Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, July 3rd:

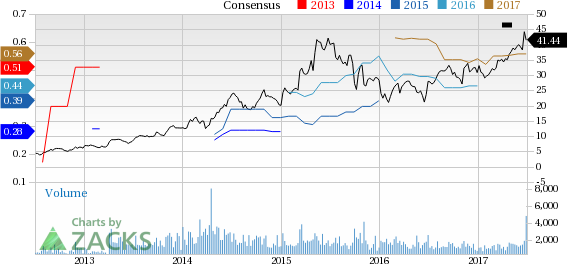

22nd Century Group, Inc. (XXII): This plant biotechnology company has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 10% over the last 60 days.

22nd Century Group’s shares gained 39.8% over the last three months higher than S&P 500’s gains of 3.3%. The company possesses a Momentum Score of A.

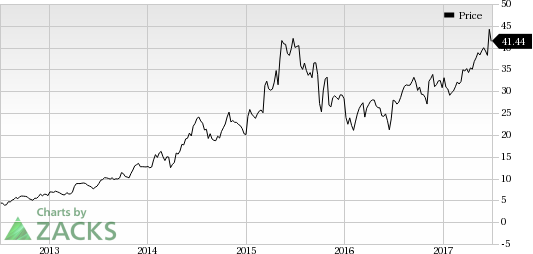

Repligen Corporation (RGEN): This bioprocessing companyhas a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings advancing 1.8% over the last 60 days.

Repligen’s shares gained 22.9% over the last three months. The company possesses a Momentum Score of A.

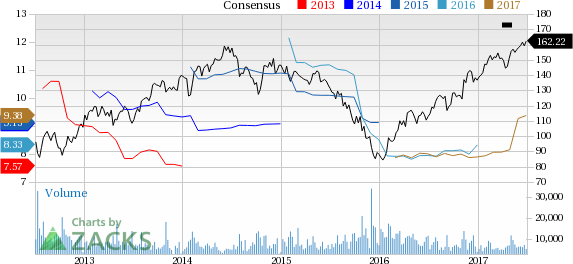

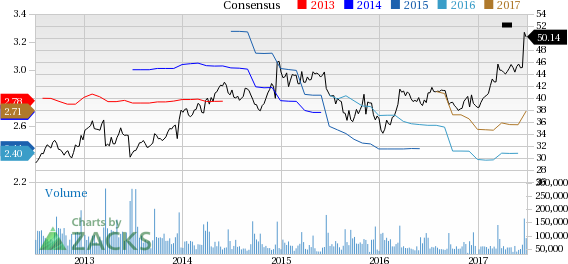

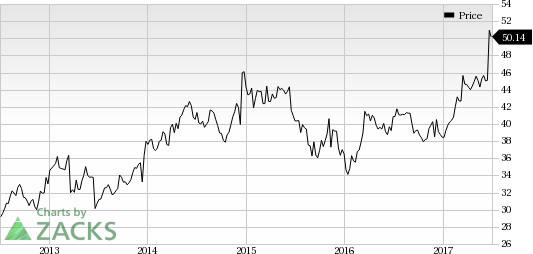

Cummins Inc (NYSE:CMI). (CMI): This diesel and natural gas engines designer has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 15.1% over the last 60 days.

Cummins’ shares gained 8.4% over the last three months. The company possesses a Momentum Score of A.

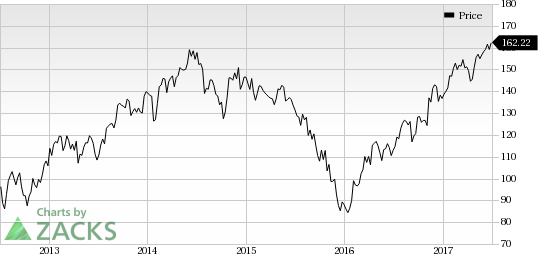

Oracle Corporation (NYSE:ORCL) (ORCL): This application, platform and infrastructure technologies marketer has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings advancing 3.8% over the last 60 days.

Oracle’s shares gained 12.3% over the last three months. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

22nd Century Group, Inc (XXII): Free Stock Analysis Report

Repligen Corporation (RGEN): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research