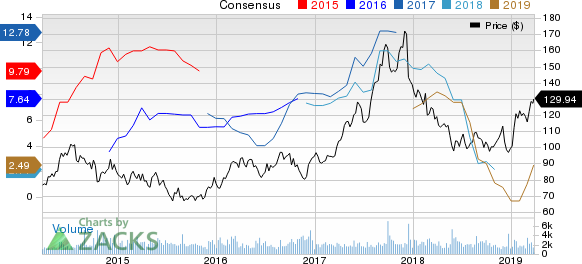

Sanderson Farms, Inc. (SAFM): This integrated poultry processing company has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing more than 100% over the last 60 days.

Sanderson Farms' shares gained 13% over the last one month. The company possesses a Momentum Score of A.

Abercrombie & Fitch Co. (ANF): This specialty retailer has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 41.8% over the last 60 days.

Abercrombie & Fitch’s shares gained 18.5% over the last one month. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Sanderson Farms, Inc. (SAFM): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

American Assets Trust, Inc. (AAT): Free Stock Analysis Report

Original post

Zacks Investment Research