Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, June 29th:

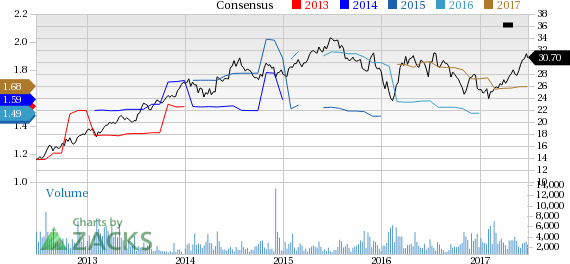

Gildan Activewear Inc. (GIL): This apparel products manufacturer has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 0.6% over the last 60 days.

Gildan Activewear’s shares gained 15.6% over the last three months higher than S&P 500’s gains of 3.5%. The company possesses a Momentum Score of A.

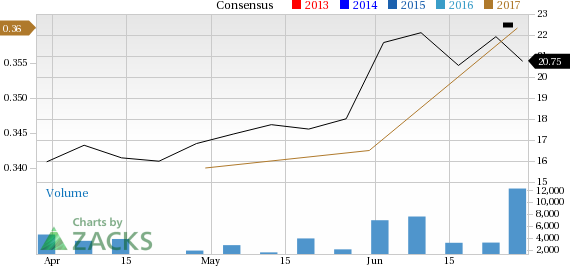

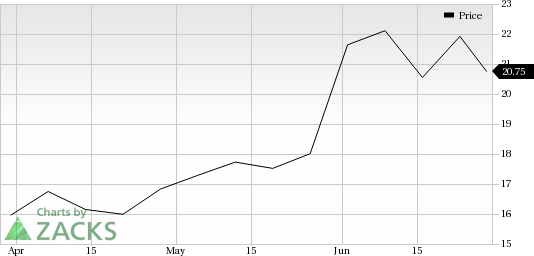

Canada Goose Holdings Inc. (GOOS): This apparel company has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.9% over the last 60 days.

Canada Goose Holdings’ shares gained 26.9% over the last three months. The company possesses a Momentum Score of A.

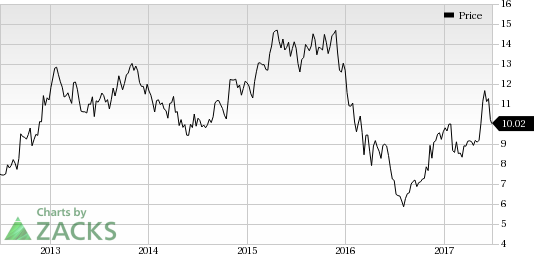

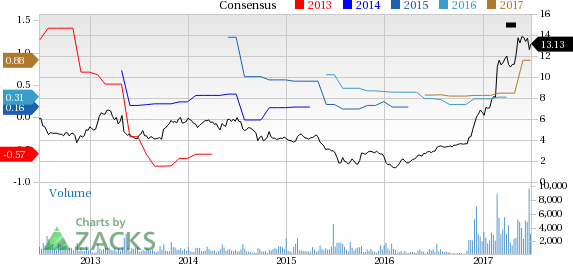

Fibria Celulose S.A. (FBR): This short fiber pulp exporter has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 87.5% over the last 60 days.

Fibria Celulose’s shares gained 14.4% over the last three months. The company possesses a Momentum Score of A.

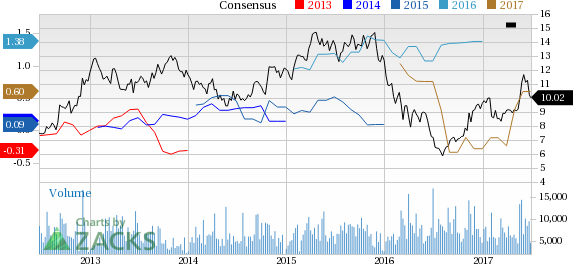

KEMET Corporation (KEM): This electronic company has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing more than 100% over the last 60 days.

KEMET’s shares gained 13% over the last three months. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

The Best & Worst of Zacks

Today you are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. From 1988 through 2015 this list has averaged a stellar gain of +25% per year. Plus, you may download 220 Zacks Rank #5 "Strong Sells." Even though this list holds many stocks that seem to be solid, it has historically performed 11X worse than the market. See these critical buys and sells free >>

Kemet Corporation (KEM): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Gildan Activewear, Inc. (GIL): Free Stock Analysis Report

Fibria Celulose S.A. (FBR): Free Stock Analysis Report

Original post