Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, December 14th:

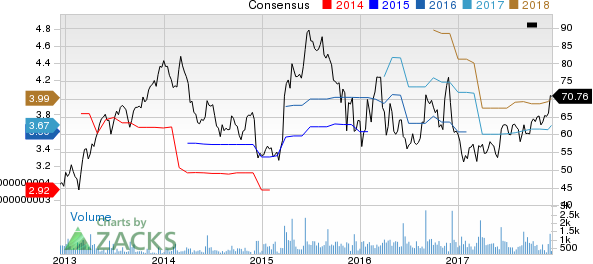

Oxford Industries, Inc. (OXM): This apparel company has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.1% over the last 60 days.

Oxford Industries’ shares gained 11.9% over the last one month more than S&P 500’s gain of 3%. The company possesses a Momentum Score of A.

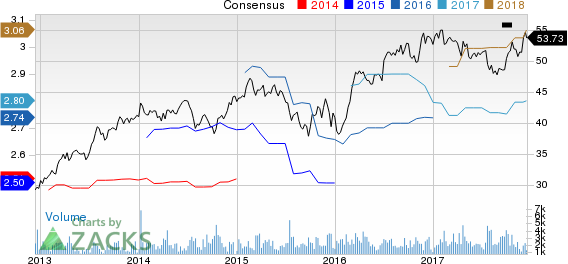

Sonoco Products Company (SON): This seller of industrial and consumer packaging products has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 1.8% over the last 60 days.

Sonoco Products’ shares gained 5.5% over the last one month. The company possesses a Momentum Score of A.

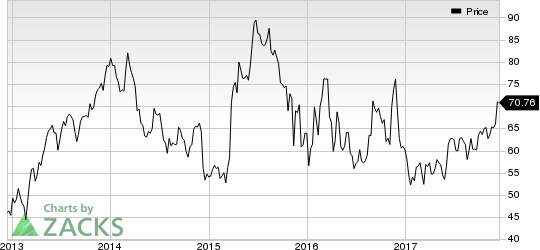

PVH Corp (NYSE:PVH). (PVH): This apparel company has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.8% over the last 60 days.

PVH’s shares gained 4% over the last one month. The company possesses a Momentum Score of A.

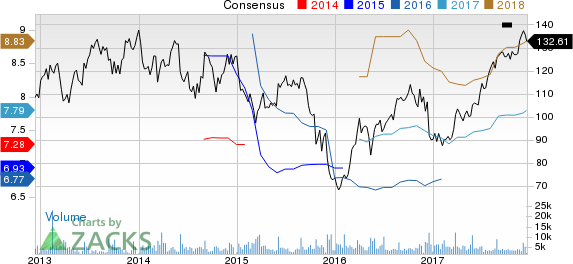

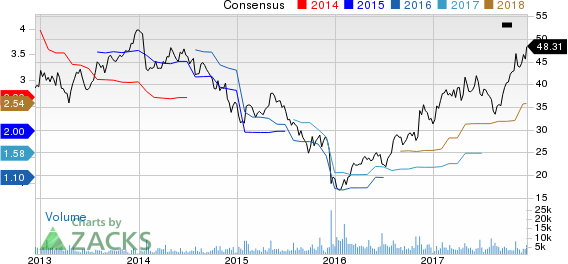

Kennametal Inc. (KMT): This supplier of engineered components has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 14.4% over the last 60 days.

Kennametal’s shares gained 10.5% over the last one month. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Sonoco Products Company (SON): Free Stock Analysis Report

PVH Corp. (PVH): Free Stock Analysis Report

Oxford Industries, Inc. (OXM): Free Stock Analysis Report

Kennametal Inc. (KMT): Free Stock Analysis Report

Original post